Bank of England set to hike rates again despite fears of a recession

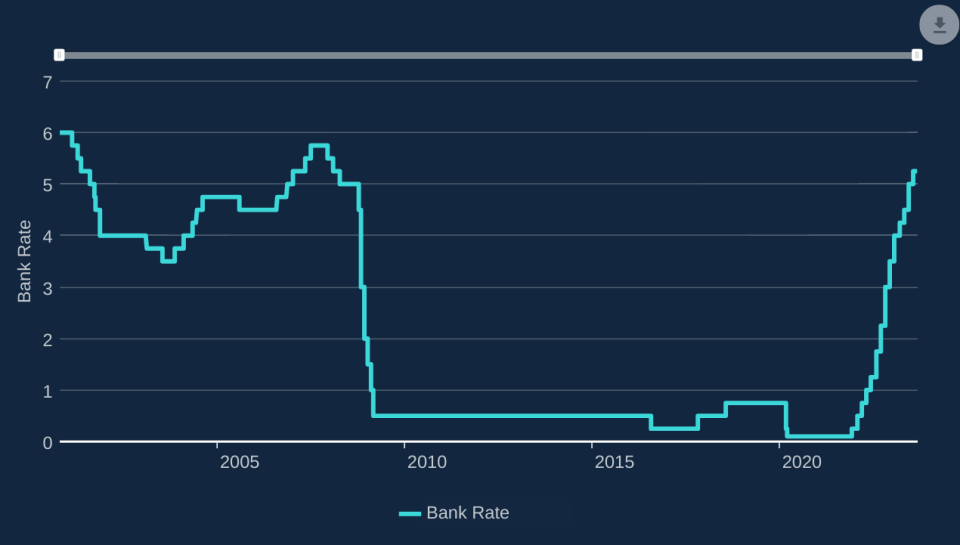

The Bank of England is set to hike interest rates for the fifteenth time in a row on Thursday, taking the bank rate to its highest level since the beginning of 2008.

Economists are expecting members of the Monetary Policy Committee (MPC) to back a 25 basis point hike, which would take interest rates to 5.5 per cent.

Although inflation has come down from its peak of over 11 per cent last year, it remains at 6.8 per cent – far above the Bank’s two per cent target.

Uncomfortably high levels of wage growth and services inflation suggest inflation is increasingly domestically driven.

As Paul Dales, chief UK economist at Capital Economics said, “the latest data suggest that inflationary pressures have been more persistent than the Bank expected.”

Although inflation remains above target, there are signs that the economy is starting to slow. In July the economy contracted 0.5 per cent, with some analysts saying the UK may already be in recession. Unemployment meanwhile has climbed faster than the Bank anticipated, hitting 4.3 per cent.

This suggests that higher interest rates are starting to take the heat of the economy. As a result, many economists argue this could be the final rate hike in the monetary tightening cycle.

In recent weeks many MPC members have implied that rates will not have to go much higher. Andrew Bailey, governor of the Bank, recently told MPs that rates are “nearer the peak” while chief economist Huw Pill said he would prefer rates to peak at a lower level, but remain at their peak for a longer period of time.

Martin Beck, chief economic advisor to the EY Item Club, argued suggested that this would be the final hike in the cycle.

“A further cooling in the labour market, downward pressure on services inflation as less expensive energy feeds through and likely policy pauses by other major central banks mean a September rate increase will prove to be the last in the current cycle,” he said.

Sanjay Raja, senior economist at Deutsche Bank, was less sure that Thursday’s likely hike would complete the cycle, but did suggest the Bank will “raise the bar” for further hikes by signalling that “rates may have reached a ‘sufficiently restrictive’ level”.

Thursday’s decision will come a day after the August figures for inflation, when there is likely to be a slight increase in the headline rate of inflation to around seven per cent due to rising oil prices.

Chancellor Jeremy Hunt has already said August’s figures will be “a blip” while Bailey did not think a rise would “change the path” of inflation.

Policymakers will be keeping a closer eye on the level of services inflation, which increased to 7.4 per cent in July.

The Bank’s decision will come a week after the European Central Bank lifted its key interest rate to record levels. The US Federal Reserve on the other hand is expected to leave rates on hold when it meets on Wednesday.