In charts: Are UK house prices suffering from pre-election blues?

The housing market could be facing a case of pre-election blues. The customary January demand-surge just never arrived. But is this cause for concern or just the market stabilising?

The figures

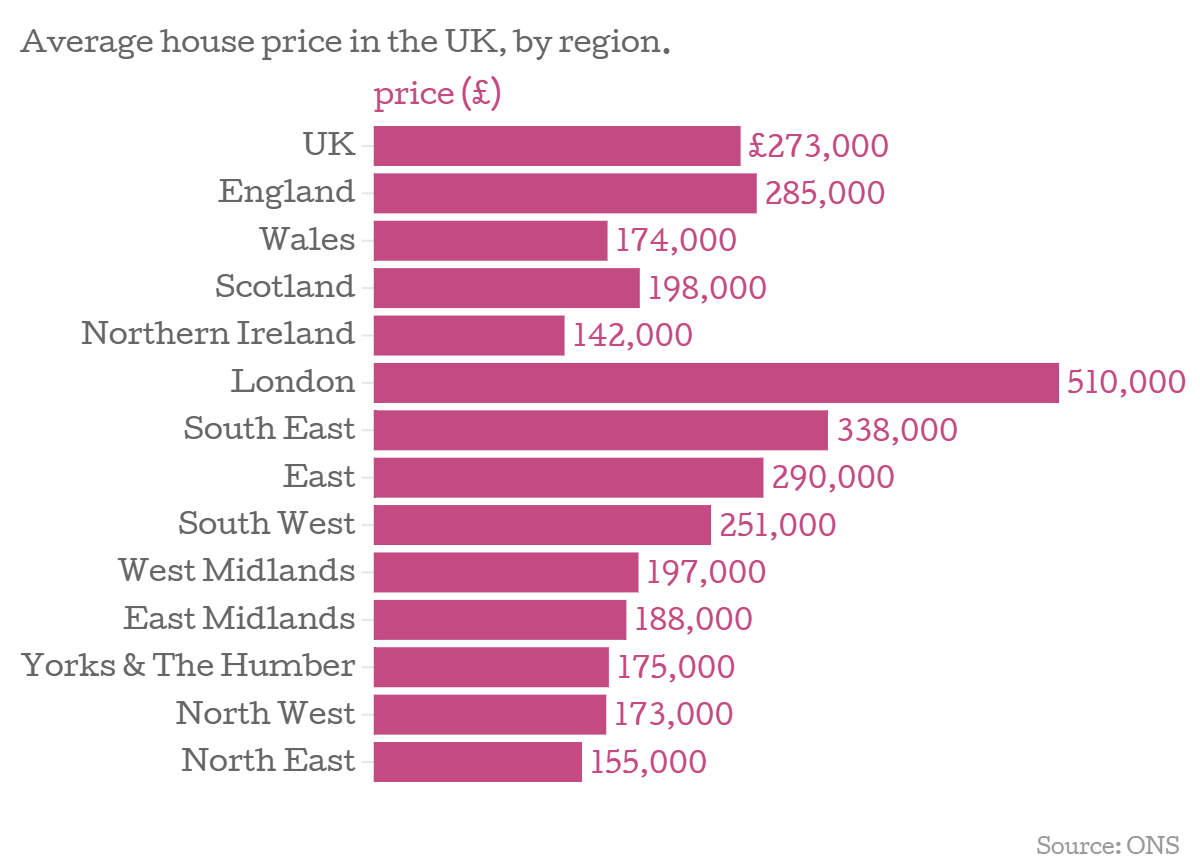

Office for National Statistics (ONS) figures show that the rate of house price growth in the UK slowed to 8.4 per cent in the year to January, a substantial drop from December’s figure of 9.8 per cent.

The monthly change showed an outright drop: on a seasonally adjusted basis, prices dropped by 0.2 per cent between December 2014 and January 2015.

There was some variation between the different countries, with Wales growing at 4.9 per cent, Scotland at 7.8 per cent and Northern Ireland 7.3 per cent.

London continued to grow faster than other areas, growing at 13 per cent in the 12 months to January. That takes the average cost of a property sold in the capital to £510,000 far ahead of other regions.

Why it’s interesting

The housing market will almost certainly be a flash point in the 7 May General Election, and many buyers could be getting cold feet, waiting for a result to offer stability.

George Osbourne has played his hand: changes to stamp duty to allow buyers at the lower end of the market to grasp or skip rungs with greater ease. But the changes could well have affected prime properties, which are taxed more in the new system.

What is more, in the budget he promised the government would contribute to anyone saving to put a deposit down. A saver putting in £200 a month would have that amount supplemented by £50 from the government.

Criticisms have come in saying that despite the boost from the government, house prices are rising so fast in the long term that it won’t make too much difference and could even push prices higher. The Office for Budget Responsibility, which rates for statistical certainty the government’s budget policies, says that buyer behaviour in regard to the help-to-buy ISA is very uncertain. These measures were only announced this month however, and so will not have been able to affect today's figures. The effect on future numbers will be keenly awaited.

It is also important to consider that the market was frenzied last summer, and therefore likely to calm at some point whilst searching for an equilibrium. The effect of a General Election on buyer sentiment shouldn’t be discounted, either; nor should the fact the UK sorely needs new houses.

What the analysts said

Adrian Gill, director of Your Move and Reeds Rains estate agents, comments:

Rates of annual growth have slowed across the board in England and Wales, as the market mellows from the extraordinary noise of the past year. After storming ahead of the rest of the country in the whirlwind of 2014, conditions have calmed in London and the South East.

The capital has already had the first taste of added pressure placed on prime property in the form of revised Stamp Duty, and the £1.5m to £5m slice of the market has also been hit by cold feet in the run up to the General Election, with the threat of a potential mansion tax.

This let-up of high-end activity has brought down the average London house price, but it is regions with the lowest average property prices which are dragging their feet.

The housing shortage may be propping up property price growth, but more needs to be done to stave off this winter lull and invigorate the property market recovery. Measures like the Help to Buy scheme and reforming Stamp Duty have airlifted support to the bottom end of the market, but unless more new homes are built, the government are practically playing a zero-sum game: reshuffling a deck doesn’t leave you with more cards.

Alex Gosling, cief executive of online estate agents HouseSimple said:

Such lukewarm results show the traditional January surge in demand for properties has not materialised.

However, average prices are still well up on last year, and there's nothing to suggest the the property market has run out of steam.

Talk of the boom times being over is a little premature. The market is likely taking a breather after a period of sustained growth over the past 18 months.

Agents aren't short of buyer registrations, but sales are harder to come by because buyers are taking their time before committing to a purchase.

That is particularly the case in London, where this time last year there was a feeding frenzy amongst buyers to snap up properties in areas where prices were rising rapidly.

In short

What we are likely seeing is a mellowing from last year’s frenzy, coupled with pre-election jitters and a period of acclimatisation to new taxes and policies.