US Federal Reserve’s rate hike cycle takes centre stage in investors’ minds

Investors are grappling with a mix of challenges they have not faced in years.

Tighter monetary policy. Sky-high inflation. Strong geopolitical tensions.

These factors have driven volatile swings in asset prices.

Usually in times of uncertainty, investors pile into the US dollar and American assets. And that is exactly what they are doing now.

US government debt has been the hottest ticket in town due to the Federal Reserve’s rapid policy tightening.

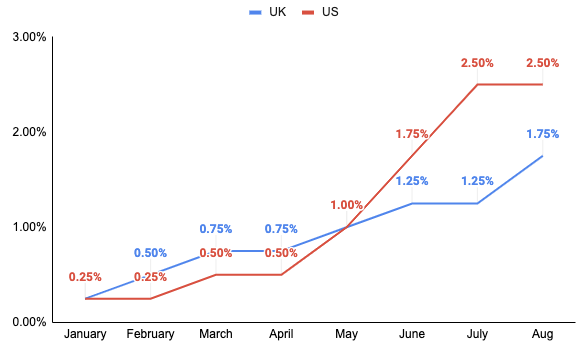

Jerome Powell, the chief of the world’s most influential central banks, and co have lifted borrowing costs 225 basis points since March, one of the fastest rate hike cycles since the early 1980s when former chair Paul Volcker led the charge against another inflation surge.

Markets think US rates will peak around 3.5 per cent compared to three per cent in the UK.

Inflation has put downward pressure on American bond prices due to investors pricing in the Fed being more forceful than the Bank of England. Prices and yields move inversely.

The difference between returns on UK and US government debt – known as the spread – depends on which part of the yield curve you look at.

Spreads on two year and 10-year UK and US bonds “have been negative for many years,” Maximilian Uleer, senior strategist at Deutsche Bank, told City A.M.

“This is not a new phenomenon: The key interest rate of the Bank of England has been lower than the US key interest rate since 2016, leading to lower bond yields in the UK across the entire yield curve,” he added.

Governor Andrew Bailey and the rest of the monetary policy committee have tried to set that record straight last week by hiking rates 50 basis points for the first time in nearly 30 years.

UK and US interest rates

But, inflation in the UK is also higher than in the US – 9.4 per cent compared to 9.1 per cent, but each 40-year highs – meaning the real return investors receive on British bonds is lower than across the pond.

This strengthens incentives to ditch UK gilts and pick up US treasuries.

London-listed have fared much better than their international rivals.

Wall Street’s S&P 500 index is down around 14 per cent since the start of the year. The pan-European Stoxx 600 has shed around 10 per cent, while Japan’s Nikkei has lost over four per cent.

The FTSE 100 has dropped just under one per cent over the same period. London’s premier index’s overperformance has been driven by it having a greater gearing toward energy and industrial companies.

“[some] 20 per cent of the FTSE 100 is comprised of energy, metals and mining stocks,” Charles de Boissezon, head of equity strategy at Societe Generale, told City A.M., adding UK stocks are an effective asset at hedging “against inflation if not stagflation”.

Oil giants BP and Shell, which collectively represent a huge proportion of the FTSE 100, have fared well amid the global energy price surge. The latter posted record profits recently.

Quite a lot of FTSE 100 companies rely on exports to generate income, meaning the pound’s slide against the dollar has boosted the index.

A weaker currency makes a country’s exports cheaper, boosting their competitiveness.

“The UK is vulnerable to higher gas prices, has a current account deficit, has ongoing political uncertainty with fiscal stimulus unlikely to be delivered quickly, which is likely to weigh on sterling,” analysts at BNP Paribas Markets 360 told City A.M.

Brent Crude prices

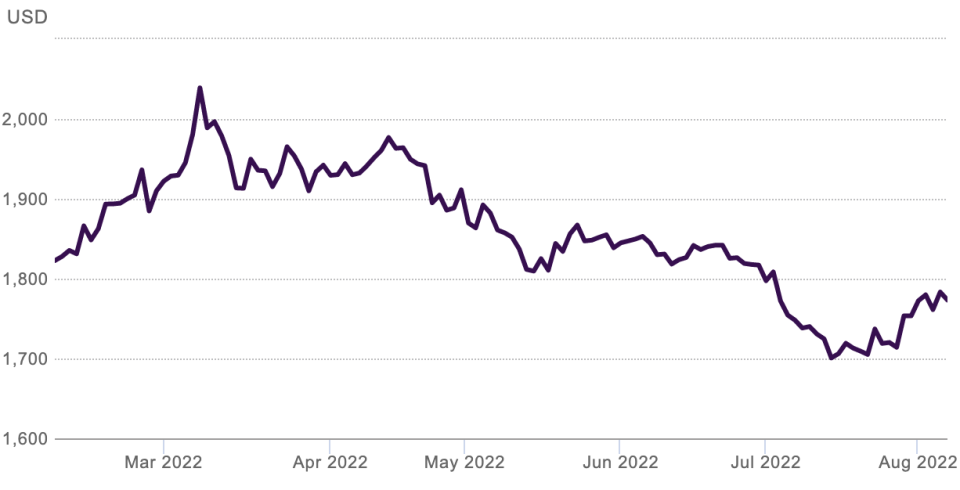

Gold has been seen as an effective hedge against inflation for decades, mainly due to it deriving its value from there being a scarce supply of the precious metal.

However, analysts point out that investors holding gold do not receive any interest, similar to cash. Gold investors can only make money on the asset by selling at a higher price than they purchased it for.

This characteristic means interest in gold is waning amid higher US interest rates.

“If you expect inflation to be transitory and to move back below three per cent, then a yield of over 3.5 per cent for ten years on a bond of a triple A rated country like the US provides the better alternative to a dividend-and interest rate-free investment into gold,” Uleer said.

Commodities have attracted a lot of investor interest this year.

Prices have soared due to countries scrambling to get their economies back to full strength after the Covid-19 restrictions were scrapped.

Tight oil supplies, intensified by western countries shunning Russian oil, have steered prices higher.

“The supply side is tight and it does not look like this will change anytime soon,” Uleer said.

Gold prices

But, some of the world’s biggest economies are set to tip into recession this year, driven by historically high inflation levels. That has put downward pressure on commodity and metal prices.

The biggest factor steering asset prices so far is how far the Fed goes in raising borrowing costs, analysts say. That trend does not look like unwinding any time soon.