UK to clock weakest growth in rich world amid economic ‘stagnation’

The UK will clock the weakest growth in the rich world caused by households retrenching amid the worst cost of living crisis in a generation, according to new forecasts released today.

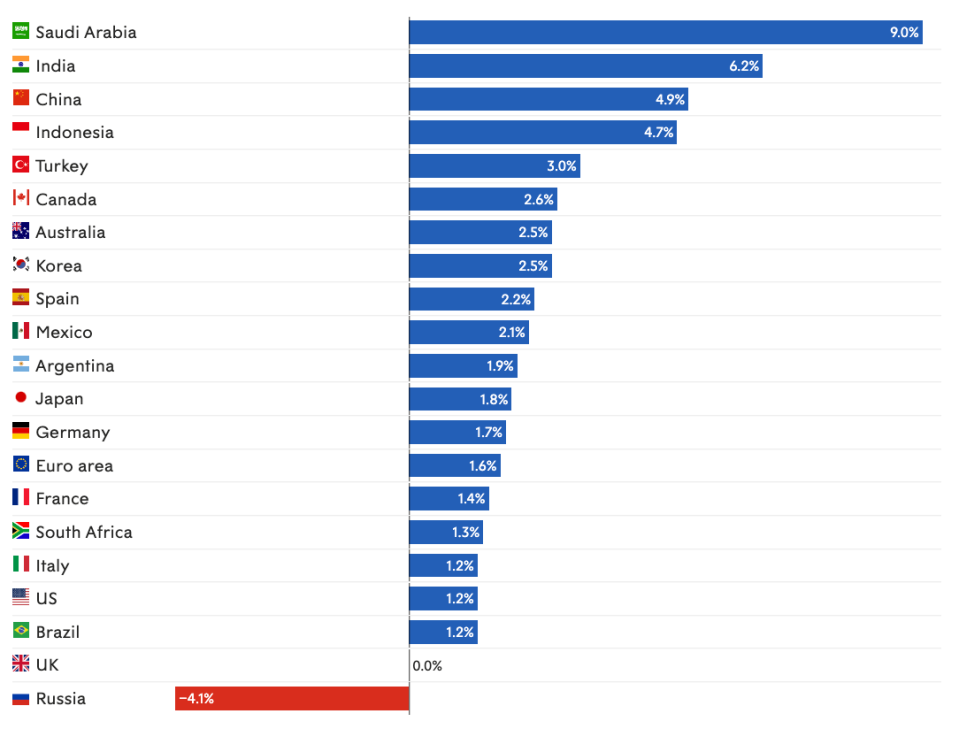

Rampant inflation driven by accelerating global energy prices as a result of Russia’s invasion of Ukraine and ongoing supply chain disruptions caused by China’s zero Covid policy will send the UK to second bottom of the G20 nations’ growth table, beaten only by Russia.

That’s according to new projections by the Organisation for Economic Co-operation and Development (OECD), who added the British economy will grow 3.6 per cent this year.

A severe erosion of households’ spending power engineered by historic high inflation will lead to “depressed demand,” resulting in the UK economy “stagnating in 2023,” the OECD warned.

A rapid rate hike cycle from the Bank of England to tame inflation, compounded by tax rises and a normalisation in government spending after the Covid-19 crisis will tighten the squeeze on the economy.

Threadneedle Street has already hoisted rates at each of its last four meetings, taking them to a 13-year high of one per cent. Market expects borrowing costs to hit 2.5 per cent.

The alert will strengthen Tory MPs’ calls to prime minister Boris Johnson to slash taxes to revive growth.

The UK tax burden is projected to swell to its highest level since the late 1940s, primarily driven by the 1.25 percentage point national insurance hike, income tax thresholds being frozen and corporation tax climbing six percentage points to 25 per cent.

A treasury spokesperson said: “While we can’t insulate the UK from global pressures entirely, we have a plan for growth, and are supporting people with the cost of living.”

Last month, chancellor Rishi Sunak announced around £15bn in support for households to deal with swelling energy bills.

Inflation will peak at 10 per cent in the final months of this year and average 8.8 per cent over the whole of 2022, the OECD said. it is already running at nine per cent, its highest rate in four decades.

Worryingly, across the whole of next year, living costs will continue to tear, with inflation averaging 7.4 per cent in 2023.

The OECD’s is the latest of the world’s top economic watchdogs to warn the UK will be among the hardest hit by a global inflation crunch.

The Bank of England, National Institute of Economic and Social Research, the International Monetary Fund and the World Bank have cast a bleak eye over the British economy, warning the country may tip into recession.

Experts have pegged bets on the UK avoiding a recession on households raiding pandemic-induced savings to maintain spending.

However, these savings are likely to be allocated to pay for energy bills, meaning the economy will not receive a sufficient spending boost.

“Household savings will decline to below pre-pandemic levels, with some households taking on more debt to keep up with the rising cost of living,” the OECD said.

Persistent supply shortfalls, high inflation and tighter fiscal and monetary policy will choke global growth.

The OECD now thinks the world economy will expand 1.5 percentage points slower, growing three per cent this year and around the same amount next year.

Most major economies are expected to grow much slower than first thought. The US will expand 2.5 per cent and 1.2 per cent this year and next, while the eurozone will grow 2.6 per cent in 2022.

China’s 4.9 per cent 2023 growth rate is below the Communist Party’s target.