UK housing sales on track to sink to lowest level since 2012

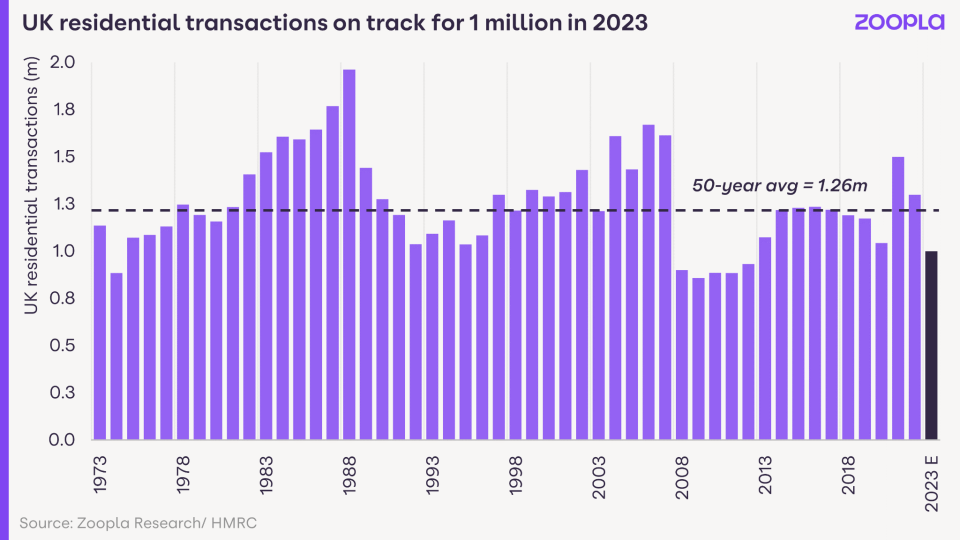

The number of housing sales completed over 2023 is on track to sink to its lowest level since 2012, when Britain was still reeling from the financial crash, as higher borrowing costs continue to decimate the market.

Sales are also set to be 21 per cent down on last year, according to new data from estate agents Zoopla, with the number of mortgage lead sales on homes projected to be 28 per cent lower than last year.

Despite mortgage lenders slashing the cost of their deals in recent months in response to easing inflation, consumer sentiment remains low and a squeeze on personal finances has led many would-be buyers to hold off making a purchase.

Zoopla said that any further improvement in affordability from lower mortgage rates is “unlikely” to impact the market until the first half of next year.

“Mortgage rates are starting to drift lower but remain over five per cent,” Richard Donnell, executive director at Zoopla, said.

“We expect them to fall below five per cent later this year but it looks set to be a drawn-out process as the financial markets re-evaluate how much longer interest rates need to remain higher to bring inflation under control.”

In London, house price growth slowed one per cent in August, with the average price of a home now costing £542,000.

“House price growth has slowed rapidly over the last year as demand weakens in the face of higher mortgage rates,” Donnell added.

“Prices are falling more in southern England where higher mortgage rates have priced more people out of the housing market, weakening demand.”

The market will turn its focus to the Bank of England’s upcoming interest rate decision on 21 September as an indicator of what buyer sentiment may look like during the autumn and winter months.

“Buyers have been more cautious and are in some cases pausing their property search in order to adjust their finances. However, there still are buyers who have already locked in a mortgage rate with their lender and are keen to secure a property before the rate expires,” Matt Thompson, head of sales at Chestertons, said.

“Meanwhile, homeowners remain eager to put their property on the market and wait for the right buyer with Chestertons’ branches registering a 10 per cent increase in properties being put up for sale last month vs the same month last year.”