UK economy in ‘early stages of recovery’ as families shrug off inflation and interest rate hikes

Britain’s economy could be in the early stages of a recovery, with consumers holding up pretty well under the pressure of high inflation and interest rate increases, a closely watched survey out today indicates.

Families’ outlook on how well the economy will perform over the coming year is improving, while confidence in their own personal finances is strengthening.

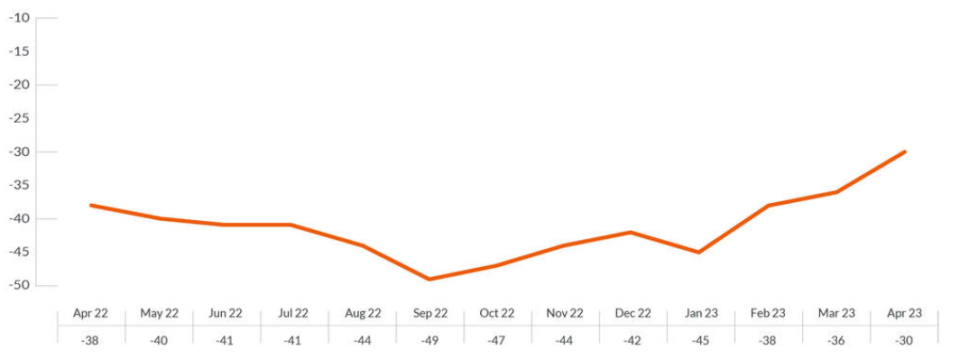

That has pushed Growth for Knowledge’s consumer confidence index – which has been running since the 1970s – up six points in April from minus 36, although the reading is still a historic low.

“As food and energy prices continue to rise, and inflation eats into wages, the cost-of-living crisis is a painful day-to-day reality for many,” Joe Staton, client strategy director GfK, said.

“But are all consumers buckling under the pressure? On the evidence of April’s confidence figures, the answer is no,” he added.

A string of data out last week from the Office for National Statistics (ONS) illustrated just how much pressure households are under at the moment.

Prices have climbed 10.1 per cent over the last year to March, a drop from February’s 10.4 per cent inflation rate, but still smashing the City and Bank of England’s expectations.

Strong inflationary pressures have prompted Bank Governor Andrew Bailey and his team of economists to lift interest rates 11 times in a row to 4.25 per cent.

March’s inflation overshoot prompted markets to price in a five per cent rate peak, much higher than their expectations before last week’s ONS numbers were released, suggesting household finances could come under yet more strain.

Despite that outlook, families’ optimism is growing.

“This is the third month in a row that confidence overall has improved; can we look forward to this momentum building for the year ahead?” Staton said.

Experts have roundly canned their recession forecasts for the UK economy due to data since the start of the year coming in much better than feared.

However, not all are so upbeat. The International Monetary Fund reckons the country’s economy is on course to shrink 0.3 per cent this year, the worst rate of growth in the G7.