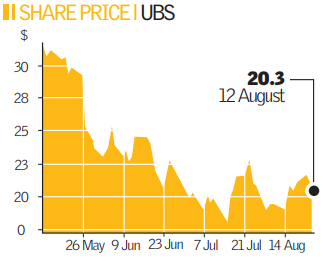

UBS rings the changes as it reports a loss

UBS announced wholesale changes to structure and personnel yesterday, including a new chief financial officer, as it posted an interim loss of Sfr358m (£173m), bringing the curtain down on a dire results season for banks.

The Swiss bank posted writedowns of $5.1bn on risky investments, mitigated by a tax credit of $2.8bn. It also took provisions of $900m on a settlement with US regulators over auction-rate securities.

On his 100th day as chairman, Peter Kurer said the results were a “source of dismay and shame” and outlined a “change in culture” at the bank.

The company will be restructured, with its three divisions given more autonomy in a bid to increase transparency at individual units. And the bank unveiled a raft of new recruits to inject fresh talent into the firm.

Marco Suter has resigned as CFO, to be replaced by John Cryan, the present head of UBS’ financial institutions group, while Markus Diethelm, chief legal officer at Swiss Re, will become general counsel. The bank also made four new appointments to the board of directors.

CEO Marcel Rohner outlined a host of cost-cutting measures as part of restructuring. He said UBS had reduced its risk positions by $25m in the quarter, shrunk its balance sheet by 7 per cent and reduced headcount by 2,400.