Treasury mulls buy now pay later crackdown and launches consultation

A regulatory crackdown on the booming buy now pay later (BNPL) sector is coming into sight after the Treasury launched a consultation on the policy options for the market today.

Consumer rights charity Citizens Advice urged the government to swiftly translate the consultation into action, as it warned that BNPL borrowing can “be like quicksand – easy to slip into and very difficult to get out of.”

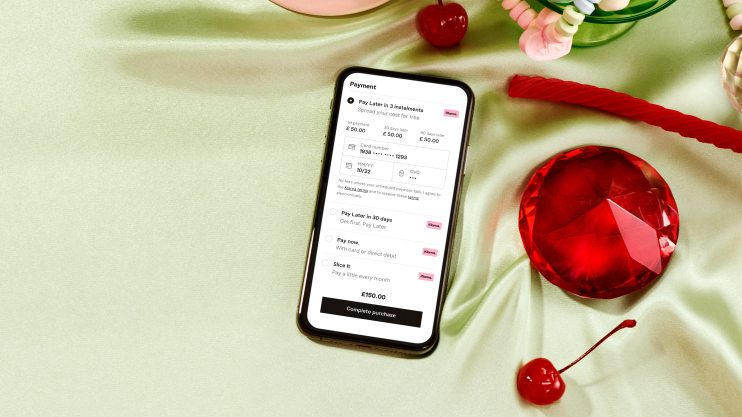

BNPL products enable online shoppers to delay payment with no incurred interest, and are offered by a host of large online retailers. Customers can push back payment for up to 30 days after purchase, or alternatively to spread repayment across six weeks to four month instalments.

The payment products have grown rapidly during the pandemic thanks to their popularity among online shoppers, and the market swelled to £2.7bn last year.

But the Woolard Review into the sector published earlier this year raised potential harm to consumers as the market balloons, including a lack of affordability checks, information about the products and credit agreements, and inconsistent treatment of people that were struggling financially.

BNPL products have also come under fire from campaigners warning that it can encourage consumers — particularly younger shoppers — to rack up debts.

The sector is not currently regulated and relies on an exemption from consumer credit rules, though this has led to inconsistent practices.

The Treasury said today that the consultation “sets out policy options to achieve a proportionate approach to regulation of BNPL”, after the Woolard Review recommended that BNPL products are brought within the scope of FCA regulation.

“When a sector of consumer finance grows as fast and as far as BNPL it is almost inevitable that the FCA is going to have to regulate it,” Richard Barnwell, financial services partner at BDO, told City AM yesterday.

“What the Treasury will need to balance is the fair treatment of borrowers with allowing this fast growth sector to deliver what consumers want.”

Startups in the space have urged caution over the FCA’s plans to introduce regulation to the sector. In a recent report, the Coalition for a Digital Economy (Coadec) hit back at the idea of “hard credit checks”, calling instead for proportionate affordability tracking.

But in a recent poll conducted by Laybuy, a BNPL providers that claims it is the “only provider to conduct hard credit checks”, 63 per cent of consumers said they wanted firms to conduct hard credit checks before allowing them to take out a loan.

“I would be very suspicious of any BNPL or credit provider who believed this wasn’t in the interest of their customers and their own business,” co-founder Gary Rohloff said.

Klarna, the largest provider in the sector, currently conducts less rigorous “soft” credit checks on consumers.

And in a pre-emptive move earlier this week, Klarna overhauled its product by introducing a “pay now” service and new wording to make it “absolutely clear” to shoppers that they are being offered credit that comes with penalties for missed payments.

Responding to today’s consultation, Klarna co-founder and CEO Sebastian Siemiatkowski said the company “continuously sets the standard for the sector” but pointed a finger at “bad products out there.”

“Ultimately, this [consultation] will drive consistency and improve outcomes for all consumers, especially as we see more traditional lenders entering the sector who, as we all know, have a long history of finding dirty tricks to keep their customers in debt by adding fees and charging high interest,” Siemiatkowski said.

Meanwhile, Anthony Drury, Managing Director of smaller provider Zip welcomed the consultation, and said that it had “not waited for regulation” and had “already put in place measures aimed at protecting and supporting customers,” but didn’t specify what these were.