Total value of derivatives held FTSE 100 companies rises to £1.1trillion, almost two-thirds of UK GDP

The value of derivatives held by FTSE 100 companies increased by 27 per cent in 2015 from £890bn to £1.1 trillion-worth of assets, according to data from Banc de Binary.

A derivative is a financial product with a price determined by the value of another asset, such as stocks, currencies or commodities, which can be bought and sold. One example is futures contracts, where you agree to buy an asset at a pre-arranged price in the future, which would hedge against a fall in price.

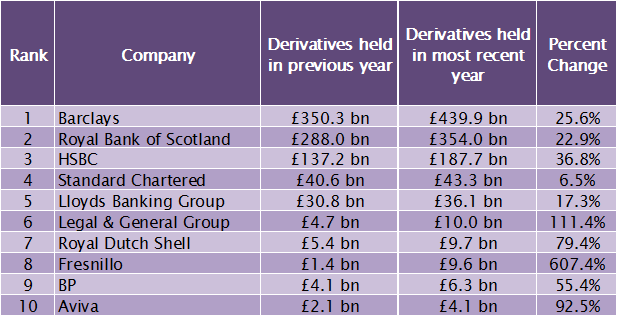

Unsurprisingly, many of the companies are banks – Barclays holds the highest value of derivatives for the second year running, accounting for 40 per cent of the total value of derivatives held by all FTSE 100 companies. It has £440bn of derivatives on its books, up nearly 26 per cent.

Source: Banc de Binary

Energy companies also significantly increased their derivative holdings, BP and Shell's derivative assets were up 55 per cent and 79 per cent respectively, as they sought to mitigate the plunging oil price.

Oren Laurent, founder of Banc de Binary, said: “The level of risk and volatility in the global economy has risen in the last twelve to eighteen months so it is not surprising to see this increase in the use of derivatives. The impact of sharp changes in two of the biggest influences on corporate profits– oil and interest rates – is something that businesses will use derivatives to try and control so as to make their profits more predictable.”