Total ‘underestimate business risks’: Activist investors to disrupt AGM over fossil fuel failures

Total Energies “completely underestimates the business risks” of being over-reliant on fossil fuels, a group of activist investors have said ahead of its AGM.

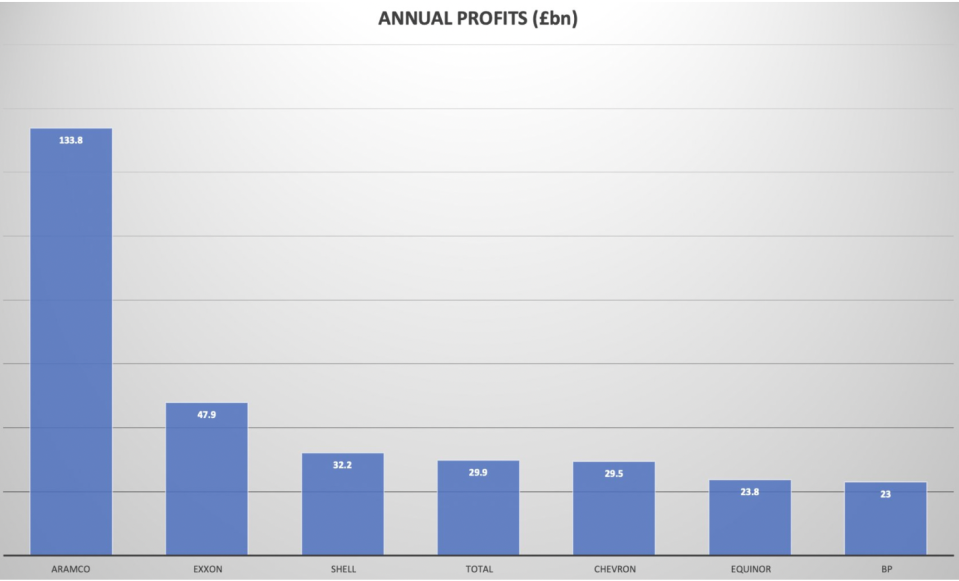

Mark van Baal told City A.M. that Total needs to recognise the “high profits they’re making oil and gas will be very soon over” and that without a credible plan to reach emissions goals and develop green technology, they will struggle to maintain their hefty earnings.

The founder of a leading group of activist investors taking on the French energy giant at a shareholder event next month argued Total was not setting stringent climate targets in line with the Paris Agreement.

He also believed Follow This’ push for Total to beef up its climate ambitions was “very optimistic,” and “business orientated.”

“Everybody agrees that to reach the Paris Climate Agreement, we need large scale emission reductions. That’s the only thing we asked for in our resolution,” he said.

The investor group has filed a climate resolution for the fossil fuel major to announce scope three emission targets in line with containing global temperature rises to 1.5 degrees.

This will be voted on at Total’s annual general meeting (AGM) with shareholders on May 26 – as an attached resolution to its sustainability and climate report, which awaits fresh approval from investors.

“We are asking for a scope three target by 2030 covering all emissions so not only Europe, not only production, but all emissions,” van Baal explained.

The resolution is comparable to motions Follow This has filed at AGMs of rival fossil fuel giants Shell, BP, ExxonMobil, and Chevron over the years.

Scope three emissions encompass those not just produced by the company itself, but those it’s indirectly responsible for, up and down its value chain.

This includes its customers, and the emissions they produce when they burn purchased oil for energy consumption.

The issue is contentious among oil and gas companies across the industry, with fossil fuel majors refusing to commit to absolute targets with scope three – arguing they are too difficult to forecast

Scope three emissions at Total rose to 389m tonnes of CO2 equivalent last year, and the company expects this level to broadly stagnate across the decade – with no target for reductions established.

Investors join Follow This for Total challenge

Follow This is a Dutch activist group, which believes that convincing shareholders to pressure energy giants is the most effective way to make companies commit to more stringent climate goals.

It has been filing motions at AGMs since 2016, and holding stakes in all the major oil and gas companies, with 5,000 shareholders across its network.

Previously, Follow This has managed to secure as much as 30 per cent of shareholder votes on climate resolutions, however its numbers dropped last year to around 20 per cent – as seen at Shell’s AGM last May.

Van Baal attributed this to the “PR capacity” of energy giants which managed to convince people the energy crisis should eclipse the climate crisis – even if he saw them as intimately linked.

This is what happened at the Shell AGM last year:

van Baal did not expect to achieve a majority but did hope to win over a higher percentage of investors, but he clear Follow This wants to work with oil majors

He said: “We will say: ‘We need you – you have the capital and the experience. You can build in the North Sea. You have global reach. Keep on supplying oil and gas, but at the same time, invest in technology of the future.’”

The activist leader was also more optimistic of progress this year, after Follow This managed to secured the backing for seventeen investors in Total – with collective assets under management of around £970bn.

The consortium consists of investors from France, Belgium, the Netherlands, the UK, and the US – including Achmea, Edmond de Rothschild, Man Group, and PGGM Investments.

In an update to its climate strategy last month, Total revealed aims to reduce emissions from its oil products by 40 per cent in 2030 from 2015 levels, increasing its reduction target from the 30 per cent first announced in 2022.

Despite its climate pledges, there is growing pressure on Total after it revealed last month it wants to grow its gas business, and that its overall greenhouse gas emissions will not see a significant reduction by the end of the decade.

This includes plans to boost its liquefied natural gas output by 40 per cent this decade – to cash in on the vast ramp up across the world.

To maintain temperature rises to ‘well below two degrees’ degrees above pre-industrial levels, the International Energy Agency is aiming for carbon neutrality by 2050, which requires a 39 per cent reduction in net energy emissions between 2015 and 2030.

This includes cutting gas emissions by around 43 per cent by 2030 from 2019 totals.

When approached for comment, a Total spokesperson told City A.M.: “Total reaffirms its commitment made in May 2021 to report to the Annual General Meeting, and again in May 2023, on the progress made in terms of sustainable development and the energy transition to carbon neutrality.

“Total will therefore submit its Sustainability and Climate Report to a consultative vote of its shareholders. This “say on climate” approach is fully in line with the recommendations of the AMF.”