Tories turn up the heat on Ofwat as Thames Water scrambles for £1bn in funds

Kemi Badenoch has raised concerns over the future of Thames Water, following the abrupt exit of its chief executive and its desperate bid for funds from investors.

The secretary of state for business and trade, told Sky News “we [the government] need to make sure that Thames Water as an entity survives” – hours after it was reported there may be contingency plans in case of its collapse.

She also criticised Ofwat’s performance, suggesting it had prioritised driving down bills over infrastructure – which risked driving up costs for customers over the long-term.

“There’s a lot of work that the government is trying to do on resolving sewage. Up until now, the regulator has been focused on keeping consumer bills down. But there’s a lot of infrastructure that needs to take place, and we need that entity to survive,” she said.

The MP recognised the situation remains “commercially sensitive” with Thames Water locked in talks with investors as it grapples with a £14bn debt pile.

Meanwhile, former cabinet minister and Tory MP for South Swindon Sir Robert Buckland told the House of Commons earlier today that his constituents would be “very concerned” about the future of Thames Water.

He said “there are aspects” of Ofwat’s operation “which do not seem to me to pass that test” of working in a way “that’s in the full interests of customers.”

When approached for comment, the government confirmed it is considering a “range of scenarios,” but that “the sector as a whole is financially resilient.”

Darren Jones, the Labour MP who chairs parliament’s influential business and trade committee, has slammed Ofwat’s regulation of the water industry.

He told BBC’s Today Programme he is “increasingly sick” of seeing the same failings, and that the watchdog has a case to answer over widespread issues in the much-maligned sector.

“We know that companies that are too important to fail must be regulated differently to other companies,” he said.

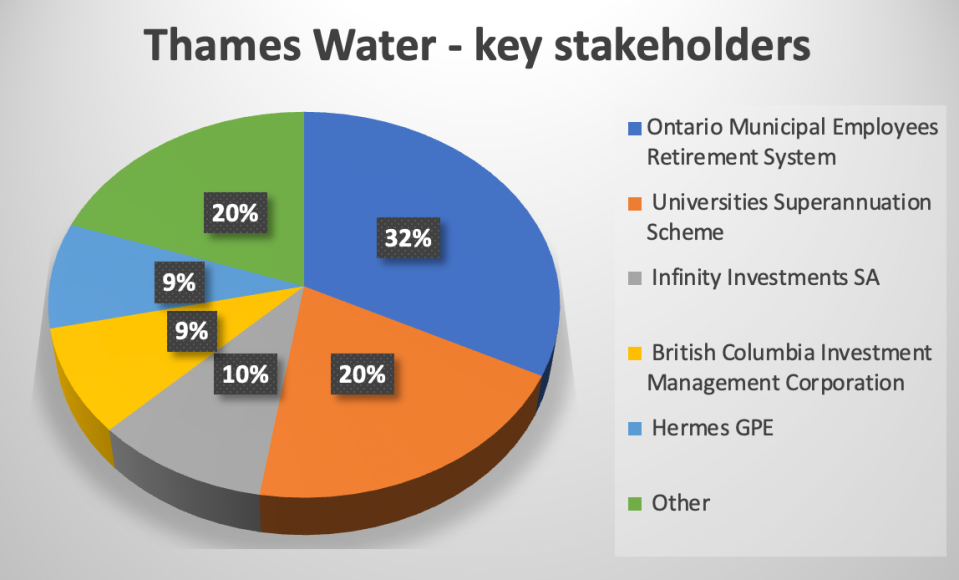

Thames Water is the country’s largest supplier – home to 15m customers, and includes a Canadian pensions group, a UAE-based investment fund and a Chinese state-backed corporation among its largest stakeholders.

Earlier this year, it raised concerns over funding its ability to raise funding for its turnaround plan for sewage spills this decade – while its chief executive left yesterday abruptly before news broke the government and Ofwat were drawing up contingency plans in case of its collapse.

In a statement to the London Stock Exchange this morning, Thames Water said it received £500m of new funding from shareholders in March earlier this year, but warned it still needs more money to support its turnaround plans for fixing sewage leaks and creaking pipeline infrastructure.

It is reportedly looking for a £1bn injection in funds, according to Sky News, and has called in management consultants Alix Partners to advise on the firm’s turnaround.

Thames Water said it has “a strong liquidity position”, including £4.4bn of cash and committed funding as of March 2023.