Stocks dive in Brazil on Rousseff election victory

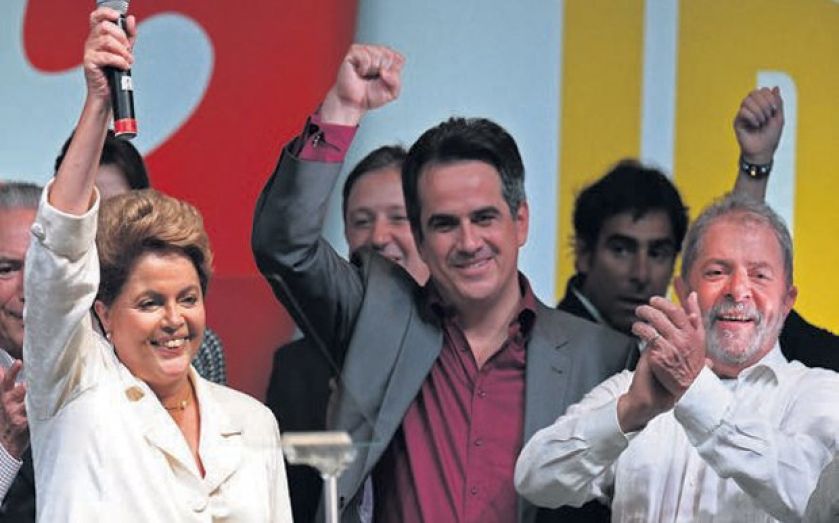

Brazil’s stock market plunged and its currency, the real, fell sharply against the dollar yesterday as markets reacted badly to the re-election victory of centre-left President Dilma Rousseff.

Brazil’s headline share index, the Bovespa, dived by 6.6 per cent in the opening hours of trading before recovering to a two per cent loss on the day. The real fell by 3.1 per cent against the dollar initially and failed to make the recovery seen in shares.

Rousseff took 51.6 per cent of the vote, edging past the pro-reform and business friendly Aecio Neves who took 48.4 per cent. She will spend another four years in office.

“Dilma Rousseff’s narrow victory in Sunday’s presidential run-off in Brazil has dented hopes that the elections might deliver much-needed economic policy reforms,” said economist Neil Shearing from consultancy Capital Economics.

The victory marks the fourth election in a row won by the Workers Party but the margin of victory has narrowed. Brazil recently entered recession again with the economy contracting by 0.6 per cent in the second quarter.

Inflation is running high at over six per cent, however, unemployment is exceptionally low.

“The election saw tensions running high between those in the poorer north of the country grateful for antipoverty campaigns, and urban voters frustrated with the slow pace of growth,” said Mike Simpson from Baring Asset Management.

“From an investment perspective, we would like to see more market-friendly policies and signs the government will be less interventionist towards business.”

Calls for investment friendly policies have been echoed by many who see Brazil as over-reliant on the export of commodities.

“Brazil has some of the highest tariff, tax and interest rates of any emerging markets. Unsurprisingly, it suffers from some of the lowest investment rates,” said Shweta Singh, economist at Lombard Street Research.