Schroders looks to the future as earnings rocket

SCHRODERS, Britain’s biggest listed asset manager, yesterday offset the exit of a top fund manager by hailing surging performance at its recently purchased wealth unit.

The 200-year old business said fresh hires and a raft of new manager talent from Cazenove Capital would take the sting out of the departure of manager Richard Buxton to rival Old Mutual.

“We have the strongest UK equity team we’ve ever had in the firm,” chief executive Michael Dobson said.

Buxton’s departure caused about £1.5bn to flow out of the company’s funds, pushing flows for the quarter ending in June into negative territory.

Ironically, analysts said much of the Buxton-related cash had flowed back to Schroders in July through a top-rated Cazenove fund, which attracted over £660m of new money according to the closely watched Pridham Report.

Cazenove Capital, which dates from 1823, saw £1.6bn of inflows for the half year. It overcame a tricky second quarter to deliver fund inflows, despite strong resistance to fund allocations following hints of a slowdown in US monetary support, known as tapering, in June.

Overall Schroders delivered a record half year pre-tax profit of £228m on revenues of £645m. Assets under management now stand at £235.7bn, up a fifth since the start of the year.

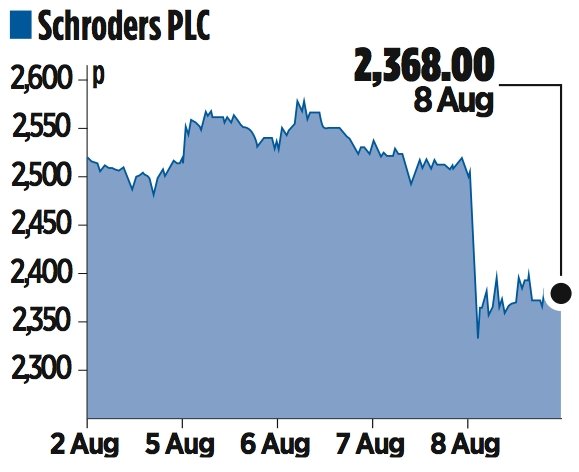

Shares in the company fell 5.3 per cent in trading yesterday to close at 2,368p. Analysts suggested this was driven by investor profit taking, after a bumper run for the stock, which has increased 50 per cent in a year.