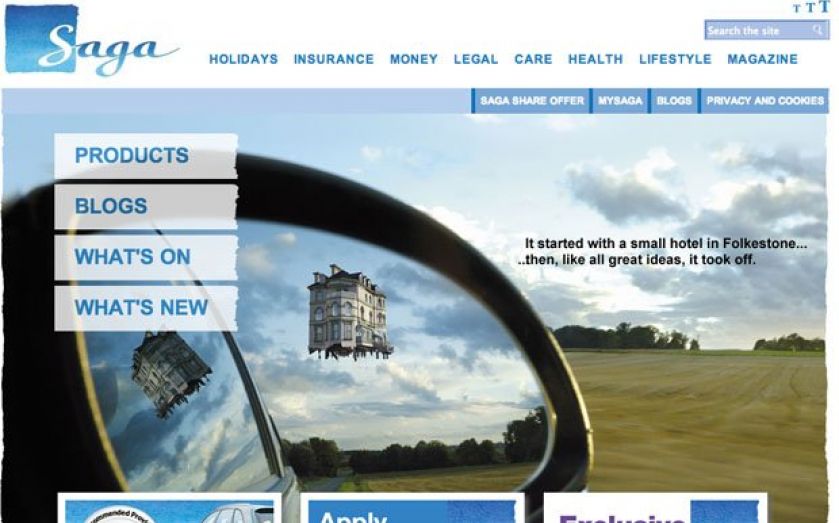

Saga customers get float off to a healthy start

SAGA customers have subscribed for enough shares in the insurance to holidays group to cover the £500m of new money it hopes to raise in its upcoming flotation.

Books for the retail element of the deal do not close until tonight but already bankers have been reporting healthy interest.

Institutional investors will be able to put their orders in from this morning, with Saga’s backers yet to decide exactly how much of their shareholdings they will sell.

Despite the obvious success of the retail offer, a source close to the deal last night said there would still be caution over the eventual pricing of the new shares on offer.

“It’s great that we have got a huge amount of consumer demand for this issue but the pricing will be determined by the level of institutional demand,” he said. “We really want a positive aftermarket.”

The new issues market got off to a riproaring start this year but in recent weeks there have been examples of shares in recently-floated companies trading below issue price.

Saga always believed it would have solid support from its customer base.