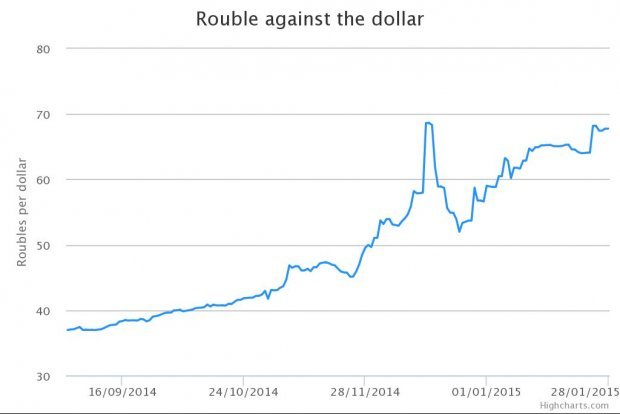

Rouble plummets against the dollar as Russian central bank makes shock cut to interest rates

Russia's central bank has made a shock two percentage point cut to its benchmark rates of, lowering it to 15 per cent, which caused the rouble to plummet against the dollar,

The currency slumped 1.2 per cent, sending it past the 70 per dollar mark.

It's the first time it has slipped past that since December's turmoil, when a shock rate rise to 17 per cent from 10.5 percent sent the rouble tumbling and the Russian economy and markets reeling.

The Central Bank of Russia (CBR) said it took the decision "due to the shift in the balance of risks of accelerated consumer price growth and cooling economy."

It believes the previous decision to "dramatically raise" the key rate has stabilised inflation and depreciation expectations.

The decision to dramatically raise the key rate taken by the Bank of Russia on 15 December 2014 resulted in stabilisation of inflation and depreciation expectations to the extent the Bank of Russia expected. The current surge of inflation is driven by the accelerated price adjustment to the rouble depreciation being time-limited. Further the inflation pressure will be contained by decrease of economic activity. According to Bank of Russia forecast, consumer price growth will be lower than 10 per cent in January 2016.

The shock move comes in the face of falling oil prices and sanctions against Russia. Moscow unveiled a £22bn economic plan this week in a bid to rescue the ailing economy.

Real wages in the country have declined 4.1 per cent and unemployment stands at 5.3 per cent, or 3.97m people, while inflation hit 11.4 per cent in December. Meanwhile, retail sales jumped 5.3 per cent in the same month year-on-year as Russians panic-bought imported items that could go up in price as the rouble falls.