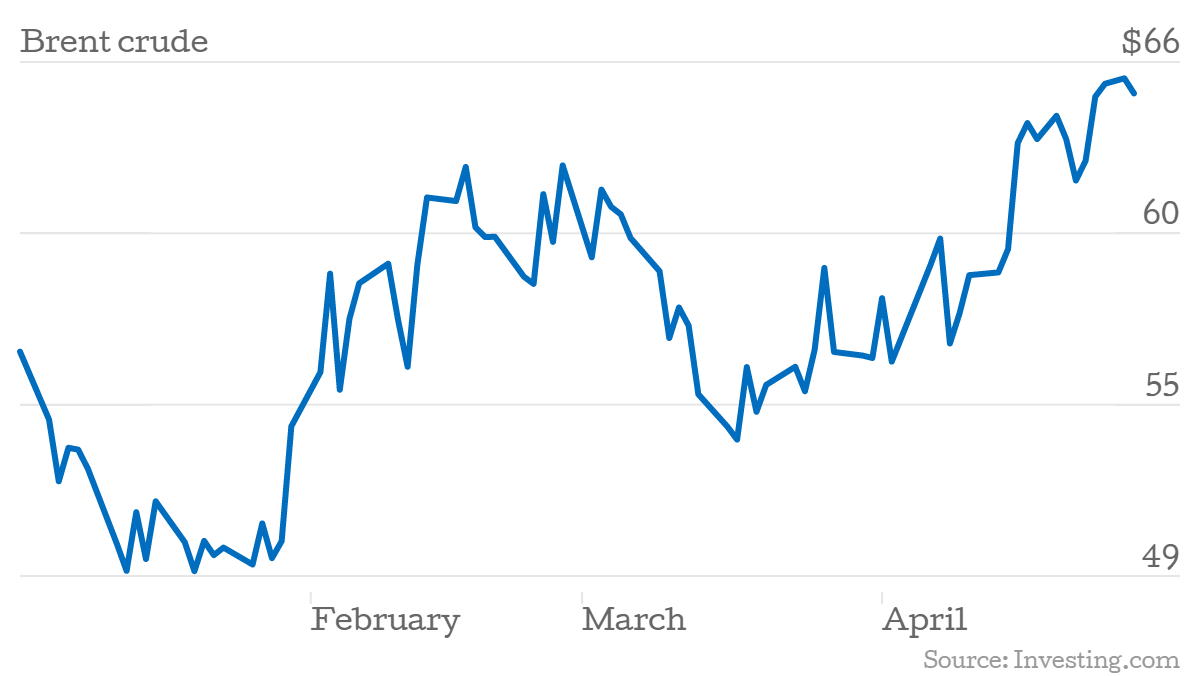

Oil prices hover close to a four-month high

Oil prices edged closer to a four-month high in afternoon trading, as a slowdown in US production and escalating conflict in Yemen took their toll on supply.

Brent crude rose to $65.37 per barrel in mid-afternoon trading, while WTI, the US benchmark, rose 0.77 per cent to $57.59. It's no coincidence the rise in prices comes after the weekly count of functioning oil rigs in the US fell 31 units to 703 on Friday. That's down from a peak of 1,609 in October.

The rise in prices coincides with reporting week for some of the UK's largest oil companies: over the next few days Shell, BP and Exxon Mobil are due to report muted results. Indeed, some analysts have predicted falls in profit of as much as 60 per cent.

Although the recent fall in oil prices puts UK oil giants at risk of takeover, today the Conservatives were adamant they would protect BP from a takeover. BP's share price edged down 0.94 per cent to 473.9p sources at Number 10 told the FT it would be "sceptical" of any takeover attempt. Analysts suggested Tullow Oil could provide a better takeover opportunity for acquisitive oil giants, after it was given approval to continue its current drilling projects in West Africa.

Analysts suggested Tullow Oil could provide a better takeover opportunity for acquisitive oil giants, after it was given approval to continue its current drilling projects in West Africa.

"BP’s attractiveness has to have been dampened a little by the event and aftermath in the Gulf of Mexico and more so by its exposure to an economically weakening Russia," pointed out Augustin Eden, an analyst at Accendo Markets.

"The UK government, while essentially powerless to prevent any takeover attempt, is hoping to deter hostile bids by simply making its feelings known. But the (possibly outgoing…) government has no such feelings about Tullow. It’s a risker asset – it’s not an oil major. Well, not yet."