Oil and gas rally as fears of Russia invading Ukraine rise

Energy commodities have responded resoundingly to reports from Washington that Russia could invade Ukraine this week, with alarmed investors driving up the prices of oil and gas following growing concerns of supply shortages and tightening markets.

UK intelligence has warned Russia could invade Ukraine “at any moment”, with multiple countries pulling embassy staff from the country and recommending their citizens to leave the country.

The latest insight from the US State Department suggests Russia now has sufficient troops and artillery in proximity to Ukraine’s border to mount an invasion if green lit by the Kremlin.

Consequently, both major oil benchmarks have consolidated Friday’s gains, with increased expectations that prices could break the historic $100 milestone for the first time in eight years.

Brent Crude and WTI Crude sustain last week’s rallies with $100 milestone now in sight

Brent Crude is down 0.02 per cent but remains in touching distance of the seven year high it recorded last week, with prices at $94.42, while WTI Crude is up 0.06 per cent, and is currently priced at $93.16.

Conflict in the region would deepen concerns of supply shortages amid rebounding post-pandemic demand, with the possibility of sanctions or volatility caused by conflict tightening the market further.

“Market participants are concerned that a conflict between Russia and the Ukraine could disrupt supply,” explained Giovanni Staunovo, commodity analyst at UBS.

Ricardo Evangelista, senior analyst at ActivTrades expected that war between both countries would push oil over the $100 threshold.

He said: “A Russian move on Ukraine would be likely to push the price of the barrel well above the $100 a barrel mark, as Western sanctions would severely limit Russian oil and gas output, compounding the supply-side issues that have driven global energy prices up.”

Mike Tran, market analyst at RBC Capital considers the market to be “fundamentally driven” and is even more bullish on potential prices this year.

He said: “We see upside visibility for prices to touch or flirt with $115 barrels per day or higher this summer.” .

Commerzbank analyst Daniel Briesemann noted the market has been further buoyed by the upgraded demand forecasts from the International Energy Agency (IEA).

The IEA has boosted its forecast for global oil demand this year considerably upwards, and now expects demand to average 100.6m barrels per day – 900,000 barrels per day more than previously predicted.

The tensions come as the Organization of the Petroleum Exporting Countries (OPEC) and its allies, a group known as OPEC+, have struggled to ramp up output despite monthly pledges to increase production by 400,000 barrels per day until March.

Investors are also watching talks between the US and Iran to revive the 2015 nuclear deal – which have suffered set backs in recent days after early optimism and hopes of a subsequent boost in oil supplies.

According to Reuters, Iran’s foreign ministry spokesman said on Monday that the talks have not reached a dead end, although a senior Iranian security official said earlier that progress in talks was becoming “more difficult”.

US President Joe Biden is desperate to decrease oil prices to reduce the cost-of-living for US citizens ahead of the key mid-terms this November, with the Democrats holding only threadbare majorities in the Senate and House of Representatives.

As for future performance in the market, Morningstar’s monthly Oil Market Update report for February, suggest prices will remain elevated, at least through the first half of 2022, as markets remain tight.

However, it expects supply to balance demand by early 2023 at the latest, which would dampen oil prices as a supply glut emerges.

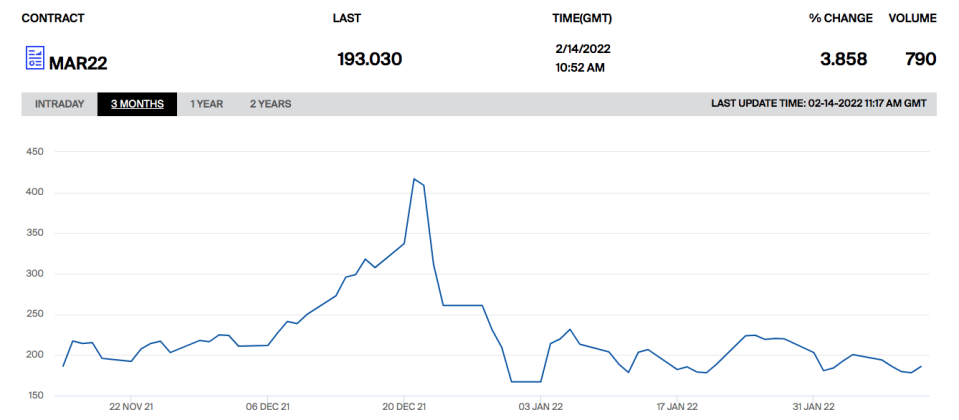

Gas booms in line with rising volatility after post-Christmas slump

Both UK Natural Gas Futures and Dutch TTF Futures have reported revivals in prices today after treading water in recent weeks amid boosted LNG supplies from the US and Middle East, and milder winter conditions.

UK prices have risen 3.9 per cent, with a 4.4 per cent boost for April contracts, while the Dutch benchmark has soared 5.9 per cent, with April prices set at 5.53 per cent.

Renewables are also rebounding from a winter of underperformance, with wind power particularly improving in terms of output in recent weeks, thus reducing the reliance of European economies on natural gas.

However, supplies remain low, and the process for converting LNG to usable gas is slow and extensive.

Henri Patricot, head of research at UBS said: “We haven’t updated our gas prices forecasts in a little while. Last time was back in November. Our broad expectation is that gas prices drop sharply at the end of the winter but that they remain above usual levels over spring/summer because of a need to rebuild inventories in Europe.”

With Europe dependent on Russia for around 40 per cent of its gas imports, there are rising fears gas supplies could shorten further with sanctions and disruption if conflict emerges in Ukraine.

Craig Erlam, senior analyst at OANDA said: “The threat of a Russian invasion of Ukraine is a major factor in the price action we’ve seen recently. Europe is so reliant on Russia for gas, especially in light of some of the supply issues the bloc has experienced this winter. The tightness of the market leaves Europe very vulnerable to an invasion as they have promised severe sanctions in the event that happens, which would almost certainly lead to retaliation.”

The Nord Stream 2 pipeline also awaits approval from both German regulators and the EU Commission, while Gazprom has no further exports planned to Europe this month.

Data from its full-year results suggests it failed to reach its export targets for Europe and Turkey, while it cut export growth to under five per cent over the last three months of 2021.

While Putin has previously dismissed accusations from the IEA it is deliberately throttling supplies to put pressure on Europe as “politically motivated blather”, it is highly likely there will be fresh disruption to supplies if Russia invades Ukraine.