Ofgem turns up the heat on UK Energy Incubator Hub amid industry crackdown

Ofgem has slapped supplier UK Energy Incubator Hub with a provisional order, as it continues it crackdown on the energy sector.

It has demanded the demanded troubled energy firm hands over key financial data – concerning both financial stress testing and management control.

If it refuses to co-operate, the supplier risks losing its operating licence.

This is the third provisional order Ofgem has imposed on UK Energy Incubator Hub this year.

Earlier this month, the market regulator imposed a ban on the company taking on new customers – raising the red flag over the energy firm’s customer service.

According to its website, the ban remains in place with the firm instead offering a waiting list for potential customers.

Ofgem compelled UK Energy Incubator Hub to take fresh action so that households could easily contact them via telephone and email, and that all complaints were resolved in a timely manner.

It also called on the supplier to ensure customer complaint resolutions which have been determined by Ombudsman Services were implemented without delay.

This followed a previous provisional order in March for financial information about its company activities.

UK Energy Incubator Hub is a domestic supplier, formerly known as Euston Energy, that offers electricity and gas on the retail market.

The supplier serves approximately 3,000 customers, and operates under two brands, Northumbria Energy and Neo Energy.

As recently as March, Ofgem reported it had around 4,000 customers on its books, reflecting a steep drop-off in customers over the past three months.

City A.M. has approached Neo Energy and Northumbria Energy for comment.

Regulator seeks to reform crisis-ridden energy market

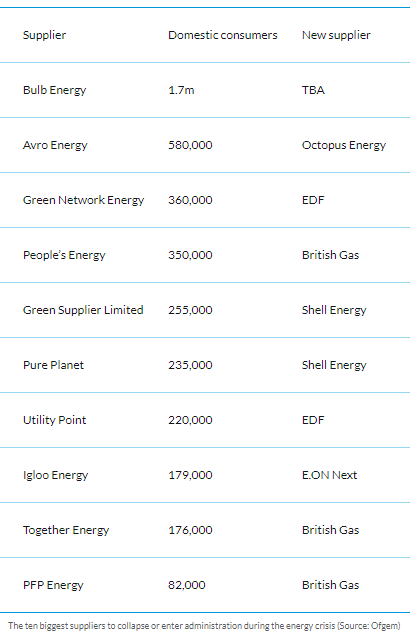

The market regulator has been forced to step in across the industry following market carnage over the past nine months that has seen 29 suppliers collapse – directly affecting over four million customers.

This was caused by industry failures such as insufficient hedging and poor management, alongside highly challenging market conditions driven by soaring wholesale prices – with firms unable to pass the costs on due to the constraints of a rigid, slowly-evolving price cap.

The chaos culminated in Bulb Energy – the UK’s seventh biggest supplier – becoming the first energy firm to fall into special administration last November.

The company has since been propped up on life-support, surviving through regular transfusions of public funds estimated at over £3bn, in order to ensure its 1.7m customers can still have access to energy supplies.

City A.M. understands there is currently a three-way tussle for the fallen firm, with Octopus Energy, Masdar and Centrica all putting in bids for its customers.

In recent months, Ofgem has brought in multiple reforms to make the market more resilient to future shocks.

This includes financial stress tests, fit and proper person rules and market stabilisation charges to ensure customers switching do not leave firms carrying the costs of long-term hedging.

It has also unveiled plans for a quarterly price cap – rather than just twice a year – under the premise that customers could enjoy reduced energy bills more quickly when market conditions ease.

However, Ofgem boss Jonathan Brearley also warned last month the price cap is likely to rise to £2,800 per year in October, meaning bills would have doubled in 12 months from last October’s cap of £1,277 per year.

Energy specialists Cornwall Insight expects high wholesale costs to be baked into the market until 2024, meaning there are growing odds ogf a further hike to the price cap next January, in the depths of winter when energy demand is at its peak.

The consumer price cap is currently sitting at £1,971 per year for average use.