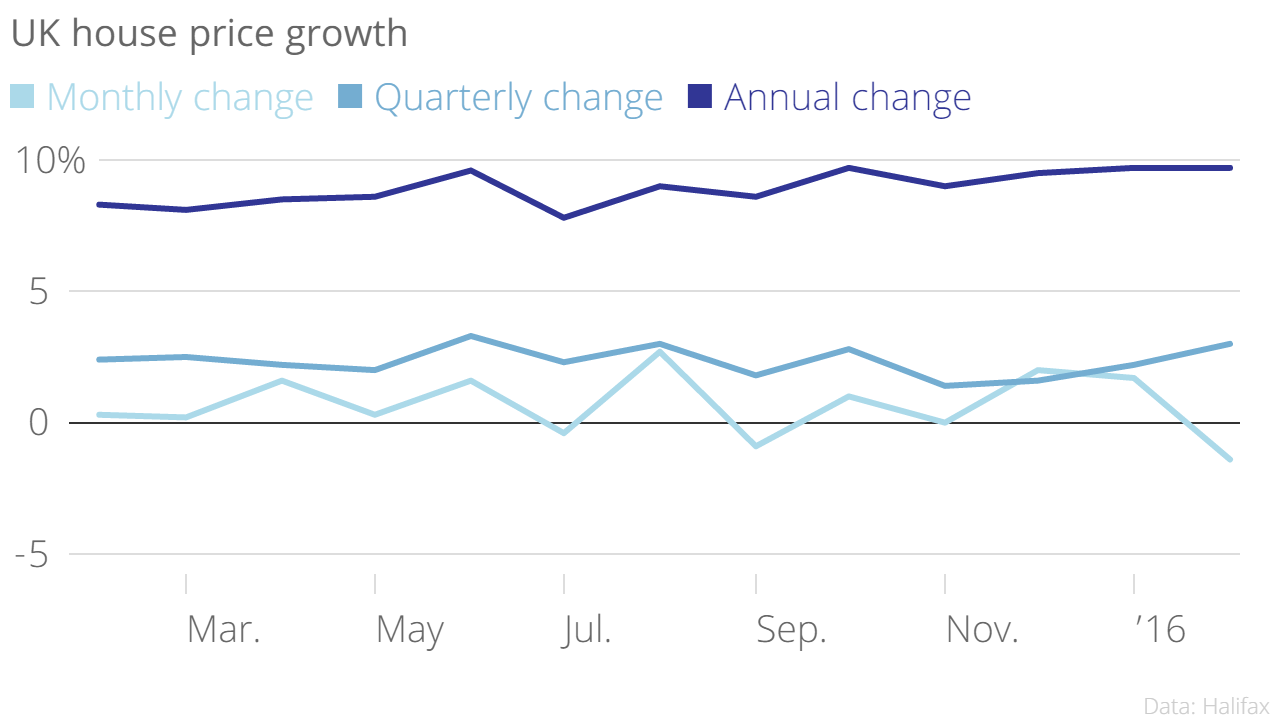

Now Halifax says UK house prices dropped last month – but rose almost 10 per cent in the year to February

It was a day of two house price indices today, and while Nationwide was insistent that house price growth was flat between January and February, figures from Halifax have shown prices fell by1.4 per cent.

But Halifax's house price index, released today, also showed prices rose 9.7 per cent from last February – and were up three per cent in the three months to the end of this February.

The average house price currently stands at £209,495, the data suggested.

Like Nationwide, Halifax pointed out that the rise in the year-on-year figure had been pushed up by a higher volume of mortgage approvals – with approvals for house purchases rising five per cent between December and January.

Meanwhile, supply remained low – although RICS figures have shown new instructions by home sellers increased in January for the second consecutive month, creating the first rise in the stock of second-hand properties for sale in 10 months.

Russell Quirk, chief executive of online estate agent Emoov, pointed out that the strong three-month figure may be a temporary effect of the impending implementation of a hike to stamp duty on second homes.

"There has been a flurry of buyers keen to secure that second home or buy to let investment before the April deadline, as well as an increase in the stock available, due to savvy buyers looking to cash in and obtain a higher price than usual during this period of high demand," said

"We expect once the stamp duty dust has settled the market will cool slightly, but whilst UK and foreign buyers are still fuelling this increase, the issue of affordability will continue to take a back seat, rather than helping to restrain a continually inflating market."