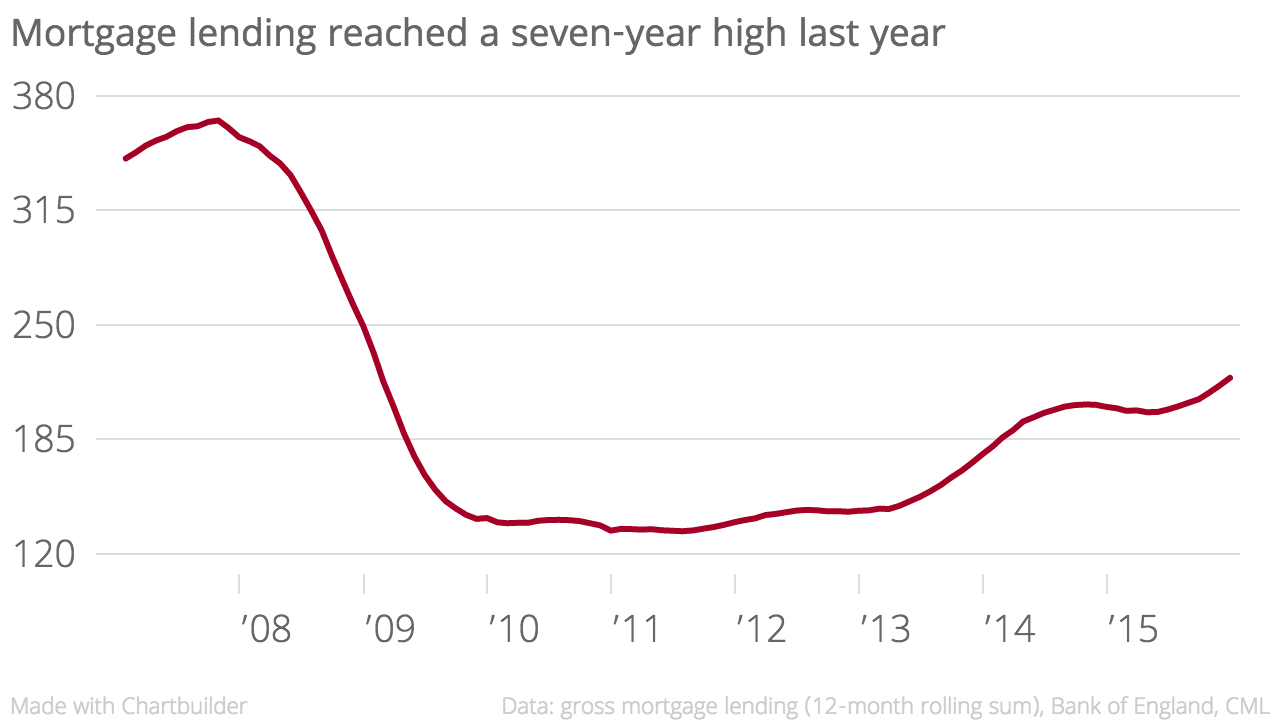

Mortgage lending hits post-recession high of £220bn in 2015

Mortgage lending rose by eight per cent last year compared with the year before, the Council of Mortgage Lenders (CML) said this morning.

Lenders approved £19.9bn of home loans in December, taking the 2015 total to £220.3bn – the highest annual figure since 2008.

December's lending figure was slightly down on November, but was 23 per cent higher than the same month last year.

The recovery in mortgage lending has been attributed to the strong economy, low interest rates at the Bank of England and intense competition between lenders.

"The low inflation environment, along with real wage growth, an improving labour market and competitive mortgage deals have all helped to underpin demand," said CML chief economist Mohammad Jamei.

"Having said this, the upside potential looks limited over the near-term, as the supply of existing and new properties on the market remains weak, and affordability pressures weigh on activity. There is an added element of uncertainty as we wait to see the impact of tax changes on the buy-to-let sector."

New rules on buy-to-let investors will come into force in April, involving a hike in stamp duty land tax and the removal of tax breaks.

The Royal Institution of Chartered Surveyors said today there were signs of a rush to purchase properties to beat the April deadline.

“House purchase lending has been rejuvenated over the past year and with the second half of 2015 looking stronger than the first in lending terms, the trend looks positive. Small-deposit lending has been transformed by a renewed enthusiasm to help first-time buyers cross the threshold of homeownership, as evidenced by the number of higher loan-to-value products available," said Richard Sexton, director of e.surv chartered surveyors.

Jeremy Duncombe, director at the Legal & General Mortgage Club, said the lending increase was due to higher prices, rather than increased purchases. He said:

2015 has been an exceedingly strong year for mortgage lending, and we expect favourable UK economic conditions to further drive demand in 2016. That said, the number of transactions has remained relatively flat throughout the year as a result of the lack of available housing stock for buyers.

This is contrary to the increases we are seeing in lending, showing that this strong performance is being driven in part by escalating house prices as people are having to take out larger loans to secure a property.