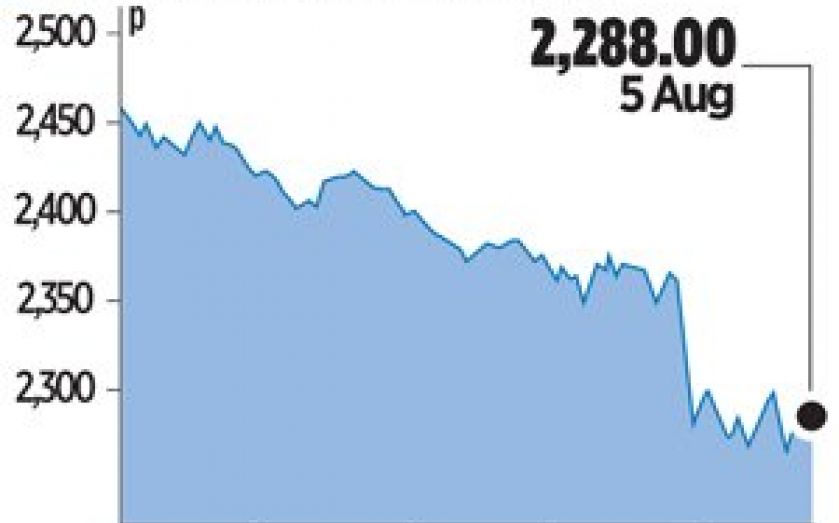

InterContinental upbeat despite decline in profit

INTERCONTINENTAL Hotels Group (IHG) said yesterday it was upbeat on prospects for the rest of the year thanks to strong trading in its biggest market the US, despite reporting an 18.4 per cent fall in half -year profits.

The Crowne Plaza and Holiday Inn owner posted a pre-tax profit of $377m (£224m) for the six months to 30 June compared with $462m the previous year, which was largely expected due to one-off factors such as the sale of two hotels in the US.

The group also warned that political unrest in countries such as Thailand and Egypt and currency headwinds had dragged on its performance.

Underlying operating profit, excluding the effect of exchange rates, one-offs and asset disposals, rose six per cent to $301m with underlying revenue up four per cent in the period.

IHG, which has around 4,700 hotels worldwide, makes almost two-thirds of its operating profit in the United States, where income is being buoyed by increasing levels of business and leisure travel.

Global revenue per available room (RevPAR), a key industry measure, rose 5.8 per cent with US growth accelerating to 6.7 per cent in the second quarter from 6.4 per cent in the first.

It also signed up to manage 30,000 rooms in the period, its best performance since 2008, thanks to improved conditions in the US lending market.

The company’s results come just a day after activist investor Marcato Capital Management said it had hired bankers at Houlihan Lokey to explore options for IHG, three months the hotels group reportedly rebuffed a £6bn takeover bid from a US suitor.

IHG has declined to comment.