Inflation drop takes the pressure off Bank on rate hike

INFLATION fell back again in July, according to official figures released yesterday, easing the pressure on the Bank of England’s policymakers to tighten their stance and weakening sterling

The consumer price index (CPI) rose by just 1.6 per cent in the year to July, according to the Office for National Statistics. The figure dropped from 1.9 per cent in June, with little sign of more pressure building up.

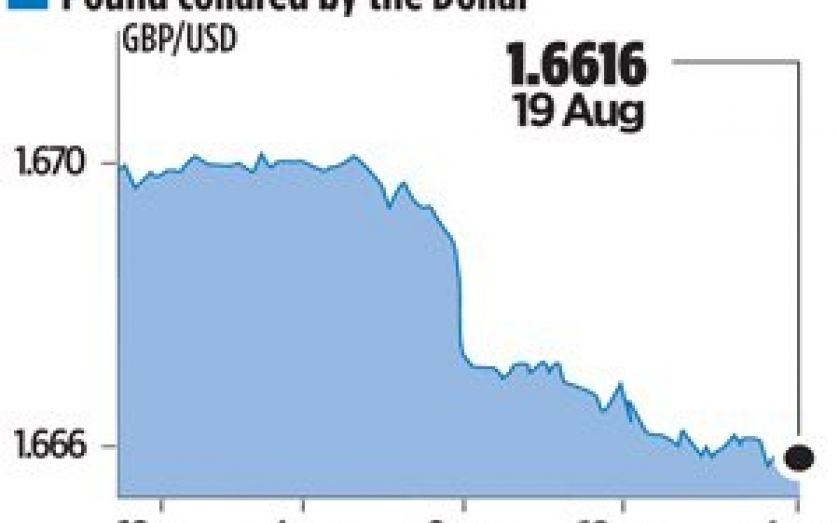

As the figures were announced, sterling slipped against the dollar, ending the day around 0.66 per cent lower at $1.662.

Producer prices dipped by 0.1 per cent in the year to July, and the price of material and fuel bought by the UK’s factories for processing fell 7.3 per cent. It was the steepest decline in almost five years.

Input prices provide a useful leading indicator of how inflation may develop in the months ahead.

The figures also come ahead of today’s monetary policy committee (MPC) minutes, which will show whether any Bank officials voted for an interest rate hike during this month’s meeting. It might be the first sign of dissent since Mark Carney became governor.

“A late-2014 increase in bank rate appears to be off the cards” said Investec’s Victoria Clarke.

“The subdued nature of price trends, both at the factory gate and in terms of headline CPI, should serve to buy the MPC some more time,” she added.