Income for richest UK households is nearly four times larger than poorest, ONS finds

The richest households in Britain earn nearly four times as much as the poorest, although government tax and benefit spending has kept income inequality in check in the UK over the last year, according to official figures out today.

Top earners made £83,700 last year, 3.8 times higher than the £22,300 average final income of the least well off in the UK, according to the Office for National Statistics (ONS).

Income inequality between the highest and lowest earners in Britain has reduced over the last year. In 2021, top earners’ income was four times greater than the bottom earners.

Wealthier Brits paying more tax and receiving less in benefits helped narrow income inequality last year.

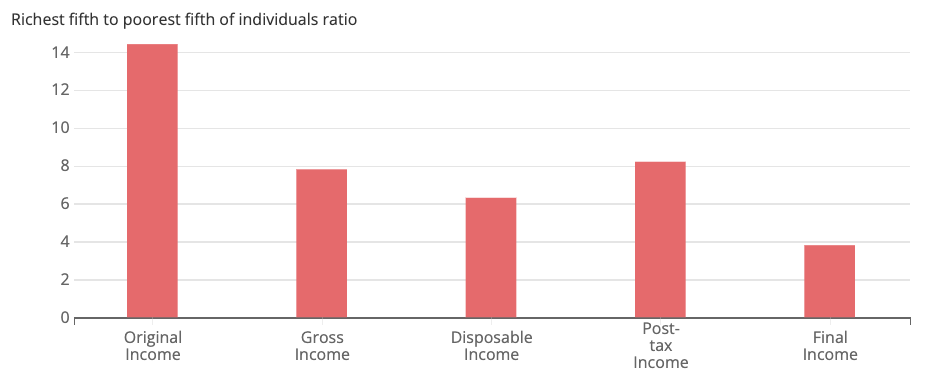

Before taxes and benefits, top earners made on average £117,500, 14 times higher than the £8,200 booked by the poorest fifth in the country.

Government spending on things like the National Health Service, education, free childcare and transport relief helps poorer households pay for basic necessities.

These categories are known as “benefits-in-kind” and give households an effective income boost by the state shouldering some of their potential expenditure. They are mainly funded from taxes.

Government tax and benefit spending brings down income inequality

ONS calculations found that the poorest received a £13,000 income boost from making use of benefits-in-kind. The same group collected £7,250 in cash benefits, which refers to transfers via packages like universal credit.

Government support is much thinner at the top end of the income distribution. The ONS said this group on average received £7,788 and £2,584 in support via benefits-in-kind and cash benefits respectively.

Taxes are another means a government uses to narrow income inequality by seizing a proportion of higher earners’ income and using the proceeds to fund support for less well off individuals.

Direct taxes – mainly income tax and national insurance – paid by the average top earner in the UK amounted to £36,360 compared to £2,193 for the poorest.

Indirect taxes – things that households only pay if they exert specific behaviour – is a driver of income inequality in the UK, mainly because VAT is a flat rate tax of 20 per cent. Because it does not increase in line with household income, VAT tends to eat up a bigger share of poorer households’ finances.

“Indirect taxes increased income inequality by 3.5 percentage points; the poorest fifth of people paid a greater proportion of equivalised disposable income on indirect taxes at 28.3 per cent, compared with nine per cent for the richest fifth of people in FYE 2022,” the ONS said.