Self-styled bank sheriff Ben Lawksy hangs up his badge

Banks in the UK and across Europe will be breathing a little easier next month after New York’s top financial crime cop Ben Lawsky, who mounted an aggressive campaign against some of the world’s biggest institutions, exits his role policing financial firms operating in the Big Apple to take up a West Coast teaching job.

The former state legal attorney, who was New York’s first dedicated law enforcer for the financial service’s industry when he was appointed in 2011, made his mark penalising banks based thousands of miles away in the City of London – but also helped mould the City’s regulatory culture.

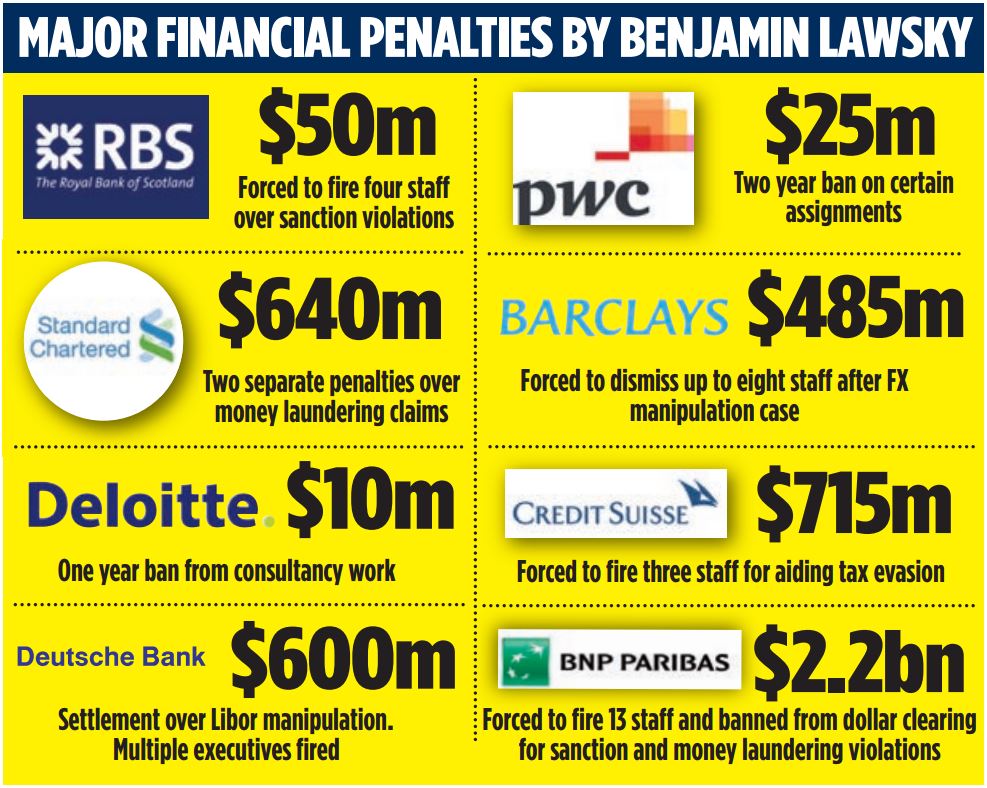

His no-nonsense style and stiff penalties – ordering banks to fire senior staff and forcing companies to install internal monitors to check behaviour – won admirers and critics in equal measure.

“People like Lawsky led the way,” said Labour MP John Mann, who sat on the UK’s Treasury Select Committee during Lawsky’s time in office. “Their actions have led to a strengthening of the Financial Conduct Authority (FCA). People like him should take some credit for helping prompt that.”

Lawsky, 45, will leave his role as the superintendent for the New York Department of Financial Services (DFS) at the end of June.

He will take up a teaching role at California’s Stanford University as a visiting scholar specialising in cybercrime and will also establish a law consultancy firm in his native New York. His replacement has not been announced.

Lawsky, who cut his teeth prosecuting insider trading cases in New York courts, mixed fiery rhetoric with an outspoken approach to naming and shaming firms and individuals accused of wrongdoing.

He came to attention in the UK in August 2012 when he labelled FTSE giant Standard Chartered a “rogue institution” which “schemed with the government of Iran” to hide illegal banking activity.

His strident prosecution of Stan Chart provoked the ire of his fellow regulators in the US, who fumed over his decision to pursue a settlement with the bank alone.

“If you want to work in a global financial environment, you need global regulatory certainty,” University of Singapore public policy dean Kishore Mahbubani told Bloomberg. “I call Benjamin Lawsky a rogue regulator because he is driven by domestic political considerations.”

But he broke new ground in his tax evasion case against Credit Suisse when he secured the first guilty plea from a major US bank since 1989 and won a major scalp by banning BNP Paribas from settling dollar trades.

Lawsky’s final assault came on Wednesday when he fined Barclays $485m and accused it of running a “brazen ‘heads I win, tails you lose’ scheme to rip off their clients”.

Whoever emerges as his successor is likely to come under pressure to replicate a similar tone. “It’s a shame he wasn’t over here,” Mann says, “Perhaps we should give him a job.”