Hotel activity to hit new record high as investor appetite grows

INVESTORS stepped up their spending on UK hotels in the first six months of the year as rising confidence and increased availability of debt helped boost activity in the sector.

According to figures released today by Deloitte, UK hotel transactions totalled £1.5bn in the first half, 65 per cent higher than the second half of 2013 but down on the same period last year when a record £1.96bn of hotel assets changed hands.

However Deloitte’s head of hospitality Nick van Marken said a strong second half to the year led by buyers from the US, the Middle East and Asia could lead to another record year for hotel activity since the peak in 2007.

“We expect deals will close more quickly in the second half of 2014 with significant appetite on the part of private equity in particular. The UK hotel sector appears firmly back in favour,” he said.

The regions accounted for 60 per cent of total sales in the first half but London led the charge in terms of deal size with the sale of Marriott’s Edition hotel to Abu Dhabi’s sovereign wealth fund ADIA for more than £150m.

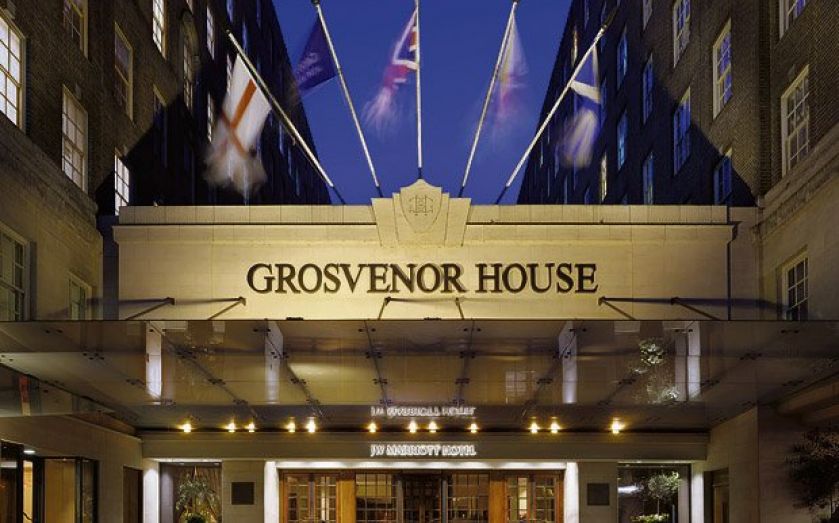

A number of deals are set to close before the New Year, including London’s landmark Grosvenor House hotel, five Hilton hotels and a portfolio of De Vere Golf Resorts and Village Urban Resorts.