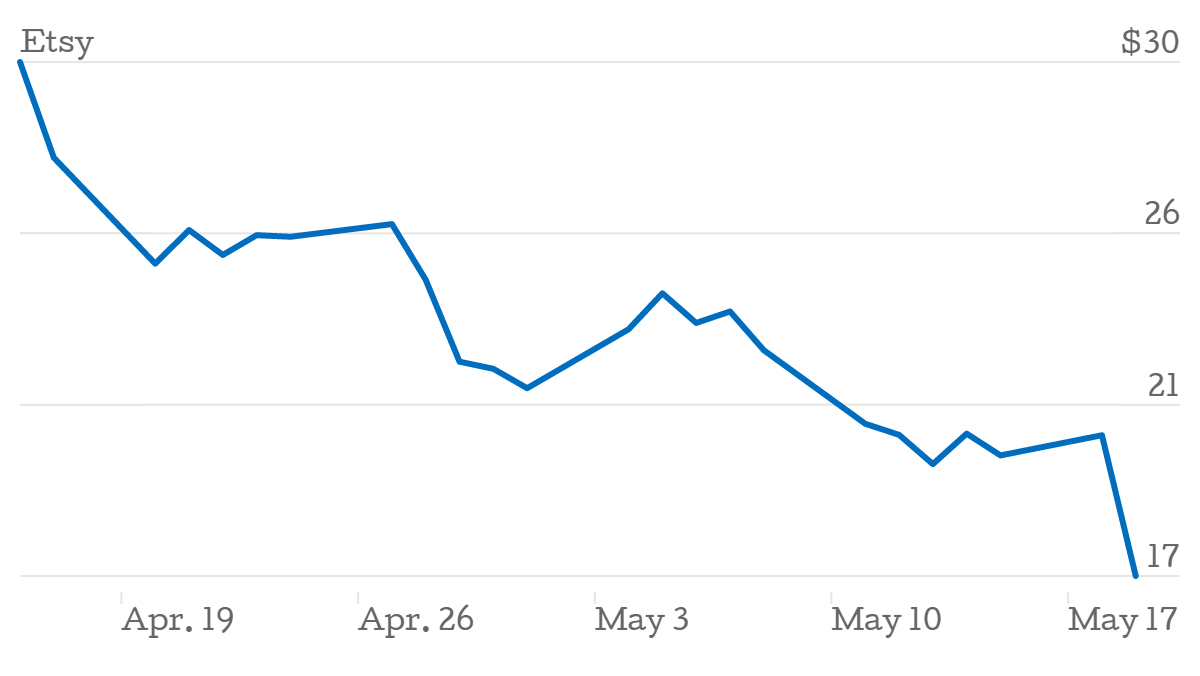

Hipstergeddon? Etsy share price plummets in after-hours trading as as losses jump

Shares in newly-floated craft site Etsy fell as much as 15 per cent in after-hours trading after its first results since it listed showed its net loss for the three months to the end of March had risen to $36.6m, from $500,000 during the same period last year. That's enough to put a droop in any hipster's moustache.

The company attributed $20.5m of that to non-cash currency exchange "largely due to intercompany debt incurred" related to structural changes implemented at the beginning of January, and a $10.5m increase to its tax provision.

Of course, given the expense of listing on the stock exchange, a dent in Etsy's finances was to be expected. But it also unveiled a 73 per cent uplift in its operating expenses, which hit $42.7m, which it said was driven by marketing and IPO costs.

Meanwhile, sales rose to $58.5m, from $40.5m a year before, above analyst expectations of $58m.

The company added that "a few factors" may impact it during the second quarter.

First, if foreign exchange rates continue at current levels, it will likely continue to impact buyer behavior outside of the US.

Second, we expect to increase the pace of hiring in the second quarter compared with both the first quarter of 2015 and second quarter of 2014.

Third, we plan to spend more on marketing in absolute dollars in the second quarter compared with both the first quarter of 2015 and the second quarter of 2014.

Finally, we would like to remind investors that second quarter 2015 results will include some one-time expenses such as Etsy's $300,000 cash contribution to Etsy.org described in the Etsy prospectus filed on April 16, 2015 and approximately $300,000 in IPO expenses not deductible from Etsy's IPO proceeds.