| Updated:

Hilton shares dip as strengthening dollar spells tough 2015 for US hotels

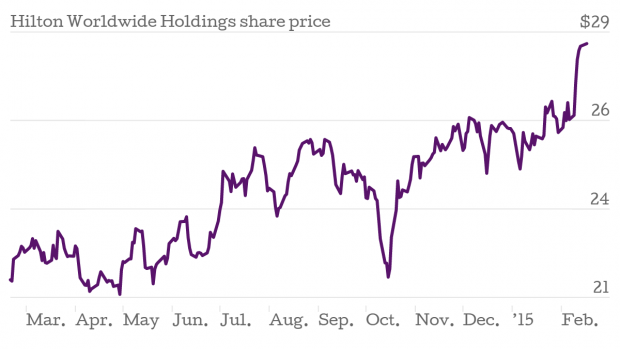

Hilton Worldwide Holdings’ share price has dipped in morning trading on the New York Stock Exchange as it said a stronger dollar could spell tough times ahead.

Shares fell by as much as 2.5 per cent in early trading to $27.9 per share.

The figures

Hilton’s results for the 2014 calendar year show the hotel group benefited from a recovering US economy, as revenues rose by seven per cent from $2.6bn to $2.8bn (£1.8bn) thanks to an increase in business travel.

Revenue per available room rose 6.6 per cent worldwide and 6.8 per cent at US hotels open for more than a year.

Earnings on an adjusted basis climbed to 17 cents per share from 11 cents per share last year, but came in below analysts’ expectations of 18 cents per share.

But what is more likely to be spooking investors is the US company’s timid profit forecast for 2015.

Why it’s interesting

The dollar has strengthened nearly 13 per cent against a basket of major currencies and is likely to lead to a slowdown in overseas visitors to the US, which spells trouble for Hilton – more than 80 per cent of its hotels are based in the US.

Hilton is forecasting adjusted profit of 10-12 cents per share for the first quarter and 18-83 cents per share for the full year. That compares to analyst estimates of 15 cents per share and 85 cents for the first quarter and full year respectively.

Hilton sold New York’s iconic Waldorf Astoria hotel to China-based Anbang Insurance Group for $1.95bn and is using the proceeds to buy five new hotels.

What Hilton said

Our distinct, world-class brands continue to deliver accelerating growth, with 40,000 new rooms opening during 2014.Even with openings increasing, we continue to expand our industry-leading global pipeline, which consists of approximately 230,000 rooms, the majority of which are under construction.

– Chief executive Christopher J. Nassetta.

In short

With a strong dollar keeping international visitors away, Hilton faces a tough task to meet profit expectations in the next financial year.