Fed documents reveal internal unease over quantitative easing

When the Federal Reserve launched the expansion of its quantitative easing programme in 2010, it was despite several policymakers’ misgivings over what impact this would have on the dollar.

Documents freshly released from the Fed’s 2010 meeting reveal internal fears that the programme would be bashed internationally as an attempt to send the dollar lower, launching as it did at the height of the currency wars. Some emerging markets were critical of the West’s loose monetary policies driving exchange rates up and hurting their economies.

Kevin Warsh, a Fed governor at the time, worried it would not be “politically correct” to express a goal of depreciating the dollar:

I think it is risky pool playing in the foreign exchange markets, asking them to do so much of our work when the world’s recovery is resting on this.

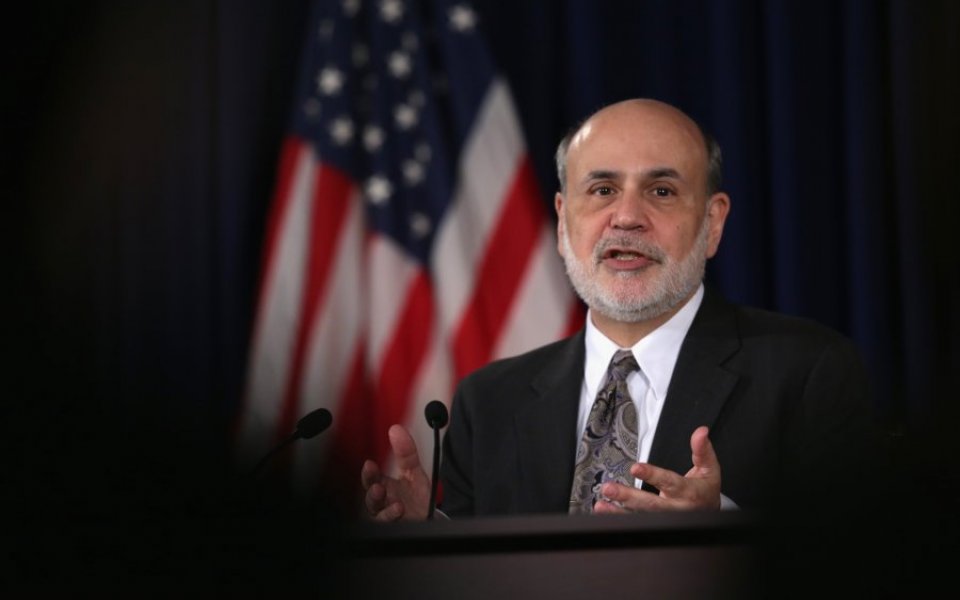

Richard Fisher and Jeff Lacker expressed similar concerns, but Ben Bernanke, then the Fed’s chair before Janet Yellen took on the role, disagreed that asset purchases were an “aggressive or adverse act”, arguing that emerging markets were also dependent on a strong US economy.

The Fed’s $600bn asset purchase programme was introduced despite these internal misgivings, and asset purchases went on until 2014.

The Fed then went on to lift short-term interest rates from their historic low for the first time in nearly a decade at the end of 2015.

Full policy meeting transcripts are released with a five-year delay.