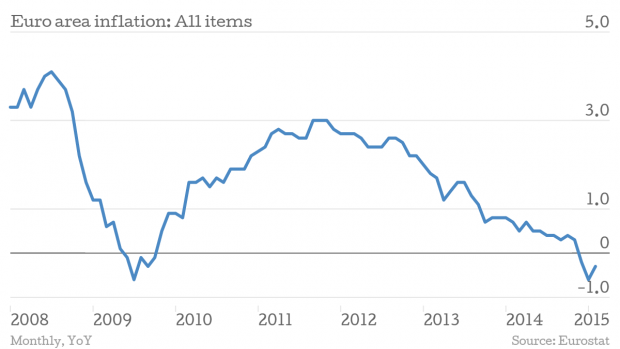

Eurozone core inflation beats expectations, but the bloc is still in deflation

It is hardly a time for unbridled celebration; the Eurozone remains in deflation at -0.3 per cent, but the core reading showed stronger than expected growth of 0.7 per cent year-on-year, compared to the 0.6 per cent analysts had been expecting.

The data may lead to suggestions that Mario Draghi's quantitative easing (QE) programme is easing the currency bloc's pain, but the headline inflation figure for February showed prices are still dropping, albeit at -0.3 per cent year on year, as opposed to January's faster decline of -0.6 per cent.

The core figure is an important measure, as it removes from the inflation basket volatile elements such as energy, food, and tobacco.

Why it's interesting

The reversal of trajectory is most likely down to Mario Draghi’s QE easing bazooka, which has begun to pepper the single currency bloc with €1tn (£720bn).

The powers that be seem to believe that the Eurozone economy is on the mend. Mario Draghi and Angela Merkel are meeting today to discuss the state of the Eurozone economy and Draghi softened the ground ahead of the talk by indicating he believes the economy is in the early stages of a recovery.

Most indicators, he said, suggest a sustained recovery is taking hold.

A nascent recovery provides us with a window of opportunity, with the conditions to press ahead with reforms that will make the euro area less fragile and vulnerable to shocks.

This rosier picture could be shredded at speed if Greece leaves the Euro. The chance of an Hellenic dash for the exit is rated at 25 per cent by investment bank Morgan Stanley. While it remains in the Euro Greece isn’t above ruffling few feathers either.

Wolfgang Schauble, who is nothing if not a figure of austere financial rectitude, said that the new guard in Athens had damaged the trust built up by the previous government.

Until November, Athens was on a road that could have lead it to exit the crisis. This has gone. I don’t know what to do now with Greece.

Greece, despite a change in direction, is still in deflation (-1.9 per cent), while Italy has popped just above the zero per cent barrier, recording 0.1 per cent inflation. France is on the Eurozone average at -0.3 per cent and Germany improved from -0.5 to -0.1.