Cost of living crisis: Inflation sees Brits take a real-terms pay cut yet again

British workers’ wages have been eroded by sky high inflation for the 15th month in a row despite them bagging bumper pay rises, official figures out today show.

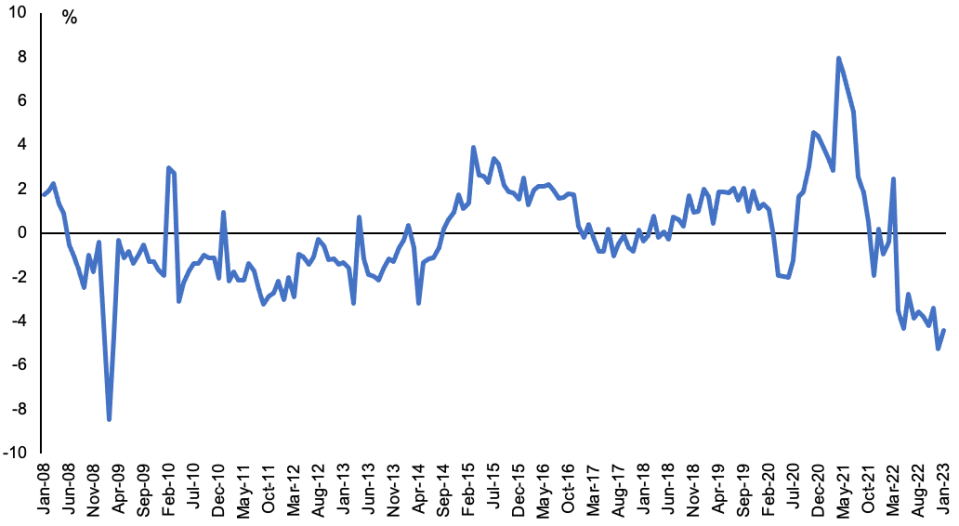

Real regular pay, which measures pay growth in cash terms minus inflation, fell on a monthly basis in January, according to the Office for National Statistics (ONS).

Over the three months to January, pay fell 4.4 per cent when using the statistics agency’s official measure of inflation, the consumer price index.

The ONS’s latest figures illustrate the scale of damage inflation is doing to family finances.

Staff in the private sector took home a seven per cent pay rise over the last three months, which is exceptionally high by historical standards.

However, those elevated pay rises were not enough to outpace inflation, which is currently running above 10 per cent.

“Although the inflation rate has come down a little, it’s still outstripping earnings growth, meaning real pay continues to fall,” Darren Morgan, director of economic statistics at the ONS, said.

The rate of price growth has trimmed three months in a row and is tipped to fall sharply this year. However, wages are forecast to trail it for most of 2023, generating the biggest living standards erosion in recent memory.

Real wage growth has been sluggish since financial crisis

City workers took home the largest pay rises of any sector, with regular wages up 7.7 per cent.

Although private sector pay is rising faster than usual, there are signs it has passed its peak, potentially emboldening Bank of England officials to hold off on an eleventh interest rate rise on 23 March.

“Even though the labour market is still tight, wage growth is easing. Together with the fallout from Silicon Valley Bank’s collapse, further rate hikes are becoming less likely,” Ashley Webb, UK economist at consultancy Capital Economics, said.

“Today’s labour market report strengthens the case for the MPC to hold back from raising bank rate further next week, which already had been bolstered by the collapse of two US banks over the weekend,” Samuel Tombs, chief UK economist at Pantheon Macroeconomics, said.

The Bank is concerned elevated wage increases that aren’t offset by productivity gains will bake in high inflation over the long run.

MPC member Swati Dhingra has argued inflation is being primarily driven by higher international trade costs, while City economists have highlighted companies raising prices to fatten profits has also led inflation higher.

Private sector pay growth has raced ahead of the public sector over the last year.

However, the wedge between the two trimmed to 2.2 percentage points.

There has been speculation that Chancellor Jeremy Hunt could use some of his £9bn windfall to offer civil servants, doctors and nurses a pay rise at the budget tomorrow to prevent further strike action.

“The jobs market remains strong, but inflation remains too high. To help people’s wages go further, we need to stick to our plan to halve inflation this year,” he said.

“Tomorrow at the budget, I will set out how we will go further to bear down on inflation.”

Joblessness was broadly unchanged over the last quarter at 3.7 per cent, extending a trend in which it has hovered around multi decade lows despite the UK economy cooling.

That figure remained unchanged due to 77,000 people returning to the workforce, offsetting a 65,000 rise in employment, pushing unemployment up 5,000.

Economic inactivity – when someone doesn’t have a job and isn’t looking for one – dropped 0.2 points to 21.3 per cent, although that level was still much higher than before the Covid-19 crisis.

A strong influx of students back into the jobs market led inactivity lower, while the number of people out of work due to long-term sickness actually grew.

“Without solving the sickness issue plaguing so many people, it will be difficult, if not impossible, to get the UK back to sustained growth, especially as the UK working age population also fell by 30,000,” Thomas Pugh, economist at RSM UK, said.

Vacancies slid 51,000 over the last quarter but are still above 1m.