City rides to the £400m rescue of B&B

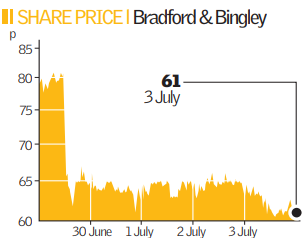

Bradford & Bingley said last night its underwriters and other City institutions will back its £400m fundraising despite a dramatic decision by American private equity firm TPG to walk away from a deal after rating agency Moody’s cut the bank’s credit status.

The move comes after Moody’s cut the cash-strapped bank’s rating to Baa1, giving it the lowest credit rating of any major British bank.

This was the second time Moody’s had downgraded B&B since TPG agreed to invest £179m in the bank in return for a 23 per cent stake after it issued a profit warning last month. The underwriters for B&B’s £279m rights issue UBS and Citigroup are understood to be prepared to press on with the share sale.

City watchdog, the Financial Services Authority, has played a central role in helping to organise other City institutions to mount a second emergency fund-raising for B&B.

This is the second time in weeks that this vital fund-raising has gone to the brink of collapse.

The Moody’s downgrade comes just days before shareholders vote on the rights issue and the stake sale. Major City investors are ready to put more cash into the lender, including M&G Investment Managers, Legal & General, Insight Investment and Standard Life.