Chinese diets set to beef up demand for agricultural commodities

Investors rocked by collapsing commodity prices should consider ditching copper and oil and park their cash in softer resources such as wheat and corn instead, a new report has suggested.

Amid a backdrop of rising prosperity Chinese consumers are demanding more top nosh, with meat and grains such as wheat high on the menu wishlist.

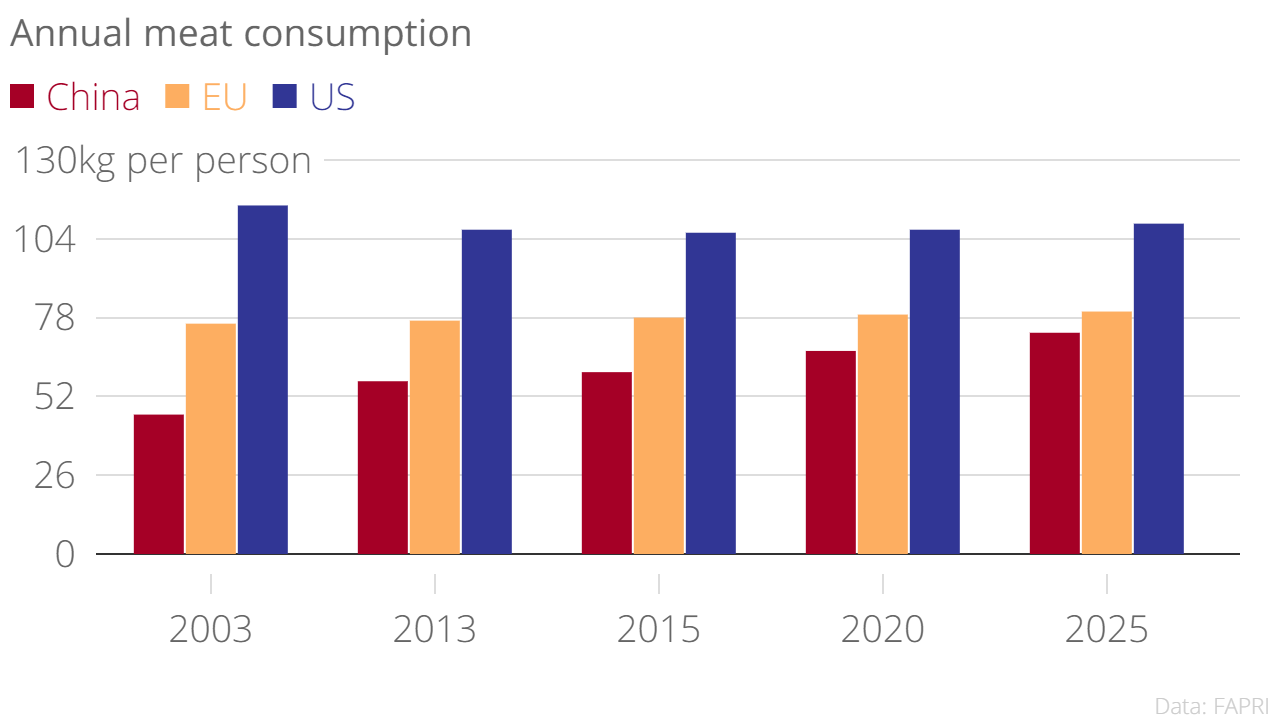

The average Chinese adult is predicted to eat an average of 60kg of meat this year, up from 46kg in 2003. Based on a comparison with countries such as Taiwan, PwC believes this will reach 73kg by 2025.

Supporting this livestock will require an extra 94m tonnes of corn and soybeans for feedstock, which needs an additional 15m hectares of agricultural land – an area the size of England and Wales – the researchers estimate.

The rosy long-term forecast for agricultural commodities is in contrast to the outlook for harder commodities such as iron and copper.

Industrial metals such as iron and copper have suffered this year as China’s economy slowed and investors began factoring in slower growth down the road. Oil prices, meanwhile, are expected to remain low with a global supply glut not expected to go into reverse until the end of next year, according to the International Energy Agency.

But while China, the world’s second-largest economy, is undergoing a slowdown, it is also undergoing a bumpy transition to an economy that focuses more on services rather than resource intensive manufacturing and industry.

As such, even if its economy never reaches double-digit growth again, Chinese demand for top nosh will continue to climb while demand for industrial metals wanes.

“China’s changing diet is already exerting a powerful influence on domestic and international agriculture. Amid volatility in commodities markets, China’s continuing shift towards consumerism, means the outlook for soft food stuffs is relativity bright,” said Richard Ferguson, agricultural adviser to PwC and author of the report.