In charts: Eurozone debt grows to 92.7 per cent of GDP

Figures released by the European statistics authority today show government debt in the Eurozone grew to 92.7 per cent of GDP in the second quarter of 2014, a jump of 0.8 percentage points.

In the European Union the level rose to 87 per cent of GDP, a rise of 1.9 percentage points.

So how much debt to countries have?

The figures were equally disappointing for Europe's largest economies, either. Debt as a percentage of GDP has risen in France, Italy and the UK. By contrast, in Ireland the figure fell 8.5 per cent, while Germany cut its proportional debt by 2.7 per cent.

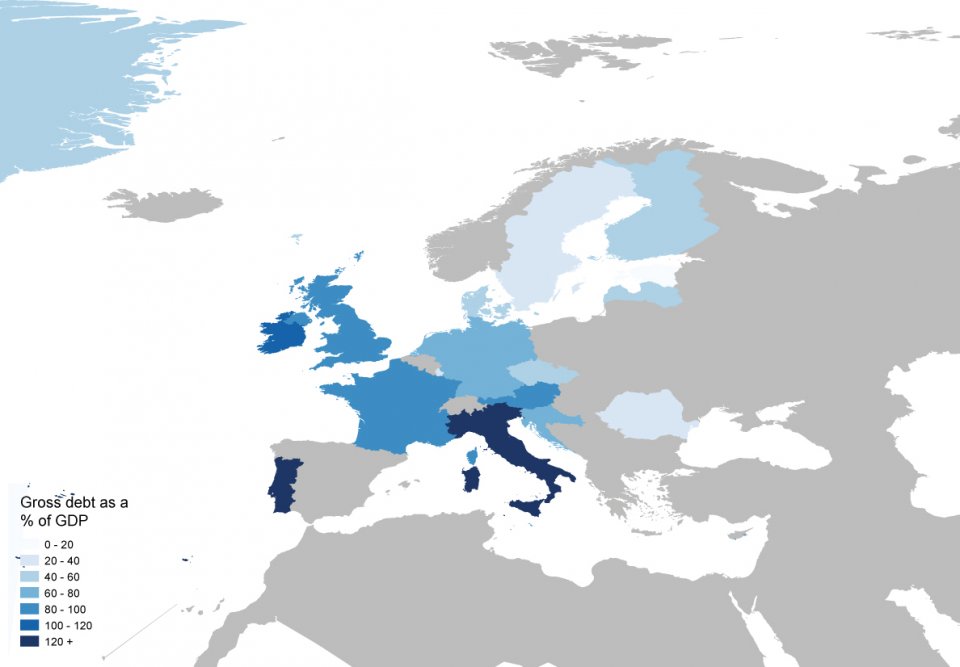

A mixed bag from the big players, then, but how did the rest of Europe get on? Here is a map giving an overview of how countries' debt has changed since the second quarter of last year. Countries in lilac were not included by Eurostat.

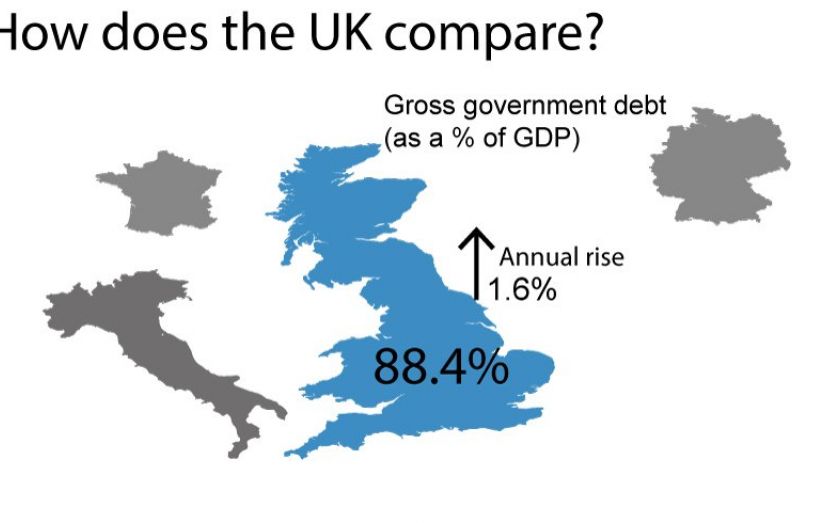

Here is a selection of big players. Countries are scaled depending on their level of debt:

Debt has become an increasingly potent issue in Europe. Brussels is embroiled in a struggle with France and Italy, which believe its budget deficit constraints (three per cent of GDP per year) are stifling growth and impeding recovery.

Germany, on the other hand, believes fiscal rectitude is the only way out of the crisis. Add into the mix inflation of 0.3 per cent (far below the European Central Bank's target of just below two per cent), poor industrial production figures and high unemployment, and you have all the elements that constitute a crisis.

Mario Draghi, the president of the ECB, has announced plans for a bond-buying programme in an attempt to find some growth. Debt as a percentage of GDP shrinks if growth is strong and begins to look more alarming if it is stagnant (as in France) or negative (as in Italy).

Unfortunately, Eurostat didn't have data for all countries on debt as a percentage of GDP. Here is a map showing how gross government debt (total in each country's own currency) has changed since the second quarter of 2013: