| Updated:

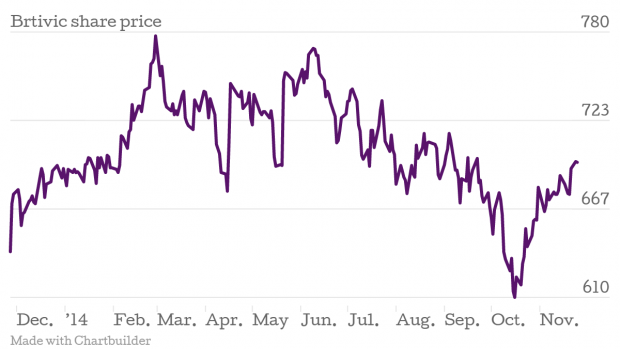

Britvic share price tumbles despite fizzing profits

Britvic’s share price fell as much as 3.6 per cent in early morning trading, even after the soft drinks company recorded revenue growth in its preliminary results for the year.

The producer of Robinsons and J2O said operating profit for the year had risen by 17.6 per cent to £158.1m, beating its own predicted range of £148m to £156m.

Overall revenue for the year grew 2.4 per cent to £1.34bn, however investors may have been concerned by the company’s admission of a slow start to the new financial year.

The company still sees operating profit continuing to grow in 2015, with a range of £162m to £173m predicted. It will further invest in capacity, including a £25m capital spend on a new high-speed plastic bottle line and warehousing.

The FTSE 250 company, which also sells PepsiCo brands such as Pepsi Max and 7UP, launched its children’s drink franchise Fruit Shoot in the US and India this year. Revenue in international markets was up 16.9 per cent.

Chief executive Simon Litherland commented:

This is a strong set of results and we have made excellent progress during the year implementing our new strategy. We have delivered revenue and margin origin growth, and profit significantly ahead of last year, despite challenging trading conditions in each of our markets.Our international operations are also progressing encouragingly and we anticipate the launch of Fruit Shoot multi-packs in the USA in the second half of 2015.The year has begun slowly, reflecting the increasingly challenging trading conditions. However we are confident of further improving our profitability in 2015, as we bring to market our strong innovation and marketing plans and benefit from the delivery of the cost savings programme.