Oil prices: Brent crude falls below $60 a barrel

Until recently the joke that was doing the rounds was that the rouble, the price of oil and President Putin would all reach 63 next year. Now just one of those is left waiting – and he's not likely to be in a celebratory mood.

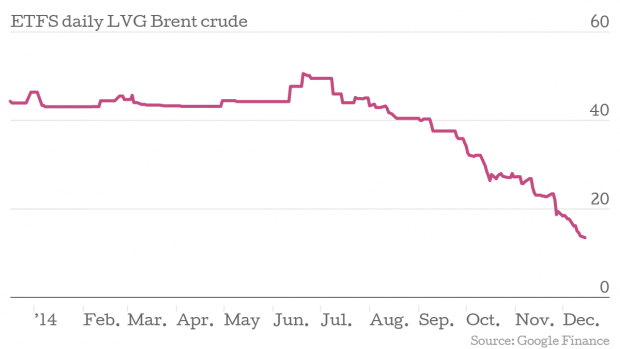

Oil prices have fallen to the lowest level in more than five years, with the price of Brent crude dropping below $60 a barrel.

Brent dropped by more than a dollar to $59.75 a barrel – nearly half the level it was at in June – while the price of US crude fell to $54.85.

Prices are falling because of increased production as demand falls off. The fall has come at a far faster rate than expected, with some commentators not expecting the $60 threshold to be breached until early 2015, if at all.

Here is what that looks like:

Speaking at the Asian Business Leadership Forum (ABLF) in Dubai, the energy minister for the United Arab Emirates Suhail Al-Mazrouei told Bloomberg: “We are not going to change our minds because the prices went to $60 or to $40. We’re not targeting a price; the market will stabilise itself.”

Commentators believe Opec is sticking to its guns to hobble its rival producers, including the US, but also potentially Russia. According to City A.M columnist John Hulsman the latter is more likely. He wrote at the start of the month:

To put it mildly, both the Saudis and the Americans have a grudge against President Putin. For Washington, it’s due to him besting them in Crimea and eastern Ukraine; for the Sunni-championing Saudis, it’s his support for Shia rivals Hezbollah, Iran, and the murderous President Assad of Syria. Given this newfound economic peril, Putin’s stratospheric popularity ratings will soon be a thing of the past, and the wolves will circle.

But while this is having a positive impact on our fuel costs, it is having a seriously damaging effect on a number of nations, including some Opec members. We round up the likely winners and losers here.