Bodycote test unit sale sees bid talk start

Engineer Bodycote’s decision to sell its testing business makes it vulnerable to a bid from a predator, analysts claimed yesterday.

The Macclesfield-based company revealed that it had sold the division, which tests materials for the oil and gas, civil engineering, food and pharmaceutical sectors, to private equity group Clayton, Dubilier and Rice for £417m, a better price than the £250- £350m range expected. The group now plans to focus on specialist thermal processing.

But analysts believe the disposal means Swiss engineer Sulzer, which made several bids last year, could be tempted to come back.

“It’s certainly possible. The main part it was after was the heat treatment business. You could argue Bodycote has now done the hard work for them,” said Nick Webster, analyst at Numis.

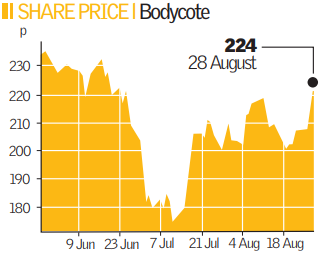

Last year, Bodycote rejected five approaches from Sulzer. Its final offer of 344.5p, up from its initial 305p a share indicative bid, valued Bodycote a £1.2bn. At the time, Bodycote said that Sulzer’s offer fell “materially short of the level at which the board would recommend any offer”. Since then the shares have fallen to around 220p. Bodycote itself said it now planned to focus on specialist thermal processing which makes metals stronger and more durable. It plans further expansion in emerging markets, where it is committed to opening one new plant or facility in China and India every year for the foreseeable future.