Bank of America Merrill Lynch share price falls on dismal final quarter results

Unpredictable volatility in December hit bond trading revenues at Bank of America Merrill Lynch (BAML) in the final quarter of 2014, the giant bank said yesterday.

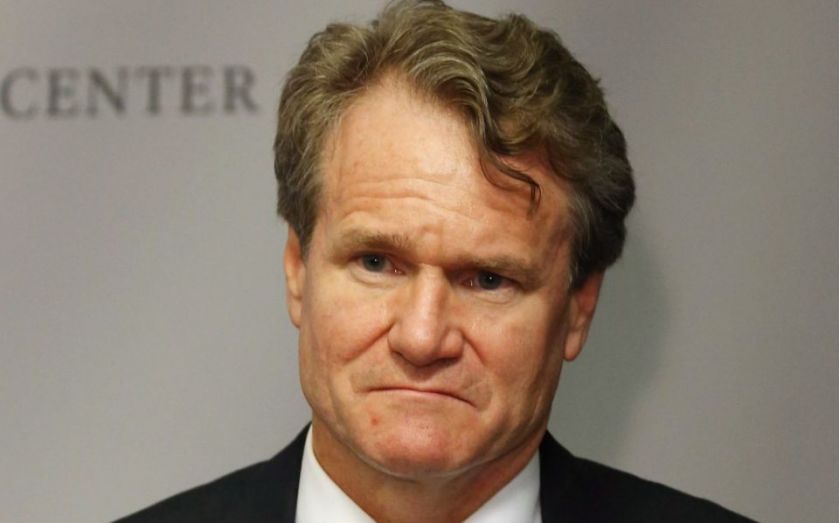

Shares fell despite the bank’s progress on cutting costs, and chief executive Brian Moynihan’s upbeat assessment that BAML is succeeding in “resolving our most significant litigation matters.”

Profits for the quarter fell to $2.74bn (£1.8bn), down 14 per cent on the year. Revenues dropped 12.9 per cent to $18.7bn for the three-month period.

Fixed income, currencies and commodities revenues were disappointing, falling 21 per cent on the year.

Analysts at Nomura had expected the unit to bring in $1.8bn, but it fell short by $300m.

“We expect the shares to come under pressure, as disappointing revenue trends (declining loan balances, trading underperformance) should overwhelm good progress on expenses (core operating expenses down one per cent on the quarter) and continued credit improvement,” said analyst Steven Chubak.

BAML’s shares fell 5.24 per cent.