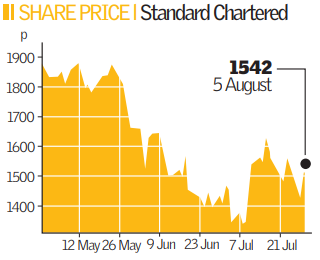

Asia helps StandChart defy crunch

Standard Chartered’s large presence in Asia helped it buck the banking trend yesterday, as it posted a 31 per cent rise in first-half profit.

First-half pre-tax profit outstripped analysts’ expectations to reach a record figure of £1.32bn, as growth in the Asian economies continued apace despite a slowdown in the West.

Chief executive Peter Sands said: “Our prudent approach to risk management has paid off”, adding the bank was ready for growth as it was “well capitalised, highly liquid and highly profitable.”

Significant operations in countries including Hong Kong, Singapore and Malaysia have been the engine for growth, as the bank’s Asian focus bears fruit. Chairman Mervyn Davies said Standard was now in a good position to increase its market share – including the possibility of acquisitions – and to recruit new talent.

Davies, who is also head of the Prime Minister’s Business Council for Britain, said rival banks had fundamentally misunderstood the economic climate. He said that “some banks did not fully understand some of the instruments they were dealing in” and that the industry “should not reward excessive risk taking.”

Standard’s wholesale bank was one of its top performing arms, posting a 38 per cent jump in operating profit to $1.65bn (£825m). Its consumer bank’s profit edged 2 per cent higher to $802m, hampered slightly by falling interest rates and an 11 per cent rise in bad debts. The bank’s core tier one capital ratio was healthy at 8.5 per cent.

Profits in Korea, where Standard Chartered made its biggest ever acquisition in 2005, rose 7 per cent as a strong performance in wholesale banking offset a drop in consumer banking. The bank’s acquisition of American Express Bank last year will also deliver more cost savings than previously expected. Sands said cost savings should be “tens of millions” higher than its $100m target for 2009.