Are any stock markets cheap going into 2021?

Where is the value in stock markets today? This is a difficult question to wrestle with. At face value, the bad news is that everywhere looks to be at nosebleed-red levels of expensiveness.

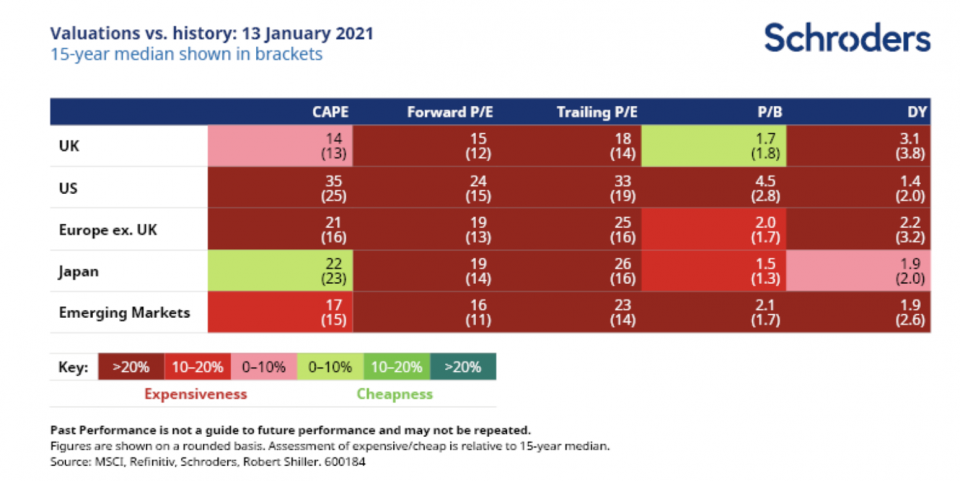

Of the 25 measures in our regular stock market valuation grid below (five markets and five measures for each), 16 are more than 20% expensive than their median of the past 15 years, five are between 10% and 20% expensive, and a further two are up to 10% expensive. Only two are in the green and even then, only just. A brief explanation of each measure is given at the end of this article.

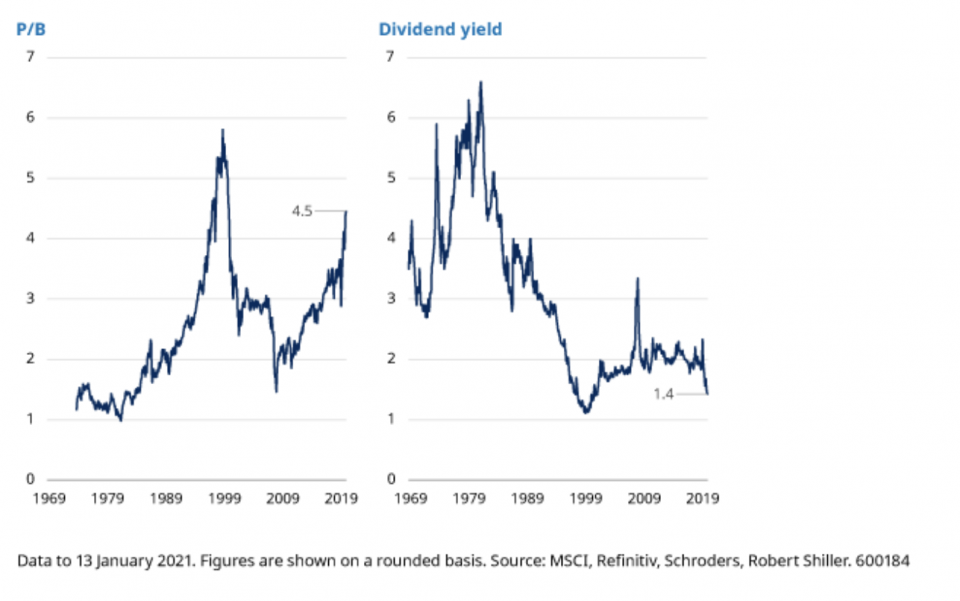

Analysis of valuations over longer time frames makes things look slightly better for some markets but doesn’t change the picture much. The US is flashing the most warning signs as the charts below show. It is more expensive than at any point in history outside of the Dotcom boom. This is especially important as it has an almost 60% weight in the global stock market (MSCI All Country World index). What happens to the US market will have a major impact on most investors’ returns.

Valuations elsewhere are less eye watering. Japan and the UK have some appeal in relative terms. Europe and emerging markets also look better value than the US. But really we’re talking about degrees of expensiveness here. Nothing is remotely good value in a historical context.

Discover more from Schroders:

– Learn: Why climate change is creating a 1929 moment

– Read: Outlook 2021: A brighter future?

– Watch: Time for investors to stop hibernating

Are there any mitigating factors?

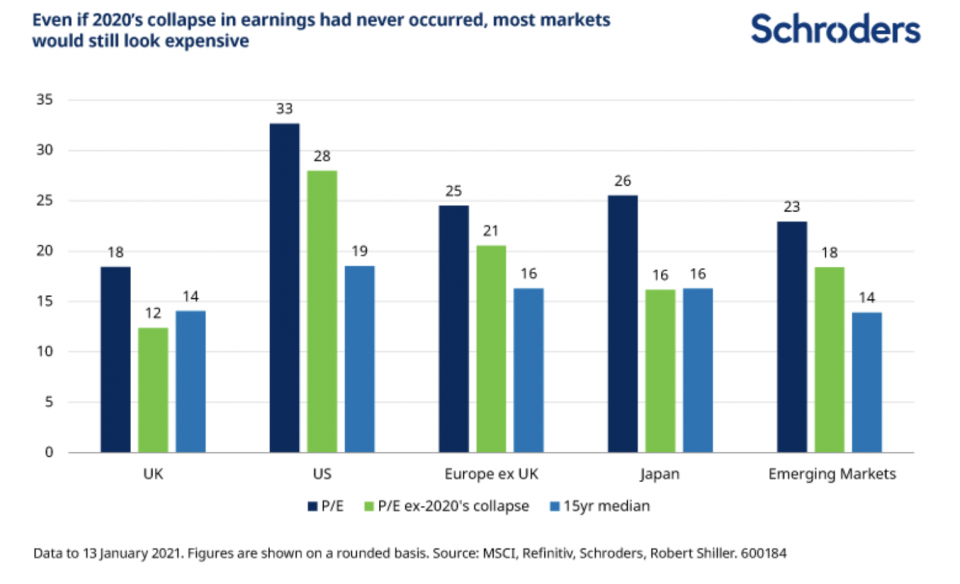

To an extent, yes. The trailing price/earnings multiple has been distorted as earnings collapsed last year due to the pandemic. Its a similar story for dividend yields, with companies having slashed dividends.

This always happens when there is a negative shock to the system – for example, during the great financial crisis, the trailing P/E peaked in December 2009, not at the market peak. In the Dotcom boom, the trailing P/E did not peak until more than two years after the market had done so.

This apparent distortion happens because markets are forward looking, so care about where earnings will be in future, not the past. They anticipate a recovery in earnings and start to price that in well before it actually happens. This can lead to a rise in prices even while earnings are falling. The trailing P/E can give a misleading “sell” signal in such circumstances.

However, even if earnings over 2020 had come in at the same as 2019, no growth but no collapse either, then the trailing US trailing P/E would still be around 50% above its median of the past 15 years. Europe and emerging markets would still be more than 25% above theirs. Only the UK and Japan would look better value. Removing the distortion would take some of the edge off, but not change things much.

The cyclically-adjusted price to earnings (CAPE) measure also tries to smooth out one-off distortions. It does this by comparing prices with average earnings over the previous decade, rather than just the previous 12 months, all in inflation-adjusted terms. However, this too suggests that stocks are expensive and the US is very expensive.

As it will take some time for things to get back to normal, the 12-month forward P/E is also being disorted by the pandemic, but not by anywhere near enough to account for current valuations.

So, yes, it is true that many of the inputs to the most popular valuation measures are distorted right now. But even if you remove those distortions, you come to the same conclusion: stock markets are expensively valued compared with history. The US is egregiously so.

Ok so that doesn’t give me much comfort … anything else?

One other factor is a prop for stock markets: the low level of interest rates. All else being equal, lower interest rates boost the present value of a companies’ future earnings. This means that, for a given set of earnings expectations, you would expect companies to be valued more highly when rates are low. And hence to have a higher price/earnings multiple. In this framework you would expect valuation multiples to be higher, on average, when rates are lower.

For more on the mechanics behind this by way of a simple worked example, see this article I wrote last year on the maths of why growth companies have been beating value.

The issue in reality is that all else is often not equal. Low interest rates tend to be associated with a poorer economic environment and weaker corporate growth prospects. As a result this relationship is not clear cut. However, it does support higher valuation multiples than would otherwise be the case.

Another way that low rates impact stock markets is by encouraging more people to invest more of their savings in stocks. Money sat in a bank account or invested in bonds is expected to return so little that it can encourage people to move further down the risk spectrum. The boom in retail share trading activity that has taken place in the past year is one example of this. If interest rates were at a higher level, some of that money would undoubtedly be in a bank account instead of the stock market. But that doesn’t describe the world today. And with low rates expected to continue for the foreseeable future, stocks will continue to retain appeal, even at expensive valuations.

So what is the overall message?

There is no way to get around the fact that stock markets are expensive. This doesn’t have to mean they will crash though. What investors should prepare for, however, is the prospect of low long-term returns. In our recently released 10-year return forecasts, we are only forecasting global equities to return 4.3% a year over the next decade. Better than the negligible returns offered by cash and bonds, but well short of long-term and recent historical experience.

There is the caveat that valuations are a long-term tool and have very little predictive power in telling you what might happen over shorter time horizons. With expectations for improving sentiment, a pickup in economic activity and a supportive fiscal and monetary policy environment, a more positive near term outlook is quite reasonable.

However, given that our 2020 Global Investor Study found that individuals in most countries were hoping for returns of more than 10% over the next five years* (with US individuals most ambitious at 15%), many people are probably in for sore disappointment.

- Discover more from Schroders’ experts by visiting Schroders insights or following on twitter.

The pros and cons of stock market valuation measures

When considering stock market valuations, there are many different measures that investors can turn to. Each tells a different story. They all have their benefits and shortcomings so a rounded approach which takes into account their often-conflicting messages is the most likely to bear fruit.

Forward P/E

A common valuation measure is the forward price-to-earnings multiple or forward P/E. We divide a stock market’s value or price by the earnings per share of all the companies over the next 12 months. A low number represents better value.

An obvious drawback of this measure is that it is based on forecasts and no one knows what companies will earn in future. Analysts try to estimate this but frequently get it wrong, largely overestimating and making shares seem cheaper than they really are.

Trailing P/E

This is perhaps an even more common measure. It works similarly to forward P/E but takes the past 12 months’ earnings instead. In contrast to the forward P/E this involves no forecasting. However, the past 12 months may also give a misleading picture.

CAPE

The cyclically-adjusted price to earnings multiple is another key indicator followed by market watchers, and increasingly so in recent years. It is commonly known as CAPE for short or the Shiller P/E, in deference to the academic who first popularised it, Professor Robert Shiller.

This attempts to overcome the sensitivity that the trailing P/E has to the last 12 months’ earnings by instead comparing the price with average earnings over the past 10 years, with those profits adjusted for inflation. This smooths out short-term fluctuations in earnings.

When the Shiller P/E is high, subsequent long term returns are typically poor. One drawback is that it is a dreadful predictor of turning points in markets. The US has been expensively valued on this basis for many years but that has not been any hindrance to it becoming ever more expensive.

Price-to-book

The price-to-book multiple compares the price with the book value or net asset value of the stock market. A high value means a company is expensive relative to the value of assets expressed in its accounts. This could be because higher growth is expected in future.

A low value suggests that the market is valuing it at little more (or possibly even less, if the number is below one) than its accounting value. This link with the underlying asset value of the business is one reason why this approach has been popular with investors most focused on valuation, known as value investors.

However, for technology companies or companies in the services sector, which have little in the way of physical assets, it is largely meaningless. Also, differences in accounting standards can lead to significant variations around the world.

Dividend yield

The dividend yield, the income paid to investors as a percentage of the price, has been a useful tool to predict future returns. A low yield has been associated with poorer future returns.

However, while this measure still has some use, it has come unstuck over recent decades.

One reason is that “share buybacks” have become an increasingly popular means for companies to return cash to shareholders, as opposed to paying dividends (buying back shares helps push up the share price).

This trend has been most obvious in the US but has also been seen elsewhere. In addition, it fails to account for the large number of high-growth companies that either pay no dividend or a low dividend, instead preferring to re-invest surplus cash in the business to finance future growth.

A few general rules

Investors should beware the temptation to simply compare a valuation metric for one region with that of another. Differences in accounting standards and the makeup of different stock markets mean that some always trade on more expensive valuations than others.

For example, technology stocks are more expensive than some other sectors because of their relatively high growth prospects. A market with sizeable exposure to the technology sector, such as the US, will therefore trade on a more expensive valuation than somewhere like Europe. When assessing value across markets, we need to set a level playing field to overcome this issue.

One way to do this is to assess if each market is more expensive or cheaper than it has been historically.

We have done this in the table above for the valuation metrics set out above, however this information is not to be relied upon and should not be taken as a recommendation to buy/and or sell If you are unsure as to your investments speak to a financial adviser.

Finally, investors should always be mindful that past performance and historic market patterns are not a reliable guide to the future and that your money is at risk, as is this case with any investment.

* Note that these return expectations were at their total portfolio level, so also including any cash, bonds and other assets held.

This document may contain “forward-looking” information, such as forecasts or projections. Please note that any such information is not a guarantee of any future performance and there is no assurance that any forecast or projection will be realised.

The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested.

Past Performance is not a guide to future performance and may not be repeated.

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.