UK’s net zero drive singled out in Trump attacks

The UK’s net zero policies were singled out in President Trump’s long tirade against European energy struggles at the World Economic Forum in Davos.

President Trump described the UK economy’s struggles in stark terms, suggesting that the Labour government had disregarded “one of the greatest reserves in the world” at the North Sea.

In his speech, he picked out countries that remained committed to net zero, pointing to it as central reason for higher prices and stagnant growth.

“The UK produces one third of the total energy from all sources that it did in 1999,” Trump said in his long speech.

“They are sitting on top of North Sea oil, one of the greatest reserves anywhere in the world.

“They like to say ‘that’s depleted’. The North Sea is incredible.”

Trump suggested that oil and gas reserves remained undiscovered in the North Sea and blasted government policies for making it “impossible” for companies to invest.

He took aim at net zero taxes, claiming the UK government took “92 per cent” of revenue. Government analysis and industry sources estimate the real tax rate to be 78 per cent, which is still considered to be high.

Trump went on to blast the UK’s commitment to building more wind farms, claiming they ruined landscapes and were loss-making.

“One thing I have noticed is the more wind mills a country has, the more the country loses and the worse that country is doing.”

He said China was “smart” for selling net zero technology while not building its own wind mills. A report by BloombergNEF last year suggested China accounted for 70 per cent of global wind farm installations in 2024.

It is not the first time Trump has attacked Labour’s net zero policies.

The US president said as early as May last year that the UK’s North Sea reserves still had “a century of drilling left”. He said they would help get energy costs down.

Trump’s swipes: Net zero to Fed chair

During his Davos address, Trump spoke about everything from drugs pricing to Europe not being “recognisable”.

When speaking about domestic economics policy, the US president repeated his attacks on outgoing Federal Reserve chair Jerome Powell.

He revealed he had interviewed candidates for the next chair of the world’s most important central bank, suggesting that he would choose someone that is “great”.

However, Trump appeared to express his desire to interfere with the Fed’s independence. In comments that are likely to worry traders, he said rate-setters who backed raising interest rates had engaged in acts of “disloyalty”.

“We should be paying the lowest interest rate of anybody,” he said.

“Without us, most of the countries don’t even work. Without our military, you would have threats you wouldn’t believe.”

Trump added that central banks had become too “petrified” about high inflation, thereby sending jitters through stock markets as fears about higher interest rates grow.

iFIT and Huge Launch “Realms You Can’t Reach,” a New Category of Cinematic Fitness Experiences Built With AI

Huge, a design and technology company, has partnered with iFIT, the global leader in connected fitness content and technology, to conceptualize, design, and produce a groundbreaking new series of cinematic fantasy running experiences. Powered by Google’s Veo 3 technology, the “Realms You Can’t Reach” series features five AI-generated running, jogging, and walking videos that allow iFIT members to move through immersive worlds that are physically impossible to shoot with traditional production methods.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20260121269154/en/

Rather than using AI as a novelty or replacement for existing formats, Huge helped iFIT define a clear creative strategy: use generative technology to build worlds that expand what fitness content can be—while complementing iFIT’s trainer-led programming and library.

Leveraging AI as an immersive world-building tool, Huge produced five seamless, 20–30-minute POV runs set across prehistoric pasts, mythic landscapes, and imagined futures. Using a custom creative pipeline that combined narrative storyboarding, Midjourney visual benchmarks, Veo 3 video generation, and first-of-its-kind long-form stitching, Huge delivered broadcast-quality experiences at a length and scale not previously possible with generative video, each paired with either original sound design or custom music scores.

“These new treadmill-based immersive runs showcase how AI can be used as a serious production tool, one that unlocks entirely new creative territory,” said Eric Vienna, Creative Director at Huge. “Our role was to apply strong creative direction and human judgment to ensure the technology served the experience, not the other way around. The result is premium fitness content that feels cinematic, intentional, and genuinely new.”

Expanding the World’s Best Fitness Library

iFIT introduced the new workout format to members on January 12, 2026. The “Realms You Can’t Reach” series is the latest installment of immersion experiences in iFIT’s more than 10,000-workout content library, which includes the “Trainer Games” reality series, “SmartAdjust” technology, and partnerships with top-tier brands such as F45, Club Pilates, and Ergatta.

“We didn’t use AI to replace what already works, we used it to unlock what’s never been possible before,” said Jeremy McCarty, Chief Subscription & Content Officer at iFIT. “By designing worlds specifically for training, we’re delivering experiences that feel cinematic, intentional and built for performance.”

AI as Production System, Not as Gimmick

Huge’s collaboration with iFIT introduces an entirely new content category in fitness: long-form, cinematic fantasy worlds designed specifically for treadmill workouts. The work demonstrates how AI can function as a production accelerator and creative enabler, not as a shortcut or substitute for human creativity, while establishing a repeatable model for future content development.

Huge has been integrating generative AI into real client work since 2023, applying the technology to solve concrete business challenges—from scaling content libraries to unlocking new experiential formats—without sacrificing craft or quality. This project reinforces Huge’s position as the premier partner that helps brands move beyond experimentation to build durable, differentiated products and intelligent experiences (IX) powered by AI.

About Huge

Huge is an independent design and technology company that creates intelligent experiences for the world’s most ambitious brands. With offices across North America, Latin America and Europe, Huge blends creativity, strategy, technology and data to build impactful human-first digital experiences that perform for many of the world’s most iconic businesses. For more information, visit www.hugeinc.com.

About iFIT

iFIT Inc. is a global leader in fitness technology, pioneering connected fitness to help people live longer, healthier lives. With a community of more than 6 million athletes around the world, iFIT delivers immersive, personalized workout experiences at-home, on the go, and in the gym. Powered by a comprehensive ecosystem of proprietary software, innovative hardware, and engaging content, the iFIT platform brings fitness to life through its portfolio of brands: NordicTrack, ProForm, Freemotion, and the iFIT app. From cardio and strength training to recovery, iFIT empowers athletes at every stage of their fitness journey. For more information, visit iFIT.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20260121269154/en/

Contact

Media Contacts

Valeene Wilson

Huge

Communications Manager

valeene.wilson@hugeinc.com

Edelman Public Relations

iFIT

ifit@edelman.com

Technology Innovation Institute and World Economic Forum Announce ‘Abu Dhabi Centre for Frontier Technologies’ at Davos

The Technology Innovation Institute (TII), the applied research arm of Abu Dhabi’s Advanced Technology Research Council (ATRC), and the World Economic Forum (WEF) have announced the launch of the Abu Dhabi Centre for Frontier Technologies, a new Centre within WEF’s prestigious Centre for the Fourth Industrial Revolution (C4IR) Global Network.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20260120284423/en/

The collaboration was formalized during a signing ceremony on the sidelines of the World Economic Forum Annual Meeting 2026 in Davos, marking a significant step in deepening international cooperation to shape the future of frontier technologies.

Established with a clear mandate to lead breakthroughs in frontier research and development, advance global policy on emerging technologies, and foster international collaboration that moves innovation from the lab into real-world deployment, the Centre builds on the UAE’s position as a real-world testbed for innovation. Supported by an agile regulatory environment and a strong link between research, policy and execution, the UAE offers a unique platform for piloting, deploying and scaling emerging technologies at a national level – a capability that will now be amplified through the World Economic Forum’s globally connected C4IR network.

The new Centre positions Abu Dhabi as a global epicenter for pioneering research of advanced technologies, with a focus on Quantum Computing, Robotics, Propulsion & Space systems, and related AI applications. Through this strategic partnership, TII joins a globally connected innovation ecosystem designed to accelerate the responsible adoption of transformative technologies.

Dr. Najwa Aaraj, CEO of TII, said: “As frontier technologies accelerate, there is a growing imperative and opportunity to guide their responsible and impactful adoption. This Centre brings together research excellence, policy leadership and global collaboration in one platform – pushing the boundaries of frontier R&D while enabling breakthrough science to move beyond the lab into real-world application. By translating innovation into responsibly governed, scalable solutions, we are reinforcing Abu Dhabi’s role as a global hub for science, innovation and impact.”

With this announcement, Abu Dhabi strengthens the UAE’s presence within the World Economic Forum’s global C4IR network, joining a distinguished group of Centres across countries such as the US, Germany, Saudi Arabia, Japan, and India.

The addition of Abu Dhabi Centre for Frontier Technologies strengthens the C4IR Global Network’s ability to shape global technology agenda,” said Jeremy Jurgens, Managing Director, World Economic Forum. “By bringing world-class research capabilities into the Network, this Centre will support industries in translating innovation into practical, responsible solutions that advance inclusion, sustainability and trust in technology.”

The Centre aims to push the boundaries of research and development in critical frontier technologies, while showcasing Abu Dhabi’s thought leadership through proof-of-concept pilots, regulatory sandboxes, and global convenings. It will serve as both an innovation engine and a strategic platform, advancing responsible technology adoption and reinforcing the UAE’s global standing in science and innovation.

Source: AETOSWire

View source version on businesswire.com: https://www.businesswire.com/news/home/20260120284423/en/

Contact

Jinan Warrayat

jinan.warrayat@tii.ae

Abstract

Technology Innovation Institute and World Economic Forum Announce ‘Abu Dhabi Centre for Frontier Technologies’ at Davos

Volkswagen Passat Estate review: Second place in the space race

Volkswagen has celebrated several big birthdays in recent years, with both the Polo supermini and Golf hatchback marking their 50th anniversaries. Yet the Passat, first launched in 1973, seemingly did not merit a special commemorative edition when it turned 50.

Volkswagen has launched a new version of the Passat, though, now only available in estate guise for European customers. The declining popularity of four-door saloons probably makes this a wise decision, but estate cars have also suffered greatly at the hands of the all-conquering SUV.

Sensibly, Volkswagen pursued economies of scale when developing the new Passat. Not only does this latest model use the same platform and powertrains as the Skoda Superb, it even shares the same production facility in Bratislava, Slovakia.

It means the closest competition for the Passat comes from within, as the Superb Estate undercuts its German brother on price. Yet the Volkswagen’s upmarket badge could also see it face off against alternatives like the BMW 3 Series Touring and Mercedes-Benz C-Class Estate, plus an endless array of family SUVs.

Five decades in the making

Although the Passat owes much to the Skoda Superb, Volkswagen’s design team has made it look distinct from its Czech relation.

The result is a handsome, if slightly anodyne estate car, but one with an impressive 0.25 drag coefficient. It means the big wagon cuts through the air cleanly, and is actually the most aerodynamic petrol-powered Volkswagen estate to date.

Another major change is the total absence of diesel engines for the UK market. Estates and the black pump have had a long-term relationship, but Volkswagen has opted for petrol engines only this time.

The model lineup has recently been updated, with buyers now offered a turbocharged 1.5-litre four-cylinder engine with varying degrees of electrification. This ranges from the entry-level 150hp version with mild hybrid assistance, through to a 272hp plug-in hybrid.

A seven-speed DSG automatic is standard for mild hybrid models, with only six cogs for the plug-in hybrids. The manual gearbox has gone the way of the diesel engine, of course…

A smooth-ish operator

The 150hp eTSI mild hybrid setup is likely to be the most popular engine choice, thanks to its combination of affordability and efficiency. However, with only 184lb ft of torque, it can feel overwhelmed by a car as large as the Passat.

Accelerating from 0-62mph takes 9.3 seconds, with the 1.5-litre unit sounding strained as it attempts to deliver maximum power. It’s where a diesel engine would make an obvious difference, thanks to its inherent extra torque.

Once up to speed on the motorway, where the typical Passat will spend much of its time, the 150hp eTSI motor is far less intrusive. Nonetheless, given Volkswagen’s premium aspirations for its big estate car, some extra refinement for this petrol engine would be welcome.

According to official WLTP figures, the eTSI should be able to achieve more than 50mpg. In reality, this is likely to be closer to 40mpg, although plug-in hybrid versions potentially offer much more.

Opting for one of the PHEVs ups the stakes to 204hp or a substantial 272hp, with the ability to cover up to 78 miles using the battery alone. If your budget can stretch to one of the plug-in powertrains, it’s likely to make driving a Passat far more relaxing.

Driving the Volkswagen Passat

The rest of the driving experience is easygoing, with Volkswagen having focused its efforts on making the Passat comfortable and refined, instead of needlessly sporty.

Most trim levels come on 17- or 18-inch alloy wheels with chunky sidewall tyres to help absorb bumps and potholes. Fancier R-Line and Black Edition versions have 19-inch rims, but ride comfort will still be more cossetting than many SUVs.

Volkswagen’s Adaptive Chassis Control is included on high-spec models, providing 15 different suspension damper settings to choose from. Selecting the softest mode brings an impressive degree of comfort, and is ideal for motorway cruising. Standard cars with non-adaptive suspension feel slightly firmer at low speeds, but improve once you get out of town.

The Passat’s handling is accurate enough to help place what is a relatively large car, but don’t expect too much in the way of feedback or fun. Sport mode adds extra weight to the steering, but it seems counter-intuitive to the big estate car’s attitude.

Plug-in hybrid sacrifices boot space

Let us be honest, the main reason for choosing an estate car like the Passat is boot capacity, and the big Volkswagen does not disappoint.

With its rear seats in place, there is a total of 690 litres of luggage space – exactly the same as a Skoda Superb Estate. Plug-in hybrid versions can only carry 530 litres, however, due to the batteries beneath the boot floor. Dropping the rear seats results in a truly cavernous 1,920kg in non-PHEV models, again matching its Skoda cousin.

The theme of spaciousness continues throughout the rest of the Passat’s cabin, with rear-seat passengers getting the best deal. Headroom and legroom in the back is vast, while the front seats offer plenty of adjustment and space.

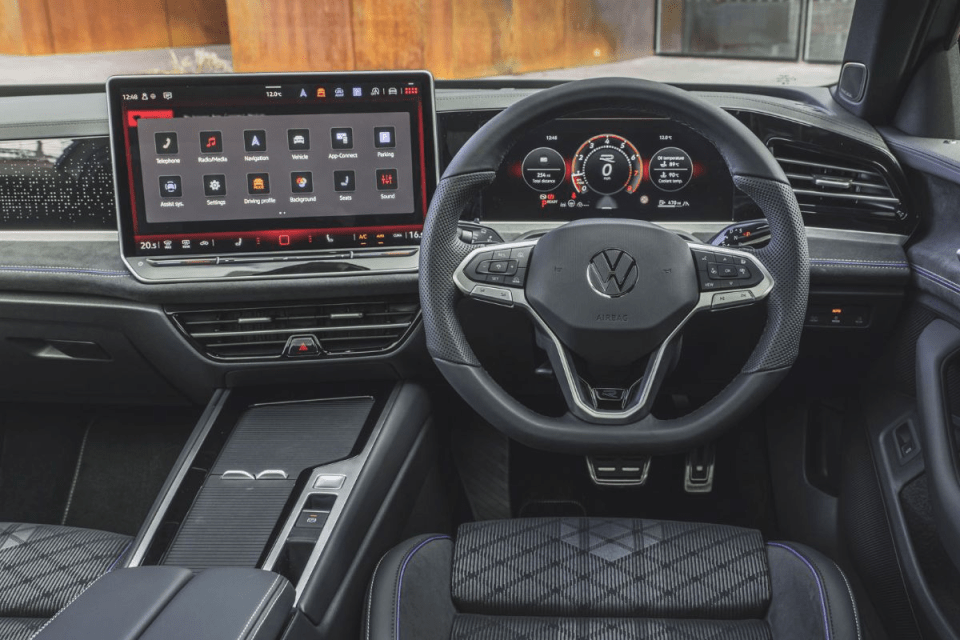

Where the Passat does differ from the Superb is its lack of buttons on its dashboard. Skoda uses innovative ‘Smart Dials’ for the climate control, which are far easier to operate than a touchscreen.

Volkswagen has vastly improved the software behind its infotainment system, though, and there are now real buttons (rather than fiddly haptic touchpads) on the steering wheel. Passats lower down the range receive a 12.9-inch touchscreen, with fancier versions gaining a 15.0-inch display.

Premium aspirations included

What makes the Passat stand out is the quality of its interior design. From the elaborate ambient lighting, which spans the dashboard and door trims, to the plush materials, it all feels suitably upmarket.

This sense of quality is important, though, when the Passat costs around £3,000 more than an equivalent Superb. The VW just edges the Skoda here, but it is a close call between the two.

Volkswagen has recently updated the Passat model range, with prices now starting from just under £41,000 for entry-level Life trim. This offers a comprehensive standard specification, including a reversing camera, satellite navigation and front seats with an integrated massage function.

At the top of the ladder, the 272hp plug-in hybrid version in Black Edition spec requires close to £51,500. A set of 19-inch alloy wheels, gloss black exterior trim and sports seats are all included.

Verdict: Volkswagen Passat Estate

With the number of large estate cars dwindling in the face of SUV dominance, the Volkswagen Passat still being here seems like something to celebrate, particularly after more than five decades.

It offers a huge practicality, combined with a comfortable and refined driving experience, plus a long list of standard equipment. Add in a wide selection of engines, and the Passat makes a compelling case for itself.

Low Benefit-in-Kind (BiK) tax rates will make the plug-in hybrid versions very appealing to company car drivers, too.

The Passat’s biggest problem is that the Skoda Superb Estate offers the same amount of space and pace, but at a lower cost – and with only a marginally inferior ambience. Unless badge snobbery matters to you, it’s checkmate to the Volkswagen’s Czech mate.

PRICE: From £40,860

POWER: 150hp

0-62MPH: 9.3 seconds

TOP SPEED: 138mph

FUEL ECONOMY: 51.5mpg

CO2 EMISSIONS: 125g/km

• John Redfern writes for Motoring Research

FTSE 100 rebounds as Trump rules out taking Greenland by force

Global markets bounced back into the green on Wednesday after President Donald Trump confirmed the US would not use military action to seize Greenland.

In his address at the World Economic Forum in Davos, Trump said: “All the US is asking for is a place called Greenland”.

“We never ask for anything and we never got anything we probably won’t get anything unless I decide to use excessive strength and force, where we would be frankly impossible.”

“But I won’t do that,” he said in his clearest indication yet of ruling out military intervention in Greenland.

He later doubled down on avoiding military action: “People thought I would use force. I don’t have to use force. I don’t want to use force. I won’t use force.”

The FTSE 100 edged up to 0.3 per cent gain at 10,153.24p on Trump’s remarks. This followed it trading in the red near 10,100p ahead of Trump taking the stage.

US markets also jumped into the green after the news. The S&P 500 notched a 0.8 per cent gain, the tech-heavy Nasdaq 0.7 per cent and Dow Jones 0.8 per cent.

Trump makes jab at ‘unfair’ Nato

Tensions have flared among a war of words between top names in the Trump administration and European leaders over the last week after the US announced sweeping 10 per cent tariff across Nato members for their stance on Greenland.

The President said the United States is “treated very unfairly by Nato” and “nobody can dispute it.”

“We give so much and get so little in return.”

He fires a major shot on economic and military support from the US, telling European nations: “Without us most of the countries don’t even work”.

The President warned Europe have a “choice” whether they “say yes and we would be very appreciative or you could say no and we will remember.”

He opened his speech at the World Economic Forum talking of his delight at returning to Davos for the third time and looked forward to addressing “so many friends, and a few enemies”.

Trump said he came with “phenomenal news from America” as he touted success in the stock market and added he had “defeated inflation”.

But the President quickly turned his attention to Europe, where he said countries were becoming no longer “recognisable”.

“We can argue about it but there’s no argument – I mean that in a bad way. It’s not heading in the right direction,” he said.

Trump takes Chagos swipe at Starmer

He made reference to efforts to secure a peace deal in Ukraine, stating a takeover of Greenland is a “very small ask” compared with how he has helped Nato.

Trump said he has “tremendous respect” for Denmark and Greenland but warned “no nation or group of nations is able to secure Greenland other than the United States”.

He added Greenland “sits undefended” in a strategic position that is in “North American” territory.

“It’s the United States alone that can protect this giant mass of land, this giant piece of ice, develop it and improve it… and make it so it is good for Europe and safe for Europe and good for us,” he said and renewed his demand for “immediate negotiations” over Greenland’s acquisition.

During Prime Minister’s Questions today Sir Keir Starmer said President Trump’s recent tirade against the Chagos Islands deal was to “pressure” him to change tune on Greenland, adding he would “engage constructively” with the US administration and other allies.

It follows a brutal Truth Social post scolding the Prime Minister over the Chagos deal, which includes a shared US military base at Diego Garcia that will be leased for 99 years at a multi-billion-pound cost, Trump called Starmer’s deal an “act of great stupidity”.

“You cant defend it on a lease, it’s not legally defensible in that way. Who the hell wants to defend a licence agreement?” Trump said in a major swipe ruling out leasing agreements.

This story is being live updated.

Duetti Secures $200 Million to Scale Independent Music Catalog Acquisitions and Enhance Platform Capabilities

Duetti Inc. (“Duetti” or the “Company”), the music-tech and financial services company that empowers independent music creators to unlock the value of their music catalogs, today announces it has secured $200 million in new funding to accelerate music catalog acquisitions and expand its technology and services globally. The financing is led by a $50 million Series C equity investment by Raine Partners, the flagship growth equity fund of The Raine Group, alongside a second $125 million private securitization and a $25 million increase of an existing credit facility.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20260121033285/en/

In over three years, Duetti has raised over $635 million, including over $100 million in equity, to support the global independent music community. To date, the Company has partnered with more than 1,100 artists, songwriters, and other music creators across 40+ countries to purchase and manage portions of their music rights catalogs.

The Series C equity investment from Raine Partners enables Duetti to strengthen its leadership in music rights acquisition by investing in its team and platform. The funds will be used to expand Duetti’s technology infrastructure, enhance marketing services, and grow its global presence. Duetti is experiencing rapid growth, currently signing 80+ deals each month (over 2.5x the monthly rate one year ago), on the back of its expansion into publishing rights, in addition to master recording rights, and its growing global footprint. In connection with the equity financing, Joe Puthenveetil, Partner at The Raine Group, will join the Duetti Board of Directors.

Duetti has a 65-person team operating across New York City, Los Angeles, Miami, Nashville, London, and Rio de Janeiro. Over 30% of Duetti’s 2025 deals originated from outside the US, from international markets such as France, the United Kingdom, Germany, Brazil, and Mexico. The Company also provides marketing and catalog management services – including playlisting through a network of 3,000+ playlists with 5+ million followers across DSPs, remix production with 60+ releases per quarter, sync licensing, and 200+ customized artist marketing programs in 2025.

“The traditional music industry and the financially driven catalog buyout funds are not able to keep pace and adapt their infrastructure to the explosive growth of the independent music sector,” said Lior Tibon, CEO and Co-Founder of Duetti. “This new funding allows us to continue building proprietary databases and systems to identify, predict, and effectively manage and support music catalogs of independent creators, the fastest growing and most exciting segment of the industry.”

“We are excited to partner with Lior and team as they develop a next-generation music company that empowers independent creators. Duetti has democratized the industry by enabling artists at every stage of their careers to monetize their rights and access the marketing and growth resources offered by a modern label and publisher,” said Joe Puthenveetil and Fred Davis, partners at The Raine Group.

Duetti completed its second private asset-backed securitization of $125 million, bringing its existing master trust total to $205 million. The Company plans to continue accessing the securitization market regularly, tapping an efficient and liquid source of financing while providing investors exposure to fast-growing segments of the music market. In Q4 2024, Duetti pioneered the first-ever music securitization transaction primarily backed by independent artists’ catalogs, and intends to continue innovating through efficient new financing structures for these catalogs.

“Working with Duetti gave me clarity and confidence around how to think about my music as an asset,” said Calimossa, the Los Angeles-based artist and producer. “They respect that every artist’s journey is different and took the time to walk me through real options I could align with my long-term goals. Beyond that, they showed up as true partners, supporting my music through marketing, sync opportunities, and career guidance. That level of trust and continued support is what allows independent artists like me to build something sustainable for the future.”

KEEP UP WITH DUETTI

WEBSITE | INSTAGRAM | FACEBOOK | LINKEDIN

About Duetti

Duetti is a music finance and services platform that partners with independent artists and creators. Founded in 2022 by CEO Lior Tibon and COO Christopher Nolte, Duetti provides capital and operational support to help creators monetize, manage, and grow their music catalogs.

Through flexible deal structures, Duetti works with a broad range of music creators and supports them with catalog management and marketing services. Since its founding, Duetti has partnered with more than 1,100 creators across over 40 countries.

Duetti is backed by The Raine Group, Flexpoint Ford, Nyca Partners, Viola Ventures, and Roc Nation, and has raised more than $635 million to date through a combination of equity and debt financing.

View source version on businesswire.com: https://www.businesswire.com/news/home/20260121033285/en/

Contact

Media Contacts:

Lucky Break PR

Erika Satler, Erika@luckybreakpr.com

Mark Umbach, Mark@luckybreakpr.com

Abstract

Duetti secures $200M to scale independent music catalog acquisitions and enhance platform capabilities.

Only pubs set to benefit from business rates U-turn as hoteliers barred

Pubs will be the only businesses to benefit from the government’s business rates U-turn as other hospitality firms will be shut out from tax relief, Rachel Reeves has hinted.

The Chancellor told reporters at Davos that pubs face a different situation to the rest of the sector, likely meaning hotels and other hospitality businesses will be given a cold shoulder by the Treasury.

This is the latest saga in a row between the government and the hospitality sector which erupted when it emerged after the Budget that pubs, bars and restaurants would face soaring business rate bills.

Reeves told reporters at the World Economic Forum on Wednesday: “The situation the pubs face is different from other parts of the hospitality sector but we will be setting out the detail in the next few days.”

A Treasury official confirmed the limited brief of the upcoming U-turn, telling the Financial Times: “this package is for pubs”. They insisted, however, that the government would continue to listen to the concerns of the wider sector.

Last week, Reeves confirmed temporary support for pubs in a climbdown from the Treasury’s previous position.

Hospitality figures had said that a combination of business rate revaluations and the end of Covid-era support could leave hospitality businesses across the country facing insolvency.

While the Chancellor maintained that pandemic-era aid would still be “unwound,” she signalled the speed of this withdrawal would be slowed to ease the pain faced by the sector.

Singling out pubs for relief ‘unfair’

Reeves’ remarks have been met with condemnation by people who claim pub-specific aid will fail to address the pain felt across British business.

Allen Simpson, chief executive of UKHospitality, said: “The entire hospitality sector faces the same cost challenges – from eye-watering business rates hikes to the soaring cost of employment. These are not challenges unique to pubs.”

Andrew Griffith, Conservative shadow business secretary, told the FT: “A U-turn which excludes the wider sector would be criminal. Many hotels and restaurants face even higher rates rises and their viability is equally at risk.”

Row over misleading claims

The announcement of temporary support followed a row over whether the government knew about the potential impact of the Budget’s reforms to business rates.

Business Secretary Peter Kyle had told Times Radio that his department “didn’t have access” to the relevant information and was only able to act after the Budget was met with outrage by the sector.

Jonathan Russell, who leads the Valuation Office Agency, responded by telling a select committee he was “very clear” with the Treasury about the impact of these changes.

Details of the support for pubs are set to be announced in the coming days.

Wealthy London boroughs see house prices plummet amid Budget speculation

Inner London house prices plummeted at their fastest pace since the global financial crisis in November, after property taxes speculation in the lead up to the Autumn Budget and affordability constraints damaged market activity.

The 4.6 per cent year on year drop of house prices in the capital in November followed a 4.3 per cent tumble in October, marking the largest decline since the financial crash where prices declined at double-digit rates.

The largest falls were recorded in the poshest boroughs of the city, according to data published by the Office of National Statistics, but despite the drop London has maintained its standing as the most priciest region in the UK.

Prices in Kensington and Chelsea plunged 16.3 per cent to an average of £1.19m, while average prices in Westminster dropped by an annual rate of 15.5 per cent to £866,000.

In contrast prices in outer London continued to rise, with both Havering and Bromley reporting annual increases of 5.2 per cent and 6 per cent respectively.

The rising prices in the outer boroughs resulted in a 1.2 per cent fall in average house prices in London in the year November, bringing prices to roughly £553,000.

Autumn Budget and flying rumours

Speculation surrounding taxes on high end homes during the run up to Chancellor Rachel Reeves’ Autumn Budget led to subdued demand during November, with many consumers opting “a wait and see approach”.

Colleen Babcock, property expert at Rightmove, said: “November was an uncertain period for the market, as many home-movers had an eye on what the Budget might contain and how it might affect their personal situation.

Rumours around property tax and personal tax changes made some home-movers adopt a wait and see approach.”

Reeves introduced a new high-value council tax surcharge for owners of properties valued at over £2m in the Autumn Budget, which is set to take effect in April 2028.

Owners of properties above this threshold will be liable for a recurring annual charge, which will be added to existing council tax payments.

There will be four price bands, with the surcharge, which has been dubbed the ‘mansion tax’, rising from £2,500 for a property valued between £2m and £2.5m to £7,500 for a property valued above £5m.

The measure is estimated to raise £0.4bn in 2029-30, with the revenue flowing to central government rather than remaining with local government.

Other tax rumours including a shake up to the stamp duty regime and the introduction of capital gains tax on primary residences also caused a sense of panic in the run up to the Budget, but were ultimately left out of Reeves fiscal plans.

Jason Tabb, president of On The Market, also noted that “increased supply, low buyer demand and stretched affordability” coupled with higher living costs also weakened the London market.

London landlords ditch the market

Despite the fall in prices in the capital, Londoners were forced to continue dealing with the highest rental prices in the country, averaging £2,268 per cent compared to the North East, which paid just £762.

Analysts credited the sky rocketing London prices to more landlords opting to sell up, ultimately drying up the rental supply.

Nathan Emerson, chief executive of Propertymark, said: Although we have witnessed rental inflation trend further downwards, the rental market continues to suffer from a chronic undersupply of properties versus actual demand.

“We currently sit in a situation where many letting agents continue to highlight concerns regarding the impact of updated legislation and the real-world effect such changes are having on many landlords’ ability to operate.

“This, coupled with additional and often more complex tax frameworks, has brought profound change within the sector and applied additional pressure on already overstretched stock levels.”

Average prices and mortgage rates

In contrast to London’s fall, the average UK house price jumped 2.5 per cent to £271,000 in November, up from 1.9 per cent in October.

The rise marked the first price acceleration since June, with the North East recording the largest bump in prices at 6.8 per cent in the year to November, followed by the North West which saw a 4.1 per cent increase.

Analysts within the property sector expect the fall in mortgage rates to bolster the market further in 2026, but noted buyers need confidence from policy makers about the state of the market.

Paige Tao, economist at PwC UK, said: “With the Budget proving less disruptive than feared, and the Bank of England cutting interest rates in December, confidence is starting to return, and we expect activity to further rebound in the New Year.”

Tom Bill, head of UK residential research at Knight Frank, noted confidence “is the key missing ingredient” for some buyers in the face of both economic and political volatility.

Starmer: I will not yield to Trump

Keir Starmer said President Trump’s tirade against the Chagos Islands deal was to “pressure” him to change tune on Greenland, adding he would “engage constructively” with the US administration and other allies.

During Prime Minister’s Questions, Starmer defiantly defended his position on upholding Greenland’s sovereignty, suggesting Trump’s unexpected attack on Chagos in a Truth Social post was designed to get him to change its stance.

Responding to Kemi Badenoch’s question on whether he would support Chagossians as he has backed Greenlanders, Starmer said: “President Trump deployed words on Chagos yesterday that were different to his previous words of welcome and support when I met him in the White House.

“He deployed those words yesterday for the express purpose of putting pressure on me and Britain in relation to my values and principles on the future of Greenland.”

“He wants me to yield on my position, and I’m not going to do so.”

Starmer also jibed at Badenoch for “jumping on the bandwagon” and undermining the government’s message on protecting Greenland, which she said she agreed with.

The Prime Minister also hit back at Liberal Democrats leader Ed Davey for arguing against working with the US. Davey questioned why the government was not ramping up expenditure on defence at a faster pace.

However, Starmer’s relationship with Trump also provided soft-left Labour backbenchers with ammunition for attack as Labour MP Steve Witherden labelled the US president a “thug” and demanded the UK government to “commit to retaliatory tariffs”.

Starmer said a trade war would hit UK consumers and businesses with higher costs.

Starmer all but denies retaliation

Speaking to broadcasters in Davos, Rachel Reeves insisted the government would not be “buffeted around by global events” and distanced the UK from threats to impose retaliatory tariffs on the US.

The Prime Minister’s comments in the House of Commons follow extraordinary remarks made by Canadian prime minister Mark Carney and French president Emmanuel Macron signalling a desire for allies to stand up to Trump.

After rejecting tariff threats as being “completely wrong”, Starmer’s bolder stance reflects his fracturing relationship with the US president.

Questions loom over the Labour government’s ability to pass the Chagos bill through parliament despite Trump’s apparent change of position.

Former foreign secretary David Lammy said last year the deal would “not go forward” if President Trump didn’t like the deal.

Officials have said a signed treaty meant the government would follow through on the handover of the territory to Mauritius and a 99-year lease of a military base on Diego Garcia island.

Michael O’Leary could land £1.7bn payout if Elon Musk buys Ryanair

The boss of Ryanair could land a cash payout of as much as £1.7bn if the world’s richest man, Elon Musk, acts on his threats to buy the airline.

Michael O’Leary, who has been chief executive of the County Dublin-based business for more than 30 years, has accumulated the sixth-largest stake in the company, with more than 40m shares worth a combined £1bn, corporate filings show.

The outspoken Irish businessman is also on course to secure another 10m worth of shares by meeting the performance conditions of a long-term bonus award, which would hand him another £150m based on today’s share price and the option price for the share award.

Musk, who has a net worth of more than £500bn, has a history of making threats to buy businesses and following through on them. His best-known acquisition was the hostile takeover of social media site Twitter, which he bought in 2022 at a 38 per cent premium to the firm’s share price prior to the offer.

Should Musk make an offer for Ryanair at the same share premium, that would force O’Leary to sell his stake, netting the executive an eye-watering £1.7bn.

Musk takeover faces legal obstacles

However, Elon’s vision to buy the Irish airline might not be as simple as his acquisition of Twitter.

Because Ryanair is headquartered in Dublin, the airline falls under strict European Union (EU) regulations. Under EU law, airlines must obtain operating licences from a member state authority and be majority-owned (50 per cent) and controlled by EU nationals.

Although Elon holds several citizenships—South African, Canadian, and US—none are from any of the 27 EU countries. As a result, he cannot own a controlling stake in an EU-based airline without jeopardising its operating licence.

Musk could build up a minority stake in the company, but would have to partner with a group of EU-based investors to form a consortium to stand any chance of taking the airline private.

X marks the spat

The eccentric row between the two billionaires kicked off over the weekend on the subject of in-flight wifi, after the official Ryanair platform quoted a Musk post which asked: “What is a propaganda you’re not falling for ??”

Ryanair jokingly responded with: “Wi-Fi on planes”.

Michael O’Leary has argued that it would not be worth the cost and weight that would be added to enable on-flight internet on Ryanair flights, particularly for short-haul journeys.

And in the days since, Musk and O’Leary have each called the other an “idiot”, whilst the Tesla chief has escalated to particularly lurid language in the days since.

The Ryanair boss has since called for “Europe to stand up to the US”, amidst growing tensions over Donald Trump’s threats to acquire Greenland and multilateral threats of tariffs.

He said: “I don’t think a trade war would last very long, given the amount of American businesses that are based here in Europe, and given the amount of Europe imports from America and vice versa.

“But we have to have a more belligerent foreign policy towards certainly the Trump administration, and we would hope that eventually common sense will prevail.”