LIVE BLOG: Boris Johnson ‘should not remain in Downing Street’ says former PM Sir John Major

Welcome to City A.M.’s rolling coverage of the ongoing Conservative coup against prime minister Boris Johnson.

We’ll bring you all the latest news, resignations, appointments, analysis and opinion, as well as the impact of the crisis on the markets and economy.

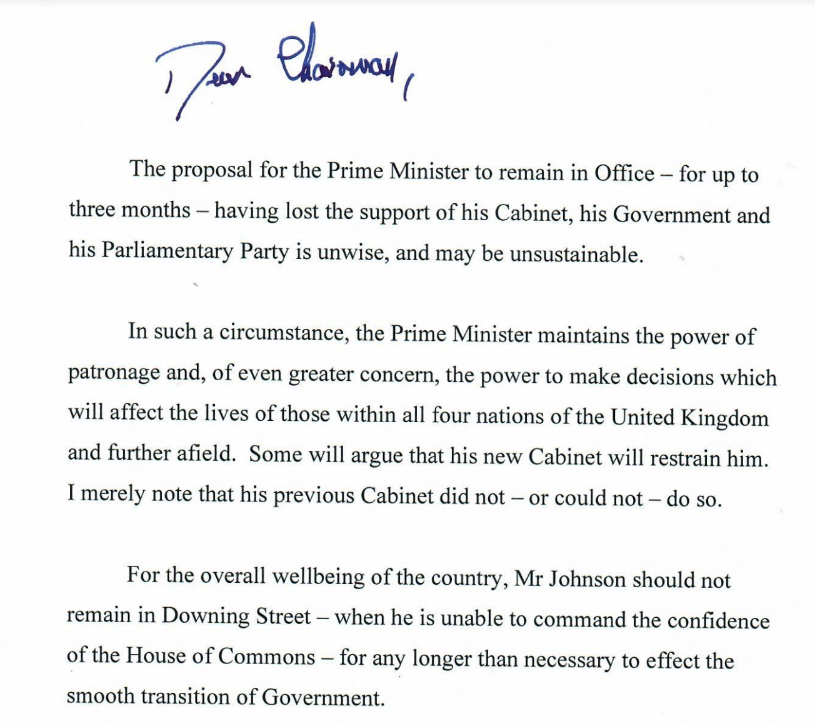

2pm – Former PM Sir John Major says Boris Johnson “should not remain in Downing Street”

Former Conservative Prime Minister Sir John Major has broken his silence on Boris Johnson’s resignation, urging him to leave Number 10 immediately.

The former leader wrote to the chair of the powerful backbench 1922 Committee, calling on it to block Johnson’s bid to remain in office until a permanent replacement is found, likely in the Autumn.

“The proposal for the Prime Minister to remain in Office – for up to three months – having lost the support of his Cabinet, his Government and his Parliamentary Party is unwise, and may be unsustainable.”

Major said Johnson, in that position “maintains the power of patronage and, of even greater concern, the power to make decisions which will affect the lives of those within all four nations of the United Kingdom and further afield. Some will argue that his new Cabinet will restrain him. I merely note that his previous Cabinet did not – or could not – do so.”

In a plea to the committee to block the move by formally removing him from office, he said “for the overall wellbeing of the country, Mr Johnson should not remain in Downing Street – when he is unable to command the confidence of the House of Commons – for any longer than necessary to effect the smooth transition of Government.”.

According to journalist Henry Zeffman of the Telegraph, Major said deputy PM Dominic Raab should fill the role temporarily or the “Conservatives should remove the members’ stage of the leadership ballot”.

12.30pm BORIS JOHNSON QUITS

Boris Johnson has formally announced his resignation as Conservative party leader and Prime Minister in a speech outside Downing Street this afternoon.

Johnson is planning on continuing on in Number 10 until a new Tory leader is chosen by the party, and he has begun to fill cabinet positions left empty by yesterday’s resignations, however some Conservative MPs are calling for him to leave Number 10 immediately.

Standing on the steps of Number 10, he said “in politics, no one is remotely indispensable … Our brilliant and Darwinian system will produce another leader, equally committed to taking our country forward through tough times”.

To that new leader, whoever he or she may be, I will give you as much support as you can,” he said.

“In the last few days I have tried to persuade my colleagues that it would be eccentric to change governments when we are delivering so much and when we have such a vast mandate and when we are actually only a handful of points behind in the polls, even in mid-term after quite a few months of pretty relentless sledging and when the economic scene is so difficult domestically and internationally.

“I regret not to have been successful in those arguments and of course it is painful not to be able to see through so many ideas and projects myself. As we’ve seen in Westminster the herd instinct is powerful when the herd moves, it moves.”

The PM also paid tribute to the “peerless” NHS which saved his life during the pandemic, as well as Downing Street staff and his wife Carrie.

Update:

Greg Clark appointed Secretary of State for Levelling Up, Housing and Communities, succeeding Michael Gove, who was fired last night during the coup.

Before Johnson resigned, he appointed a new cabinet.

Here’s who’s in it:

Johnson has begun to appoint new people to his cabinet after a mass walkout, with James Cleverly named as education secretary, Kit Malthouse named as the Chancellor of the Duchy of Lancaster and Robert Buckland as Welsh secretary.

Here is a full list of the new cabinet officials:

Greg Clarke – Levelling up secretary

James Cleverly – Education secretary.

Robert Buckland – Wales secretary

Shailesh Vara – Northern Ireland secretary

Kit Malthouse – chancellor of the Duchy of Lancaster

Andrew Stephenson – minister without portfolio.

Numerous ministers have remained in post, including newly-appointed chancellor Nadhim Zahawi, Home Secretary Priti Patel and Foreign Secretary Liz Truss.

More resignations are expected throughout the day.

Who might take over? Runners and riders

How it unfolded:

Updates

11.04 – Kwarteng bemoans “depressing state of affairs”

Business & Energy Secretary Kwasi Kwarteng has responded to the resignation of Prime Minister Boris Johnson, and the “depressing state of affairs” the go

So much needless damage caused. We now need a new Leader as soon as practicable. Someone who can rebuild trust, heal the country, and set out a new, sensible and consistent economic approach to help families.

I’m on Teesside today launching a £400m investment – a new offshore wind factory that will employ hundreds of local people. Westminster is a mess, but this investment – and those jobs – will outlast any PM. The wheels of Government must continue in the meantime

10.45 – FTSE 100 ignores political chaos as London markets up

London markets today shrugged off prime minister Boris Johnson bowing to days of pressure and ministerial resignations and quitting office.

The capital’s premier index jumped 0.75 per cent to 7,161.17 points, while the domestically-focused mid-cap FTSE 250 index, climbed 0.88 per cent to 18,757.67 points.

Investors have been muted to the upheaval at Westminster over the past few days, with the City’s main indexes registering gains yesterday and today.

10.32 – Ed Davey

Lib Dem leader Sir Ed Davey says Johnson “may have gone but the stain on the Conservative Party can’t be removed that easily. This cruel callous Government must go”

“The idea that the Conservatives might make Boris Johnson caretaker for anything is frankly ludicrous. The man’s never taken care of anything in his life.

9.50 – Sadiq Khan says Johnson row ‘most shameful sagas in the history of UK politics’

Mayor of London Sadiq Khan has branded Boris Johnson’s refusal to quit ” one of the most shameful sagas in the history of British politics”.

The Labour politician, who took on the job from Johnson in 2016, said the PM “has presided over a government defined by lies, sleaze, an utter lack of integrity, unlawful behaviour, incompetence, and a damaging culture of impunity in public office.”

“At every turn, his government has sought to stoke division, play communities off against one another and level down our capital city for political gain. This has caused immense damage – harming our economy, feeding cynicism among the British public, degrading our country’s standing in the eyes of the world, and undermining the very principles and norms of our democracy.”

He also said the “departure cannot wait until the Autumn” and “it’s clear the Tory party is incapable of governing in the national interest and fixing the huge challenges we face.”

“The only way our country will be able to get the fresh start it deserves is for the next Prime Minister to call an immediate General Election so we can get rid of this appalling government.”

9.43 – Sturgeon uses Johnson resignation for new independence push

The Scottish First Minister took to Twitter to respond to the PM’s resignation:

There will be a widespread sense of relief that the chaos of the last few days (indeed months) will come to an end, though notion of Boris Johnson staying on as PM until autumn seems far from ideal, and surely not sustainable?

Boris Johnson was always manifestly unfit to be PM and the Tories should never have elected him leader or sustained him in office for as long as they have. But the problems run much deeper than one individual. The Westminster system is broken.

For Scotland the democratic deficit inherent in Westminster government doesn’t get fixed with a change of PM. None of the alternative Tory PMs would ever be elected in Scotland. And in policy terms, it is hard to see what real difference hard Brexit supporting Labour offers.

Independence only happens if a majority living in Scotland choose it – but there is no doubt it offers the real and permanent alternative to Westminster, and the opportunity to fulfil our potential at home and play our part as a good global citizen. It’s time for that choice.

Lastly, my differences with Boris Johnson are many and profound. But leadership is difficult and brings with it many stresses and strains, and so on a personal level I wish him and his family well.

9.36 – Keir Starmer responds to Johnson’s resignation announcement

The Labour leader said the resignation “should have happened long ago” but it will be good for the country.

“He was always unfit for office. He has been responsible for lies, scandal and fraud on an industrial scale.”

“And all those who have been complicit should be utterly ashamed.”

He accused the party of having “inflicted chaos” on the country amid the cost of living crisis, and over the last 12 years, where the “damage they have done is profound.”

Starmer accused the government of 12 years of “economic stagnation, declining public services and empty promises.”

9.05 Caroline Johnson resigns, just in time

Carlone Johnson

Shortest ever term?

Michelle Donelan has resigned as education secretary just 36-hours after her appointment.

Zahawi urges Johnson to quit with letter

Nadhim Zahawi writes to the Prime Minister Boris Johnson, urging him to quit. He told him Johnson knows “in your heart what the right thing to do is, and go now”.

He addressed accepting the role of Chancellor on Tuesday, saying “If people have thought poorly of me for that decision, it is criticism I am willing to shoulder.”

“Yesterday, I made clear to the Prime Minister alongside my colleagues in No10 that there was only one direction where this was going, and that he should leave with dignity. Out of respect, and in the hopes that he would listen to an old friend of 30 years, I kept this counsel private.”

“I am heartbroken that he hasn’t listened and that he is now undermining the incredible achievements of this Government at this late hour.”

“But the country deserves a Government that is not only stable, but which acts with integrity. Prime Minister, you know in your heart what the right thing to do is, and go now”

Brandon Lewis quits

The northern Ireland secretary submitted a letter to the PM saying Boris Johnson’s government had lost its “honesty integrity and mutual respect”.

Who has resigned from the government?

Rishi Sunak

Sajid Javid

Bim Afolmi

Laura Trott

Will Quince

Virginia Crosbie

Jonathan Gullis

Robin Walker

Nicola Richards

Alex Chalk

Saqib Bhatti

Andrew Murrison

Theo Clarke

John Glen

Felicity Buchan

Victoria Atkins

Jo Churchill

Stuart Andrew

Selaine Saxby

David Johnston

Claire Coutinho

Kemi Badenoch

Neil O’Brien

Alex Burghart

Lee Rowley

Julia Lopez

Duncan Baker

Mims Davies

Fay Jones

Craig Williams

Mark Logan

Rachel Maclean

Mike Freer

Mark Fletcher

Sara Britcliffe

Peter Gibson

Ruth Edwards

Brandon Lewis

Jacob Young

James Daley

David Mundal

Simon Hart

Ed Argar

Helen Whately

David Mundell

Michael Gove (fired)

Damian Hinds

Gareth Davies

George Freeman

Guy Opperman

Chris Philp

James Cartlidge

Who has written letters against the PM?

Rob Halfon

Lee Anderson

Chris Skidmore

Anthony Browne

Sir Roger Gale

Jo Gideon

Robert Halfon

Caroline Nokes

Anthony Mangnall

Peter Aldous

Sally-Ann Hart

Mark Harper

William Wragg

Nick Gibb

Steve Brine

Aaron Bell

Anne Marie Morris

Bob Neill

Alicia Kearns

Elliot Colburn

Andrew Bridgen

Steve Baker

David Davis

Andrea Leadsom

Tim Loughton

Simon Hoare

Julian Sturdy

Robert Syms

Tom Tugendhat

Craig Whittaker

Jeremy Wright

Iain Duncan Smith

Jeremy Hunt

Tom Hunt

Anthony Magnall

Andrew Mitchell

Simon Fell

John Baron

Gary Sambrook

Douglas Ross

Michael Gove

Andrew Bowie

David Mundell

Dehenna Davison

Karen Bradley

Angela Richardson

Paul Holmes

Kate Griffiths

Liam Fox

Laurence Robertson

Robert Buckland

Alec Sheelbroke

Nickie Aiken

Huw Merriman

Kwasi Kwarteng