Windfall tax hike risks no new investment in North Sea, warns analyst

The UK risks no new investment in the North Sea oil and gas sector, if the Government toughens up the windfall tax at the fiscal event this week, warned investment analyst group Stifel.

In his latest report on the oil and gas sector, managing director Chris Wheaton predicts that future investment will only consist of pledges already made by energy companies in British waters.

He told City A.M.: “The combination of higher tax and uncertainty about the tax environment, rather than solely the tax itself, is what is likely to curtail investment, as companies which have alternative regions to invest in will not want to risk stranding capital in a high tax environment. “

Over the long term, Wheaton predicted this will cause North Sea production to decline faster and make the UK more dependent on imported gas.

City A.M. understands Chancellor Jeremy Hunt is leaning towards hiking the Energy Profits Levy tax from 25 to 35 per cent, and extending the levy’s duration from 2025 to 2028.

The Government has has been scrambling to shore up the nation’s finances following the severe market fallout from the mini-budget two months ago under former Prime Minister Liz Truss.

It is preparing to further harness record profits from the oil and gas sector, fuelled by soaring oil and gas profits following Russia’s invasion of Ukraine, to fill a £50bn fiscal black hole.

This comes with households suffering record energy bills, with the Government shielding households from the full extent of soaring wholesale prices via the Energy Price Guarantee – which is expected to be wound down in April.

Cornwall Insight predicts the price cap will rise to £3,702 per year in April, well above current record averages of £2,500 per year established in the support package.

Wheaton doubted whether the windfall tax would be eased, even if it turns out the Government is overestimating commodity prices, with oil and gas slipping amid warmer weather and reduced demand in recent weeks.

He said: “It is clear to us that even if prices fall further, the windfall tax is not going to be removed – this is politics, not policy.”

Alongside the rates of the tax and its duration, Wheaton further believed the investment allowance will be scaled back, and not expanded in line with a longer tax.

Currently it offers 80 per cent investment relief to North Sea oil and gas operators, providing a 91p in the pound saving, which sufficiently develop new domestic projects – with fossil fuel exploration featuring the UK’s energy security strategy.

City A.M. revealed last weekend that major energy firms have been pushing the Government to maintain the investment allowance in line with any windfall tax expansion, while Labour is pushing for it to be scrapped altogether.

Wheaton argued the Government should instead focus on reforming the balance of the investment relief – rather than curtailing or scrapping it.

He said: ” The investment uplift tax allowance makes no distinction between gas and oil, and the Government is treating all production the same despite the U.K. being more reliant on gas imports than oil imports.”

The UK produces around 45 per cent of its gas domestically – and relies on Norway as its chief overseas partner, which meets 38 per cent the country’s gas needs.

By contrast, it produces around 70 per cent of its oil requirements, making investment in such projects less critical to the UK’s supply security.

Independent companies set to suffer under levy

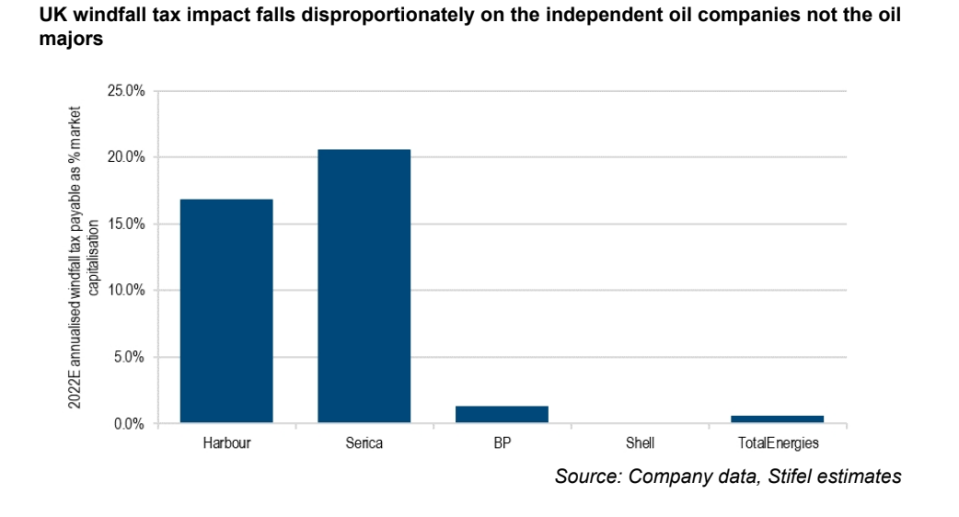

An windfall tax could also hit independent companies disproportionately compared to energy giants, according to Stifel.

This is due to such producers lacking diversification in projects compared to companies with vast international footprints.

For instance, Serica and Harbour would take a much bigger hit to their market cap from a raised windfall tax than BP, Shell and Total Energies.

Serica could potentially suffer a 20-per cent plus hit to its market cap, compared to less than 1 per cent for Shell.

Without further investment in new projects, industry body Offshore Energies UK warns the UK could be dependent on overseas vendors for 70 per cent of its oil and 80 per cent of its gas by the end of the decade – risking the country’s energy independence while boosting emissions.

The Climate Change Committee, Westminster’s independent advisory group, predicts half of the UK’s energy requirements between now and 2050 will still be met by oil and gas, and as much as 64 per cent of UK energy needs between 2022 and 2037.

OEUK recently published its economic report on the sector, which revealed that just five exploration wells were drilled last year.

This was the lowest total since the North Sea sector was opened up to development nearly 60 years ago.

The UK is currently chasing a mega liquefied natural gas deal with the US as part of a future energy security partnership, which could provide 10bn cubic metres of gas.

For context, the entire European Union was promised 15bn cubic metres by the US this spring.

National Grid has warned of rolling blackouts as a potential worst-case scenario this year, and the pressure has been raised in Downing Street since talks with Norwegian energy giant Equinor over a potential 20-year gas deal hit the rocks the last week – with The Treasury baulking at the asking price.

Wheaton argued that domestic energy generation should be prioritised as the UK pushes to meet its net zero goals with a baseline of oil and gas to meet its energy needs over the coming decades.

He said: “he transition to renewables has to happen to save the planet. The way to minimise the cost of that transition is to make sure there is a steady decline in hydrocarbon use and therefore production, but that scenario needs some investment into hydrocarbons to be maintained to ensure a smooth and just transition between the energy system we have now and the one we must have in 25-30 years’ time.”