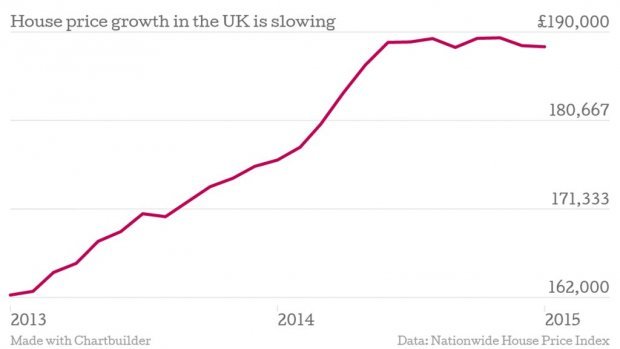

UK house price growth slowest since 2013

House prices in the UK have risen at the slowest pace in more than a year, according to the latest figures from building society Nationwide, a further sign that the UK housing market is cooling.

Annual house price growth slowed for the fifth month straight to 6.8 per cent this month, down from 7.2 per cent in December, also representing the slowest increase since November 2013. Month-on-month, house prices rose 0.3 per cent in January.

The average house price was £188,446, falling around £100 from the previous month, and remaining below the previous peak of £189,388, reached in November last year.

Mortgages approved for house purchase were around 20 per cent below the level seen at the start of 2014, according to Nationwide, and surveyors continue to report subdued levels of new buyer enquiries.

Robert Gardner, chief economist at Nationwide, said while the housing market is cooling, a strong economic backdrop makes it difficult to pinpoint why.

“The reasons for the slowdown in activity remain unclear. Unemployment has continued to decline and wage growth has started to outstrip increases in the cost of living for the first time since the financial crisis," Gardner said.

"Surveys suggest that consumer confidence remains elevated – a view corroborated by healthy gains in retail sales over recent months," he said.

Analysts have attributed the lukewarm housing market to tighter checks on prospective mortgage borrowers which came in last year, uncertainty ahead of the General Election in May, as well as knowledge that eventually interest rates will rise.

However, activity should pick up in the next few months, as wage growth has finally started to outpace the rate of inflation and unemployment is continuing to fall.

“If the economic backdrop continues to improve as we and most forecasters expect, activity in the housing market is likely to regain momentum in the months ahead," Gardner said.

And yet, despite the economic optimism, he said that the number of new homes being built was still well below its pre-crisis peak.

"It is encouraging that the number of new homes built in England was up eight per cent in the year to Q3 2014," Gardner said. "However, this is still 34 per below pre-crisis levels and little over half the expected rate of household formation in the years ahead.”