UK attracts record £2.46bn of venture capital investment into tech and London secures more than 60 per cent of the funding

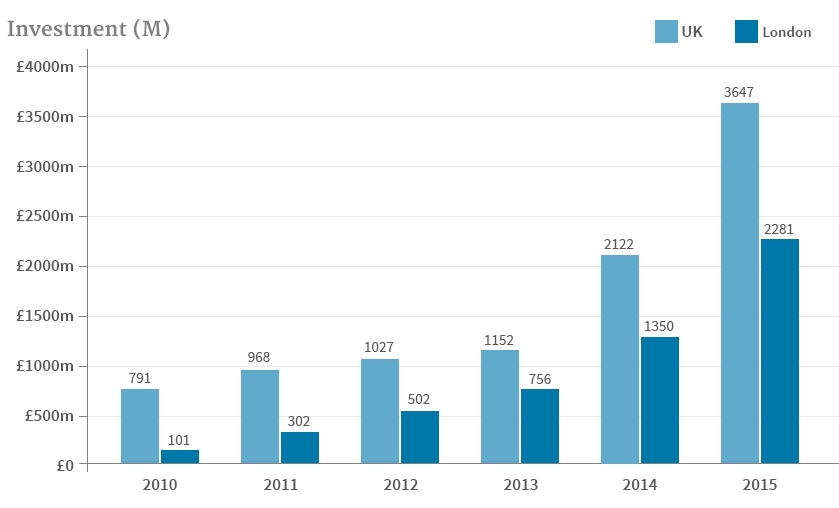

Venture capitalists invested a record $3.6bn (£2.46bn) in the UK's tech scene in 2015, up 70 per cent from the year before, according to data from London and Partners, the Mayor’s promotional company.

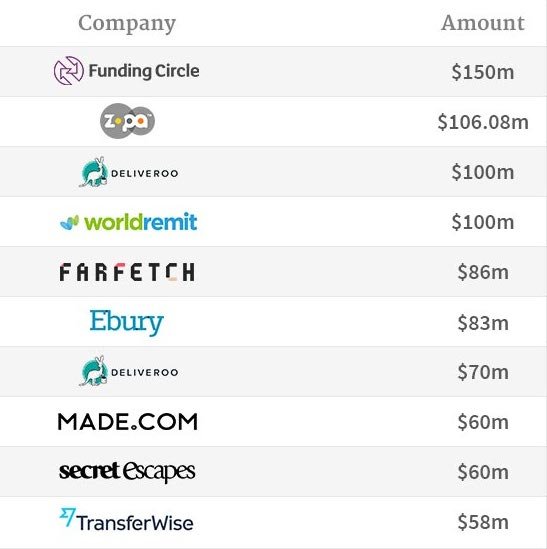

London-based crowdfunding company, Funding Circle secured the largest single deal of the year with a $150m funding round led by DST Global in April last year. London’s booming financial technology (fintech) sector continued to secure record funding, with firms such as Zopa, TransferWise and WorldRemit accounting for almost a quarter of all investment in the capital’s tech firms.

The 10 biggest tech venture capital investments in of 2015

James Meekings, co-founder and managing director of Funding Circle in the UK, said: “Small businesses are the lifeblood of the economy. The money we raised, from some of the world’s leading investors, allows us to continue to increase the number of small businesses that can borrow through Funding Circle, both in the UK and across the world. We want to become the first choice for small business lending.”

Last year was a strong one for the UK’s ecommerce sector as well, with a number of companies featuring in the top ten deals including: FarFetch, MADE.com and Secret Escapes. The online takeaway start-up also Deliveroo had a successful year in the capital, securing a total of $195m in three separate funding rounds.

London secured 63 per cent of investment in the UK, $2.28bn, and more than the total investment figure for all of the UK in 2014, which stood at $2.1bn. Investment in London rose 75 per cent from 2014.

This is the fifth consecutive year of growth for investment into the UK and London’s burgeoning tech scene. In 2010, London tech companies received $101m in funding.

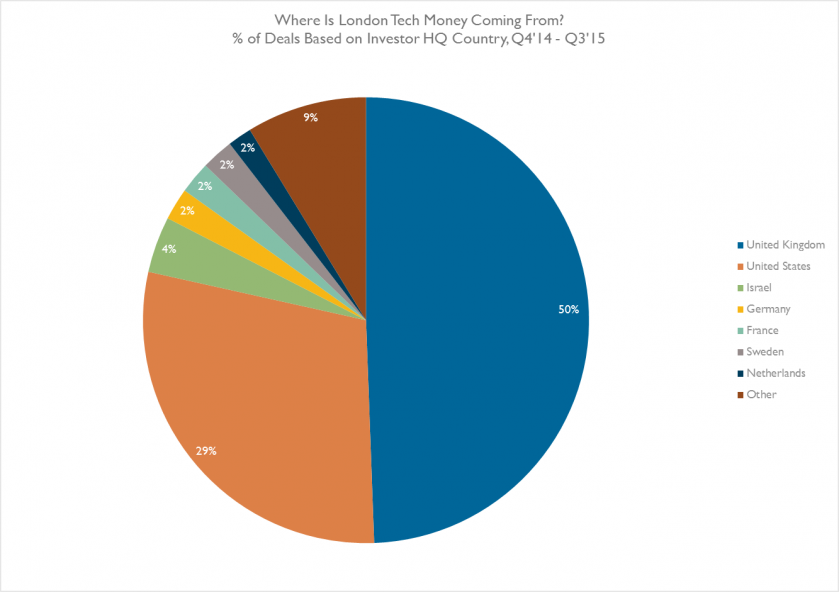

San Franciso and London-based Index Ventures was the most active investor into London tech, participating in 12 deals, including Deliveroo, Secret Escapes and Onefinestay.

Source: London & Partners

Mayor of London Boris Johnson said: “It is no surprise to see that London’s tech companies are attracting record levels of investment. Our world-class talent pool and culture of innovation and entrepreneurial spirit are helping the sector to grow from strength to strength."