Tullet Prebon and GFI end merger talks

Merger talks between GFI and Tullett Prebon ended last night after the two interdealer brokers failed to agree on the terms of a deal.

Tullett, the second largest broker between banks, combined with GFI, the largest interdealer broker of credit derivatives, would have created a firm to rival market leader ICAP.

This is the second time talks between the two companies have failed. Earlier discussions between the two broke down in July of 2007.

The two companies had confirmed in July that they were in merger talks although the structure of any possible combination was never disclosed.

There had been reports that New York-based GFI was talking to Tullett, owned by Collins Stewart boss Terry Smith who is also chief executive of Tullett, on “an equal shareholding” basis, which would mean that any deal would have been structured as a merger of equals.

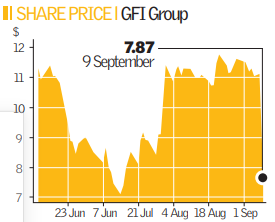

Shares of GFI plunged 17 per cent in after-hours trading in New York.

The companies were unable “to reach acceptable economic terms for a transaction,” New York-based GFI said last night in a statement.

Tullett, which is based in London, said the two couldn’t agree on “satisfactory terms for a potential combination.”

The company’s share price has fallen by 25 per cent in the last year to close at 398p a share yesterday.

Smith and GFI Chairman Michael Gooch had agreed, however, on how responsibilities would be divided if the merger were to be successful.