St James’s Place lures £1.2bn on improving customer sentiment

FTSE 100 wealth manager St James’s Place yesterday said the improved outlook of investors helped it deliver a strong start to the year, as customers gave the company £1.2bn more of their savings to manage.

The wealth manager, which offers services for affluent savers, reported a 17 per cent rise in assets under management versus a year ago, taking the total pot of money it looks after to £45.8bn.

Chief executive David Bellamy said in an interview with City A.M. that despite the poorer start to the year for equities, improved sentiment echoing around markets had helped the company.

“The economy is picking up and investor sentiment is in a very positive place,” he said. “We will never attract people who want to make quick money because we focus on the long and medium term and that is driven by sentiment but at the moment we’re in an okay place.”

Net inflows for the three month period ending March were 26 per cent higher than last year, led by surging demand for investment products, unit trusts and ISAs.

Unit trust sales alone were up 37 per cent versus a year ago. Corporate analysts said such products have higher margins than pension products, which would benefit the firm in future.

St James’s Place has previously announced plans to move billions of pounds from its fund manager Invesco Perpetual to a new company being set up by ex-Invesco star Neil Woodford.

The money has been placed in a holding account until Woodford sets up his new company, Woodford Investment Management, but Bellamy said the veteran stockpicker would start running the money early next week.

Bellamy also welcomed the changes introduced at this year’s Budget to give people approaching retirement more flexibility with their pension savings and said it would give savers “encouragement”.

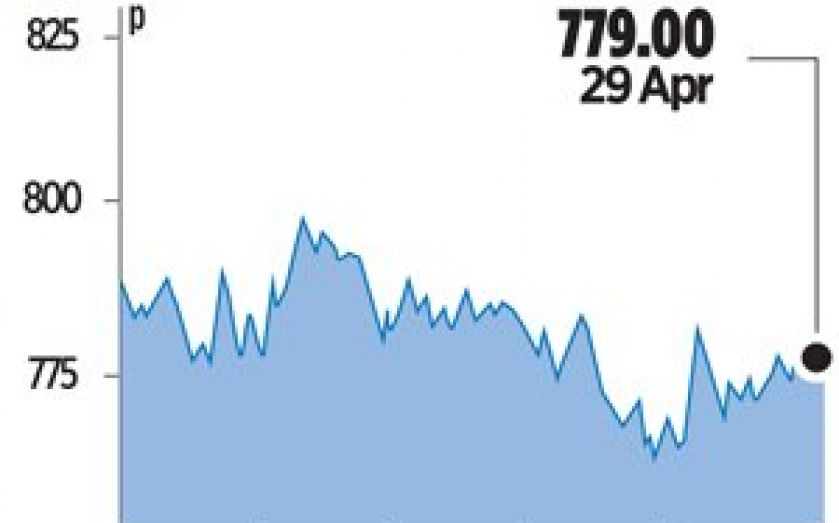

Shares in the company closed up over two per cent yesterday as investors welcomed the results, helping drive the FTSE to a seven and a half week high.