Number of higher rate income taxpayers soars to record high 5.59m

The number of Brits paying the higher rate of income tax has surged to its highest level on record, caused by Prime Minister Rishi Sunak and Chancellor Jeremy Hunt freezing tax bands to help rebalance the public finances, official figures out today reveal.

Some 5.59m people in the UK are being subjected to the higher 40 per cent rate of income tax, the steepest number HMRC has recorded since data started back in 1990.

Over the last year alone, an additional 310,000 people have been shoved into the higher income tax band, a six per cent increase.

HMRC’s figures reveal the bucket of voters in the 40 per cent tax bracket has been swelling for years, up nearly a third from 4.23m in 2018/19.

A greater number of people are being caught by more punitive tax rates due to Sunak and Hunt opting to freeze income thresholds at which higher tax bands apply.

Hunt at the November 2022 autumn statement froze income tax bands for an additional year to 2027/28 after Sunak announced the initial freeze at the March 2021 budget.

Greg Thwaites, research director at the Resolution Foundation, told City A.M.: “The five-year freeze on personal tax thresholds is pushing millions more employees into higher and additional rate tax bands, and exposing them to inequities in our tax system, where employees face far higher marginal tax rates than many rich, well-advised business owners.”

Workers pay no income tax on earnings up to £12,570. A 20 per cent levy is imposed on income up to £50,270 from that level and income above that threshold up to £125,140 is exposed to a 40 per cent charge.

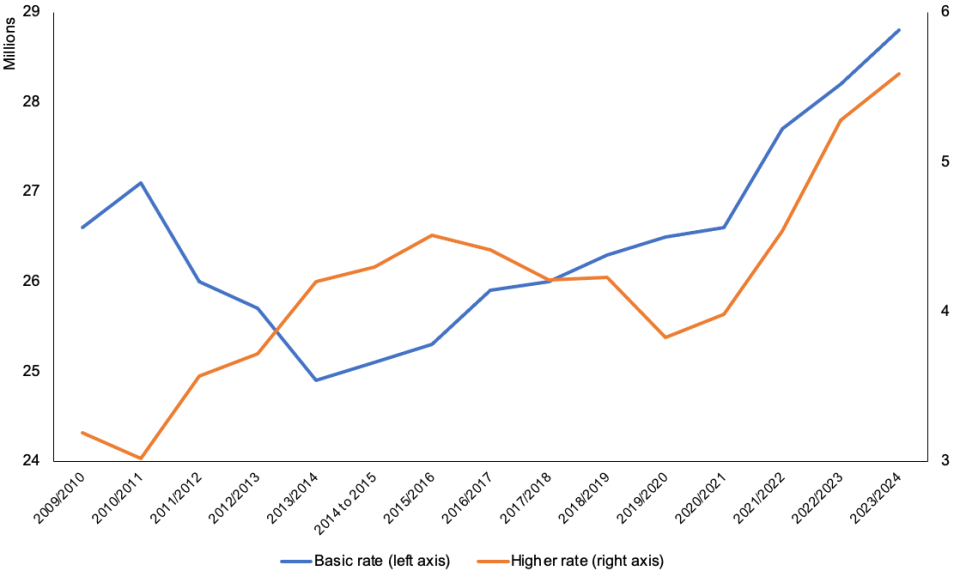

Basic rate income taxpayers have also spiked, up to 28.8m this year, also a record, from 28.2m last year.

Number of basic and higher income taxpayers in the UK

Soaring inflation has fuelled wage growth by raising companies’ revenues, handing them cash to compensate their staff. Rising prices have also incentivised workers to demand pay rises to protect their finances.

Because the Chancellor and PM have kept income tax bands frozen, workers receiving pay rises have been pushed into higher income tax brackets, a process known as “fiscal drag”.

“Current high inflation rates mean more people are getting significant pay rises to try to keep pace with rising prices. But with income tax bands frozen it means many are being pushed into the next tax bracket,” Laura Suter, head of personal finance at AJ Bell, said.

Around 310,000 Brits are now paying the top 45 per cent rate of income tax, a 55 per cent increase over the last year. This group has to earn at least £125,140.

Britain is on course for the highest tax burden – government revenues as a share of GDP – since just after the second world war, up to 38 per cent.

Hunt and Sunak are trying to cut borrowing and reduce the debt pile in five years, forcing them to steadily raise taxes over the coming years.

The country’s debt pile has topped the size of the economy for the first time since 1961 due to the government borrowing hundreds of billions of pounds to support the economy through the 2008 financial crisis, pandemic and energy shock.

The Treasury has been contacted for comment.