Henderson on track despite market hiccups

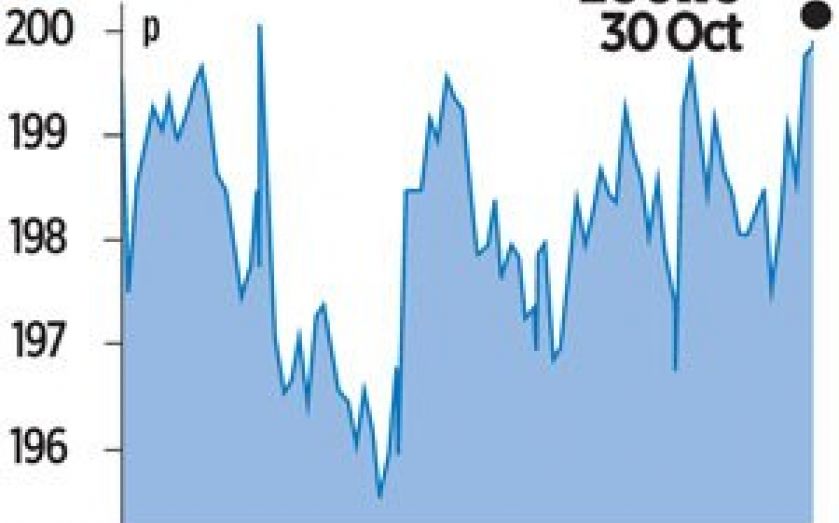

CHOPPY markets failed to stem the tide of assets flowing to fund manager Henderson Group yesterday after it reported quarterly inflows of £1.4bn.

The FTSE 250 listed group, originally formed to manage the estate of railway magnate Lord Faringdon, said investors pulled £10m from its European equities products but gains elsewhere pushed the group forward.

Property and private equity products were the strongest, adding £822m more to the group’s assets.

Elsewhere multi-asset added £197m, global fixed income attracted £225m more and global equities grew £192m.

“Current markets are proving challenging, as investors seek safety in cash and lower risk products,” chief executive Andrew Formica said.

“We expect these conditions to persist while the outlook for world economies remains uncertain.”

Assets under management were up 2.5 per cent to £76.6bn for the three months ending 30 September, rising to £79.9bn if its recent acquisition of Geneva Capital Management is included.

“While we remain vigilant on costs, recent investments in our business have positioned us well, with a broad product range and a more geographically diverse business,” Formica added.

Last week it said it would merge its Henderson UK Property fund with the Old Mutual Property Fund.