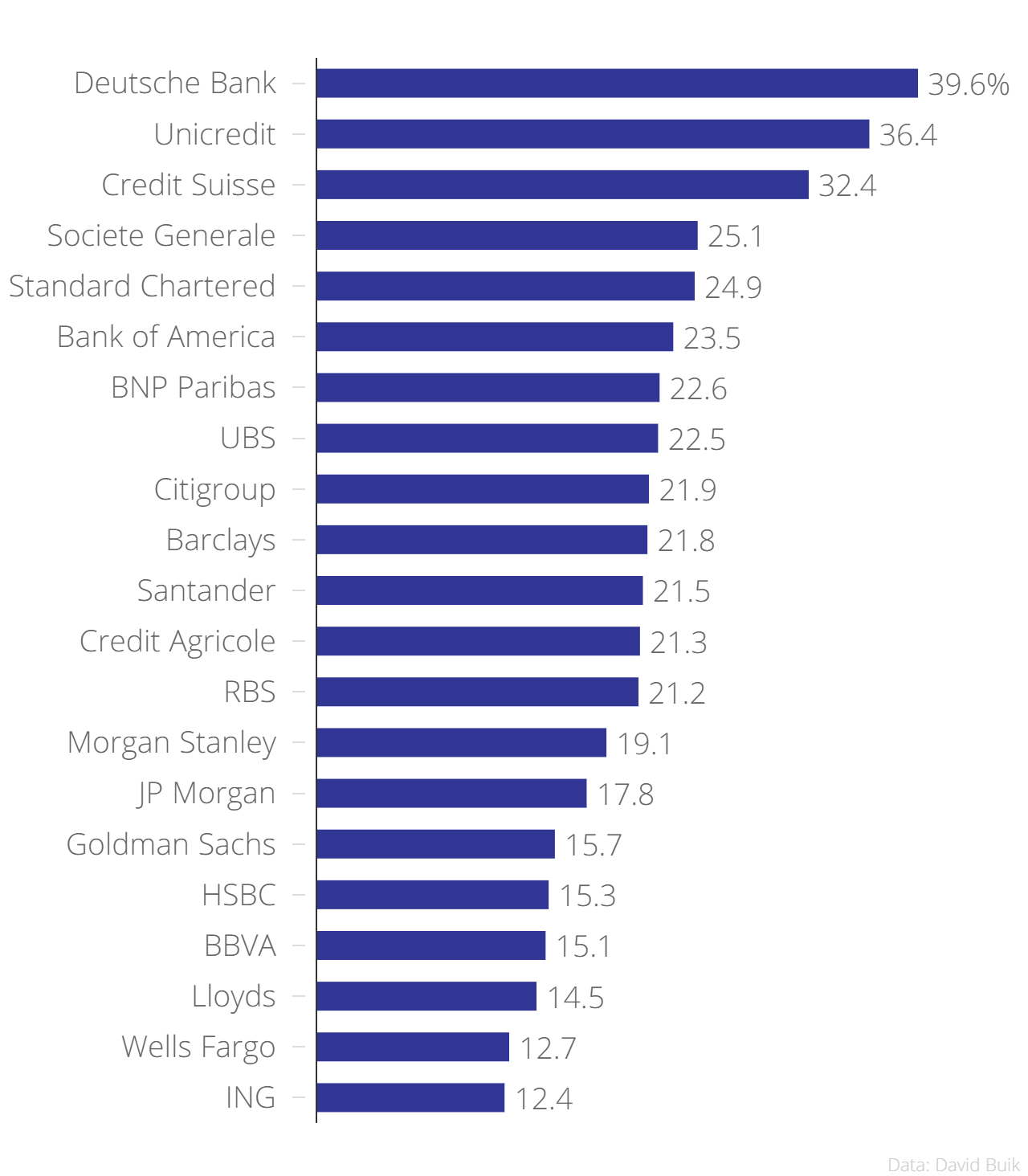

From Deutsche Bank to Credit Suisse and RBS: This chart shows exactly how much global banks’ share prices have fallen this year

An interesting note from Panmure Gordon market commentator David Buik, who laid out this afternoon, in percentage terms, exactly how much banks have suffered in the first weeks of 2016.

The out-and-out winner in the loser stakes is Deutsche Bank, whose share price has fallen 39.6 per cent, from €23.01 to €15.05 since the beginning of the year.

The least worst-affected? ING, whose shares have dropped a mere 12.4 per cent, from €12.20 to €10.71. Not bad, all things considered…

Why is this happening?

"Since the financial crisis capital requirements for banks have become increasingly onerous," says Buik.

"With the relative collapse of emerging market economies and the quality of their respective debts, these have put added pressure on banks’ balance sheets.

"There is also a school of thought that believes many banks may not be able to maintain dividends as a result of ‘on-going’ impairments and the requirement of further capital. Also the fact that bond yields have fallen sharply could eat in to earnings.

"There has always been some correlation between low bond yields and the falling value of bank shares. There now seems little prospect of interest rates going up in the US, UK or Europe in the foreseeable future, though [Jane] Yellen is attempting to keep a hike on the agenda."

Think you've had a bad year? Spare a thought for bank chiefs….