Eurozone manufacturing economy flashes strong recession signal

The eurozone manufacturing sector has tumbled into recession, driven by customers slashing spending in response to soaring prices and higher interest rates, a closely watched survey out today suggests.

S&P Global’s final manufacturing purchasing managers’ index (PMI) for the 19 countries using the euro fell to 46.4 last month, down from 48.4 in September.

The reading was revised down from an earlier estimate and came in below analysts’ expectations.

It also signalled eurozone factory output is shrinking quickly. The PMI has a threshold of 50 that separates growth and contraction.

“The eurozone goods-producing sector moved into a deeper decline at the start of the fourth quarter. The PMI surveys are now clearly signalling that the manufacturing economy is in a recession,” Joe Hayes, senior economist at S&P Global Market Intelligence, said.

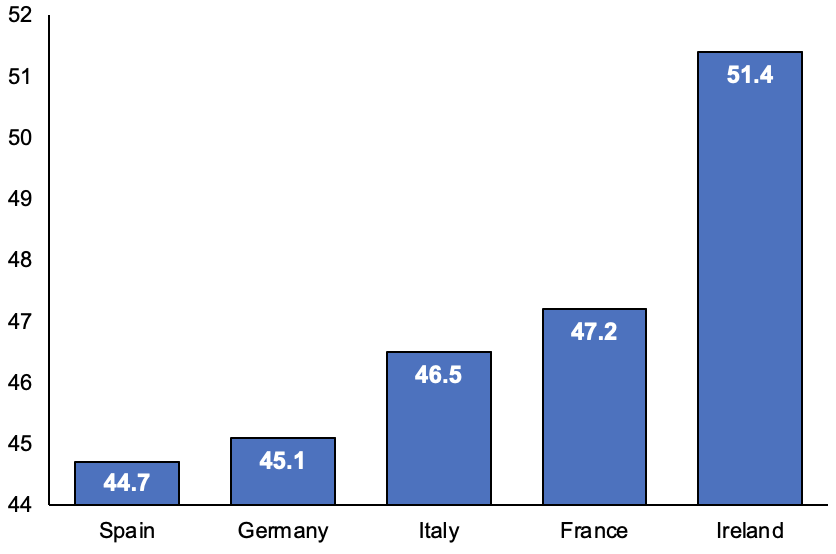

Germany, the currency bloc’s economic powerhouse, had its PMI revised down to 45.1 from 45.7. Its composite survey is running at 44.1, among the lowest in the area.

Germany’s manufacturing sector has held up its economy for decades, largely funded by cheap Russian energy.

Eurozone economies’ PMIs

However, Putin’s invasion of Ukraine has rocked international energy markets, forcing gas prices higher, squeezing German factories.

European gas prices have fallen sharply recently in response to the bloc partly replacing Russian supplies with liquified natural gas imports.

But, inflation is still running at a record 10.7 per cent across the eurozone. The European Central Bank has hiked interest rates 75 basis points two times in a row, heaping pressure on businesses’ balance sheets.

France’s manufacturing PMI was also chopped down to 47.2. Most of Europe’s biggest economies’ PMIs have swung back to levels notched during the early stages of the Covid-19 crisis.

The set of bad surveys “confirmed the story of broadening weakness in the euro area’s industrial sector,” Claus Vistesen, chief eurozone economist at Pantheon Macroeconomics, said.